Despite a significant downturn in the cryptocurrency market, BlackRock’s spot Bitcoin ETF continues to see strong investor interest.

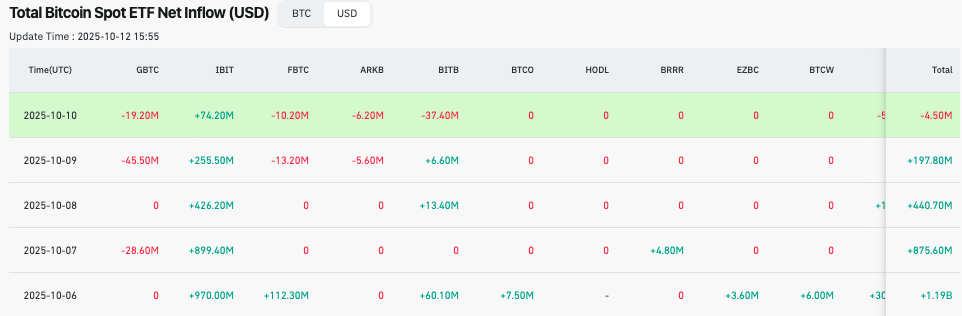

Between October 6 and October 10, the iShares Bitcoin Trust (IBIT) experienced consistent inflows over five consecutive days, amassing approximately $2.63 billion. This data was gathered from Coinglass by Finbold on October 12.

The daily inflow figures for IBIT were impressive: $970 million on October 6, followed by $899.4 million on October 7, then $426.2 million on October 8, with another $255.5 million coming in on October 9 and finally an additional $74.2 million recorded on October 10.

This steady influx of capital positioned IBIT as a leader among U.S.-based spot Bitcoin ETFs at a time when others like GBTC and FBTC were experiencing withdrawals across several days.

The surge in investments occurred during a dramatic market decline that erased hundreds of billions from crypto valuations.

Bitcoin notably fell below the critical threshold of $110,000 due to widespread panic selling that triggered mass liquidations across trading platforms.

Heightened trade tensions between the U.S. and China—marked by new tariffs reaching up to $100% on Chinese tech imports—exacerbated global risk aversion and prompted investors to retreat from high-volatility assets.

This announcement led to widespread selloffs affecting stocks, commodities, and digital currencies alike—resulting in more than $400 billion being wiped off total crypto market capitalization within just a few days.

Bitcoin Price Analysis

At present reporting time , Bitcoin is grappling with maintaining its position above the $110 ,000 support level . Over the past day , it has decreased by about .5% while suffering over nine percent losses throughout last week settling around $ ;111 ,918 .

The immediate goal for this asset involves reclaiming resistance near at least around & #112k mark which if met could potentially push BTC towards targeting higher ranges such as & #115k given continued institutional fund movements into space .

Featured image via Shutterstock