On Tuesday, Bitcoin experienced a significant surge, climbing past the $97,000 mark as major investors re-entered the spot market following weeks dominated by ETF-related sell-offs. This upward movement rekindles hopes of reaching the $100,000 milestone and highlights a change in market leadership.

Analysis of recent on-chain metrics and derivatives data reveals that this price increase is not driven by retail traders using leverage. Instead, large holders—often referred to as whales—are accumulating Bitcoin directly on spot exchanges while smaller traders are engaging through futures contracts. This distinction is crucial because rallies fueled by spot purchases generally have greater longevity.

Whales Accumulate While Retail Traders Rely on Leverage

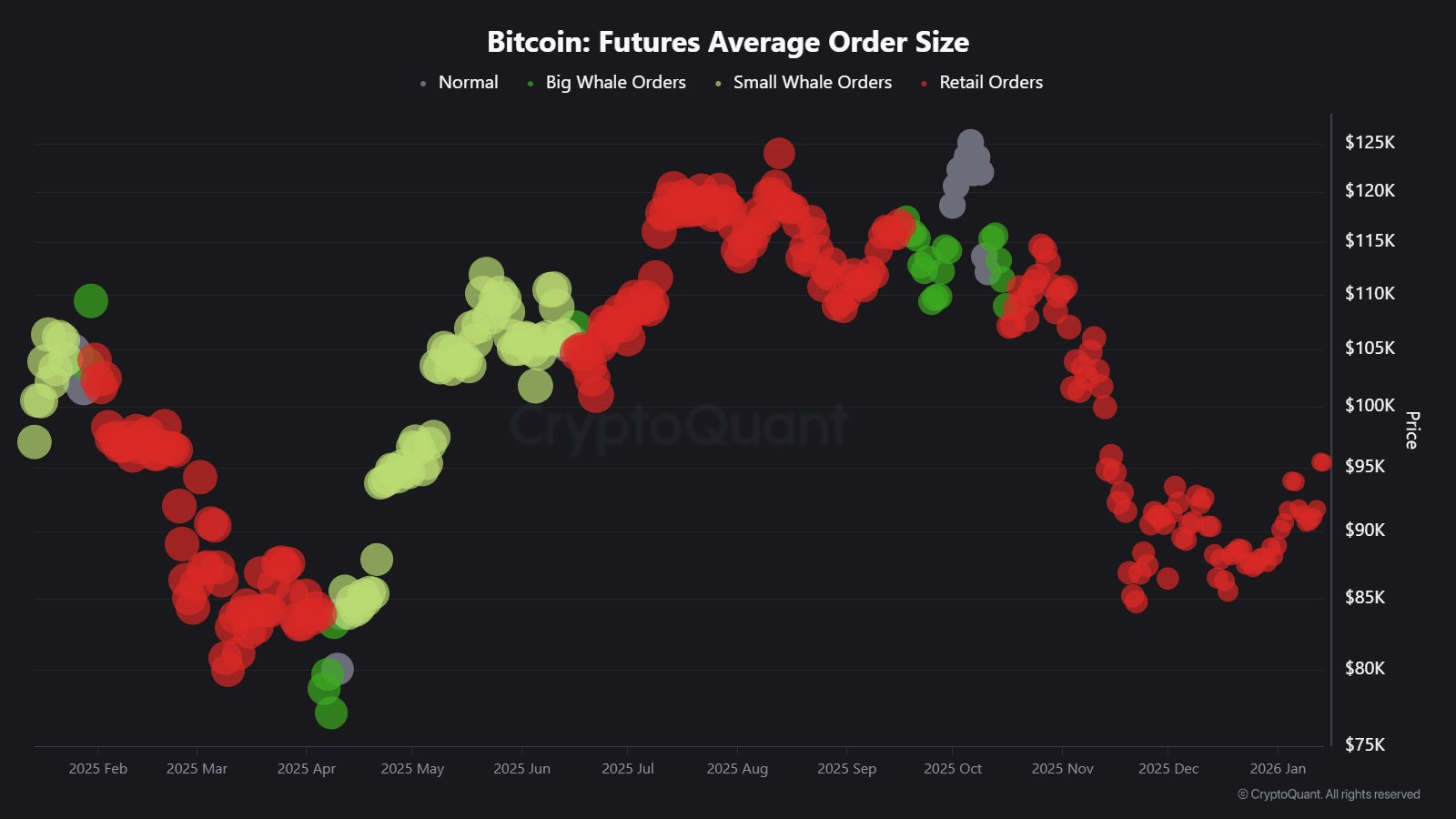

The Futures Average Order Size chart from CryptoQuant illustrates a distinct trend: sizable orders typically associated with institutional players and whales have grown as Bitcoin’s price rose from the mid-$80,000s to above $95,000.

Simultaneously, there has been an uptick in smaller futures trades indicating that retail participants are primarily entering via leveraged positions rather than direct buying.

This divergence is significant because previous market peaks often saw retail investors leading with heavy buying before whales began selling off their holdings. Currently though, it’s the opposite scenario where whales initiate accumulation and retail follows suit.

This pattern aligns more closely with an early-stage uptrend rather than signaling an imminent end-of-cycle frenzy.

Spot Market Buyers Fueled Recovery From $84K

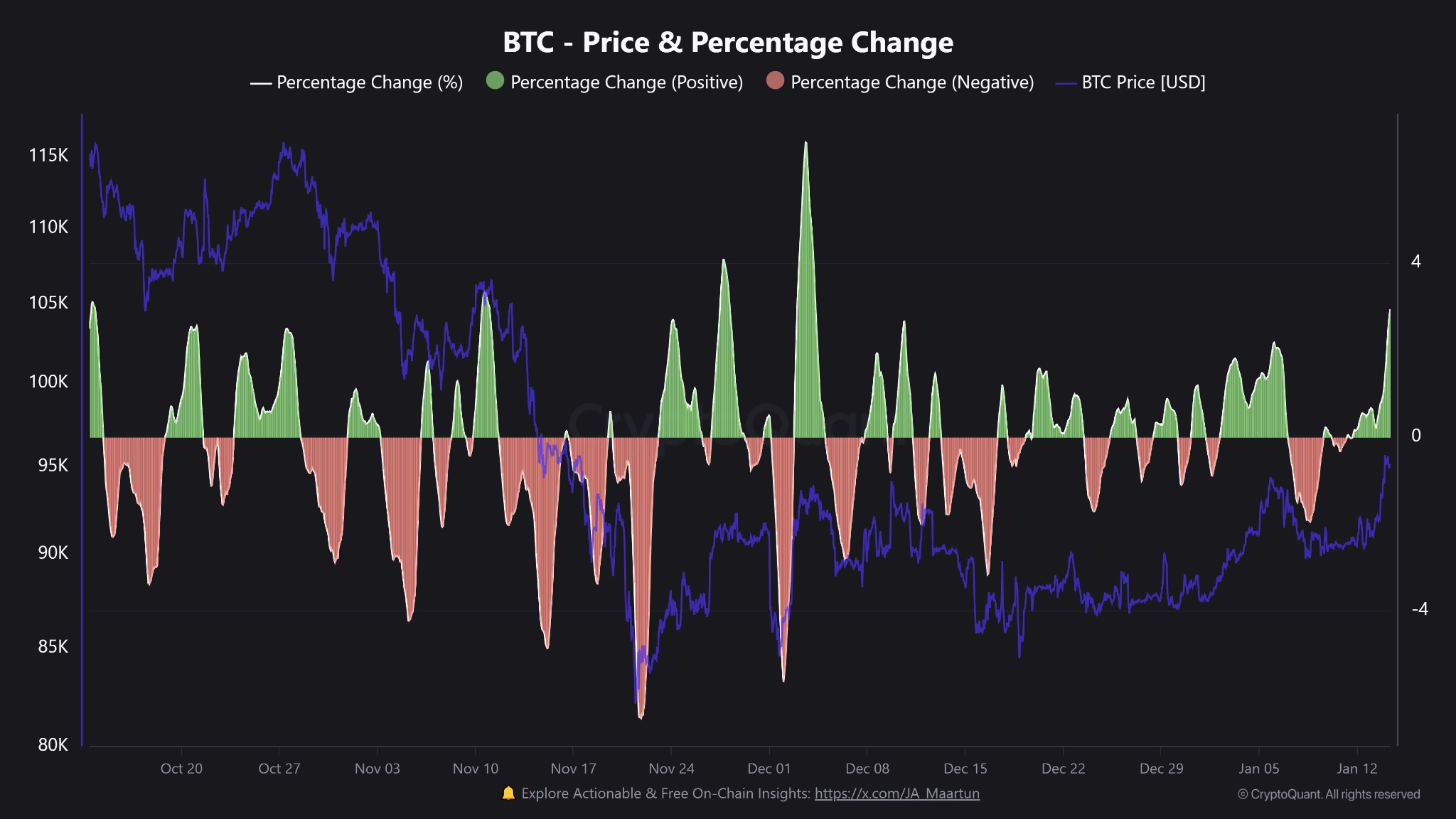

A different CryptoQuant visualization tracks daily percentage changes in Bitcoin prices showing a transition from sharp declines in November to consistent gains throughout January.

This shift indicates genuine buying pressure instead of short squeeze dynamics; when prices advance steadily with minor pullbacks it suggests demand at spot levels is absorbing available supply effectively.

The rally took Bitcoin from roughly $84,400 up beyond $96,000 under these conditions while earlier selling pressures diminished considerably since November’s lows.

The ETF Correction Cleared Weak Hands

Earlier this month witnessed over $6 billion withdrawn from US-based spot Bitcoin ETFs. These redemptions stemmed largely from late entrants who bought near October’s peak but exited at losses during subsequent declines.

The price hovered close to the ETF cost basis around $86,000 which acted as strong support; once these redemptions slowed down price action stabilized accordingly.

This process effectively weeded out weaker holders and reset overall positioning within the market. Subsequently whale investors started rebuilding their exposure at more favorable prices below prior highs.

Bitcoin Remains Within Its Long-Term Bull Market

The decline between approximately $110K down to about $85K did not mark an end to Bitcoin’s macro bull cycle but rather concluded its initial speculative phase aimed at clearing excessive leverage and forcing some ETF participants out of positions prematurely.

A consolidation or reaccumulation period followed where stronger hands accumulated coins while prices moved sideways without dramatic swings;

“Bitcoin ETFs had Big Day with $760m in flows. They needed it, started year real strong, dipped & now made it up, YTD above water. “— Eric Balchunas (@EricBalchunas), January 14, 2026

A New Phase Of Expansion Is Underway

Currently holding steady above &$95,000, which had previously capped every rally since early December,suggests buyers have regained control over momentum.

If large holders continue accumulating via spot markets while ETF related selling remains subdued,a clear path toward reaching &$100,000.s becomes increasingly likely.

This ongoing rally appears supported by solid capital inflows instead of fragile leveraged bets,bracing bitcoin for potentially sustained growth after months of uncertainty.

<em>The post titled “Bitcoin Whales Return To Spot Markets As Price Nears $&semi100,&semi00 Again” originally appeared on BeInCrypto.</em></P>