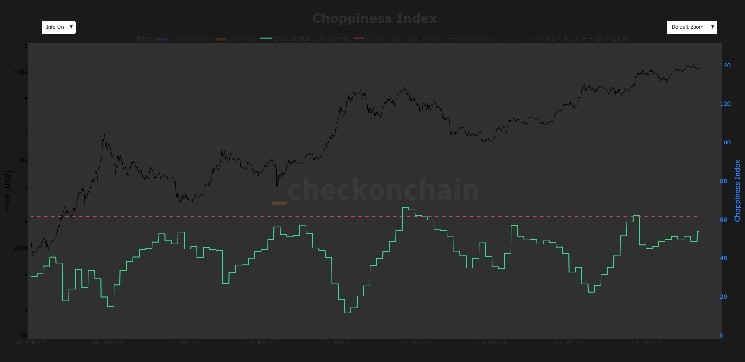

The ongoing compression of Bitcoin’s volatility has become more pronounced, as highlighted by analyst Checkmate’s “choppiness index,” a tool used to measure periods of sideways price movement. Recent findings from CoinDesk have pointed out that Bitcoin’s implied volatility is currently at its lowest levels in several years, which aligns with the current trend of price stabilization.

This choppiness indicates that Bitcoin has been trading within a specific range lately. Over the past few months, it has fluctuated between $110,000 and its peak value of $124,000, presently resting around $113,000.

In terms of the one-month timeframe data provided by checkonchain, the choppiness index has climbed to 54. The last time it reached such heights was in early November 2024 when President Trump’s election victory sparked a rally that pushed Bitcoin above $90,000; during this period, the index peaked at 64. Prior to this event was early 2023 when the index recorded a value of 57 at the beginning stages of what is now recognized as an ongoing bull market.

This trend implies there could still be potential for additional consolidation as volatility continues to diminish.

The upcoming U.S. Consumer Price Index (CPI) report set for release at 12:30 PM UTC may serve as a significant macroeconomic catalyst capable of triggering either increased volatility or directional shifts in price movements.

Furthermore, research from CoinDesk conducted in February observed an extended phase similar to this one before prices fell and eventually hit their lowest point around $76,000 in April.