Bitcoin’s recent recovery following last week’s sharp decline is already encountering significant resistance.

After briefly dipping into the low $60,000 range during a capitulation phase last week, the leading cryptocurrency surged back toward the $70,000 mark over the weekend. However, this upward momentum has since weakened considerably.

This pause in price action has led traders to interpret the rebound as a typical bear-market relief rally—an intense bounce that lures in buyers hoping for a dip purchase but then faces heavy selling pressure from investors eager to exit at more favorable prices.

“There remains substantial supply in the market from participants looking to offload Bitcoin after its initial rebound,” explained Alex Kuptsikevich, chief market analyst at FxPro. “Given these conditions, we should prepare for another test of Bitcoin’s 200-week moving average soon.”

“We continue to be cautious about near-term prospects because recovery momentum faded over the weekend amid selling pressure near a $2.4 trillion market cap,” he added. “It might be that what we witnessed was merely a temporary bounce on an ongoing downward trajectory.”

Market sentiment indicators echo this fragile outlook. The Crypto Fear and Greed Index plummeted to 6 over the weekend—matching levels seen during FTX-related turmoil in 2022—before rebounding slightly to 14 by late Monday.

Kuptsikevich noted these figures remain “too low for confident buying,” suggesting that investor apprehension runs deeper than just short-term jitters.

The liquidity environment is also contributing to instability. With thinner order books present, even modest selling can trigger outsized price swings which then cascade into further stop-loss triggers and liquidations—a feedback loop creating erratic price movements rather than steady trends.

This mechanism helps explain why Bitcoin can fluctuate by thousands of dollars within one trading session yet still fail to break through critical resistance levels despite no major news driving such volatility.

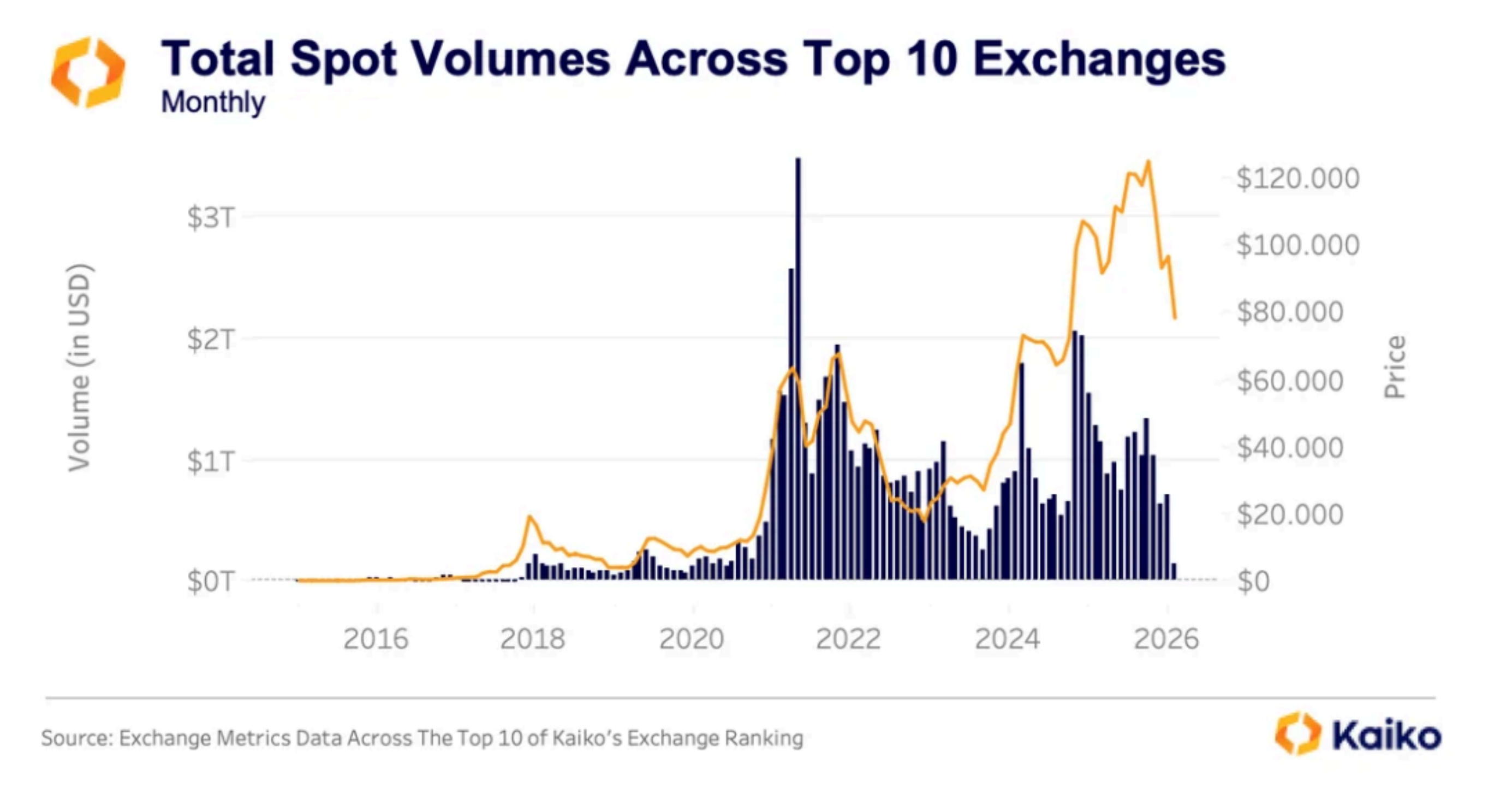

(picture credit: Kaiko)

A report from Kaiko on Monday described this environment as part of a broader risk-off unwind across crypto markets. It highlighted that total trading volumes on major centralized exchanges have dropped approximately 30% since October and November peaks—with monthly spot volumes declining from around $1 trillion down closer to $700 billion recently.

The firm observed that although there were sporadic spikes in activity last week, overall participation continues its gradual descent—indicating retail traders are slowly exiting rather than being abruptly forced out en masse.

When liquidity thins so dramatically like this, prices can fall rapidly even with relatively light sell orders—not necessarily accompanied by panic-driven volume surges typically associated with definitive capitulation points or solid market bottoms.

Kaiko also placed these developments within Bitcoin’s well-known four-year halving cycle framework: after peaking near $126,000 between late 2025 and early 2026, BTC has retraced sharply—with current declines into the $60K-$70K range representing more than a 50% drop from those highs.

Historically speaking, such bottom formations often take several months and include multiple unsuccessful rallies before stabilizing fully.

The crucial factor now is whether Bitcoin manages to maintain support around $60,000. If buyers successfully defend this level consistently, it could lead markets into an extended period of choppy consolidation. Conversely if support fails again under thin liquidity conditions—and broader macroeconomic risks remain elevated—the same dynamics fueling previous sell-offs may quickly reemerge causing further downside pressure on prices.