Privacy, once viewed as a negative aspect for cryptocurrencies, has now become an essential factor according to experts who believe it is crucial for bitcoin’s evolution as a store of value. Influential figures such as Chamath Palihapitiya, Changpeng Zhao, Ray Dalio, and Barry Silbert have all emphasized that bitcoin’s lack of privacy undermines its potential growth.

The Shift in Perspective: Privacy Emerging as Vital for Bitcoin

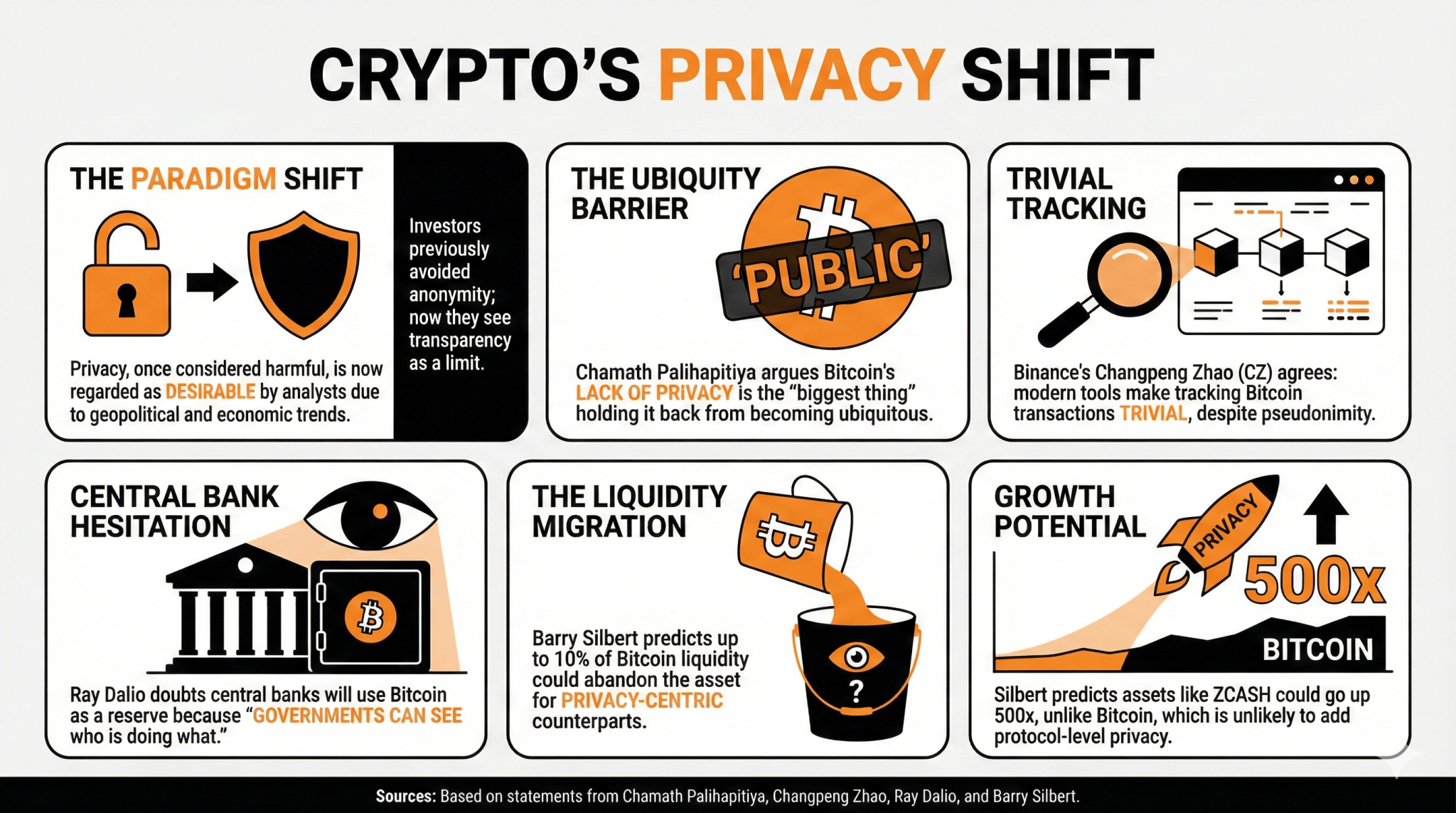

Previously regarded with suspicion due to anonymity concerns, privacy is increasingly seen by analysts as a key attribute that bitcoin must embrace amid changing geopolitical and economic landscapes.

Not long ago, cryptocurrency exchanges tended to avoid privacy-focused coins like Monero or Zcash because their anonymous nature raised regulatory alarms. However, prominent investors including Chamath Palihapitiya and Binance co-founder Changpeng Zhao now highlight the absence of robust privacy features in bitcoin as a significant obstacle limiting its widespread adoption.

Palihapitiya recently admitted he does not consider himself a strict bitcoin maximalist precisely because BTC lacks strong privacy protections. During an interview with Zhao, he pointed out that this shortcoming might be “the biggest barrier” preventing bitcoin from becoming universally accepted.

Zhao concurred by emphasizing the fundamental role privacy plays within society. While acknowledging that bitcoin was designed around pseudonymity rather than full anonymity, he noted how modern technology makes tracking transactions relatively easy today. Both agreed there are specific scenarios where maintaining transaction confidentiality is critical.

In January this year, Palihapitiya forecasted central banks would transition away from gold and traditional cryptocurrencies toward new cryptographic assets characterized by being “fungible,” “tradable,” and offering complete security alongside strong privacy guarantees.

The renowned investor Ray Dalio—known for his advocacy of gold—also expressed doubts about central banks adopting bitcoin as part of their reserves due to transparency issues inherent in the blockchain system.

“I doubt any central bank will accept it as reserve currency since everyone can monitor transactions openly,” Dalio remarked last October. “Governments can easily track who conducts which operations on the network because there’s no real privacy.”

More recently Barry Silbert—the founder of Digital Currency Group (DCG)—predicted up to 10% of current bitcoin liquidity could migrate towards cryptocurrencies prioritizing user anonymity if BTC fails to integrate adequate protocol-level privacy features.

“Unless the U.S. dollar collapses entirely,” Silbert explained, “bitcoin won’t experience exponential growth like 500 times its current value—but coins such as Zcash or Bittenser might.”

Frequently Asked Questions

How has attitudes toward cryptocurrency privacy evolved?

Privacy was once considered detrimental but now analysts recognize it as vital due to recent shifts in global political and economic dynamics.

What do leading investors say about Bitcoin’s lack of private transactions?

Figures like Chamath Palihapitiya and Changpeng Zhao argue that insufficient transaction confidentiality restricts Bitcoin’s broader acceptance.

What reservations did Ray Dalio express regarding Bitcoin’s suitability for reserves?

Dalio pointed out that transparent blockchains make Bitcoin unattractive for central banks seeking discreet reserve assets.

What are predictions concerning shifts in Bitcoin liquidity toward private coins?

Barry Silbert anticipates up to 10% liquidity may move from Bitcoin into more private-focused digital currencies if protocol-level changes aren’t made.