The price of Bitcoin is currently stabilizing around the $89,000 mark following the U.S. Federal Reserve’s decision to maintain interest rates within the 3.5% to 3.75% range.

Summary

Bitcoin is maintaining support at both its channel low and value area low.

Regaining control at a key price level suggests an improving short-term trend.

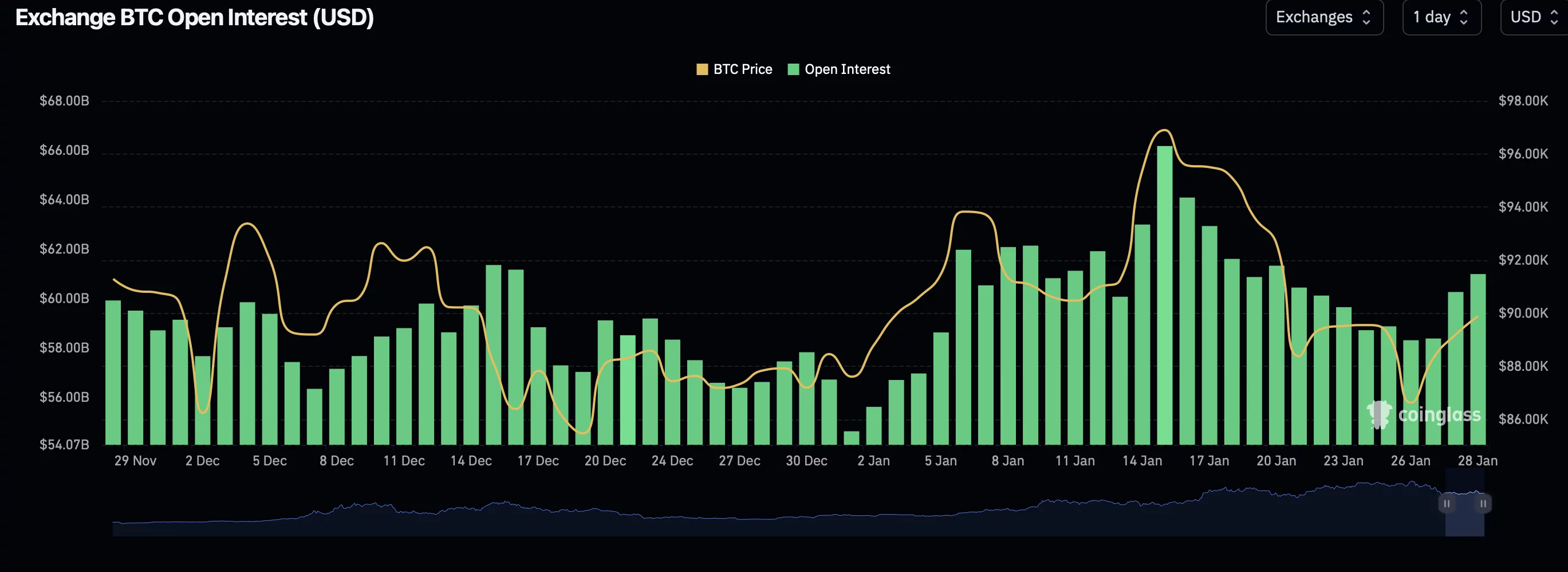

An increase in open interest indicates a potential for a relief rally.

Bitcoin (BTC) has begun showing signs of stabilization after experiencing a corrective phase, with price action responding positively near crucial technical support zones.

Trading close to the lower boundary of its channel, Bitcoin appears to be seeing reduced selling pressure. This observation is supported by rising open interest figures, reflecting heightened activity in derivatives markets.

Although confirmation is still pending, this combination of strong technical support and increased market participation hints at the possibility of a short-term upward correction if current conditions persist.

The Federal Reserve’s Interest Rate Decision

The Fed’s choice to keep interest rates steady signals stable borrowing costs and often diminishes appeal for cash and bonds, which can lead to weakening of the U.S. dollar.

Since Bitcoin frequently moves inversely relative to the dollar, a softer or stagnant dollar environment tends to enhance demand for cryptocurrencies as alternative stores of value.

A pause in rate hikes also implies that inflation-fighting measures are not being aggressively pursued right now, encouraging investors toward riskier assets like Bitcoin.

Key Technical Highlights for Bitcoin Price

- The channel low along with value area low continue serving as solid support levels;

- The point of control has been reclaimed indicating strengthening market structure;

- An uptick in open interest supports optimism about an upcoming relief rally;

This recent rebound from Bitcoin’s channel bottom coincides closely with its value area low—a zone dense with technical significance—attracting buyers seeking favorable entry points within this broader trading range. The initial positive response suggests demand may be absorbing previous selling pressures effectively.

This bounce was sustained rather than rejected outright; prices managed enough momentum to reclaim an important level often regarded as controlling within this range.

You might also like: MEXC launches RNBW platform offering users up to 50% discounts on 750,000 tokens

Reclaiming Point Of Control Indicates Strengthening Momentum

A particularly promising sign lies in Bitcoin retaking its point of control (POC)—the price level where trading volume peaked recently—which typically acts as a pivot between bullish and bearish dominance.

Maintaining levels above POC shifts short-term sentiment toward buyers’ favor. If sustained acceptance above this threshold continues, it increases chances that recent gains represent more than just temporary rebounds but rather signal emerging upward rotation inside the established channel boundaries.

$BTC Open Interest data courtesy CoinGlass

Together with improved pricing patterns comes rising open interest—a critical confirmation metric suggesting traders are actively initiating new positions instead of merely closing existing ones during consolidation near key supports.

This behavior reflects conviction especially when observed around technically significant zones: here it implies derivatives participants expect further upside rather than immediate breakdowns.

However, open interest alone doesn’t guarantee bullishness—it depends heavily on whether prices hold their ground above these reclaimed areas. If those supports fail, rising open interest could exacerbate declines instead. For now though, such positioning aligns well with expectations for relief rallies ahead.

You might also like: PayPal survey reveals surge in crypto payments as over one-third major US companies adopt digital currencies

The Next Resistance: Value Area High Level

If BTC sustains itself beyond POC territory,

attention will shift towards challenging resistance at the value area high. Clearing this hurdle would confirm transition back into higher-value zones,

bolstering prospects toward testing upper limits represented by channel highs.

This gradual reclaim process matters greatly since many relief rallies stumble failing surpass upper boundaries leading either back into sideways ranges or renewed sell-offs.

</blockqu…

Cautious Yet Improving Market Structure

Despite some recovery signs, BTC remains entrenched within broader bearish dynamics. While downward momentum has eased somewhat, no full-fledged trend reversal exists yet. Instead, current developments suggest temporary upward rotations confined inside wider ranges rather than decisive breakouts.

Nevertheless, improvements such as holding critical lows plus regaining pivotal controls mark meaningful progress compared against prior weakness periods.

Outlook For BTC Price Action

Bitcoin stands at an important inflection juncture over shorter timeframes. Provided it stays above both point-of-control plus lower-channel supports,

probabilities favor continuation toward higher targets including value-area highs followed potentially by upper-channel resistances. Rising derivative-market engagement backs these scenarios signaling active trader commitment near foundational levels.

Failing these thresholds would weaken bullish cases reopening downside risks imminently.

Immediate focus remains on whether prices can firmly accept values beyond resistance turning relief moves into lasting uptrends.

Read more:&amp;amp;amp;amp;

South Korea finalizes draft legislation regarding digital assets