Bitcoin May Reach Its Lowest Point Soon as 2026 Recession or Stock Market Crash Seems Unlikely

Since last September, my perspective on the Bitcoin market has remained consistent, even before we reached the all-time high in October.

I clearly articulated my medium-term bearish outlook for Bitcoin at $49,000 in a piece published on November 24, 2025, and revisited it again on January 30, 2026.

The core argument has not changed:

Bitcoin continues to operate in cycles; the true “this is the low” moment typically occurs when miner economics and institutional investments align. The eventual bottom often feels more mechanical than emotional.

Since then, discussions surrounding 2026 have settled into familiar territory. Many individuals (especially on social media) are attempting to link Bitcoin’s next movement to an impending global recession or a stock market crash that would force everything to liquidate simultaneously.

I understand why this narrative is appealing. It’s straightforward and dramatic; it provides everyone with a single scapegoat.

However, this scenario increasingly seems less likely as the primary outcome.

If you examine major macroeconomic forecasts, they tend to use language of slowdown rather than collapse.

The IMF projects global growth at 3.3% for 2026. The World Bank anticipates growth easing to 2.6% while framing the world as resilient despite trade tensions. The OECD expects global GDP growth will slow down to about 2.9% in that same year.

You also have crowd-sourced insights reflecting similar sentiments.

On Polymarket, predictions of a U.S. recession by late-2026 hover around low twenties percentages—indicating that while recession risks are acknowledged as real concerns, they aren’t viewed as central expectations by most participants in this market environment.

The first place where these narratives get tested is through job data since employment directly affects how ordinary people perceive economic conditions. Herein lies genuine warning signs—a reminder that slowdowns differ significantly from crashes.

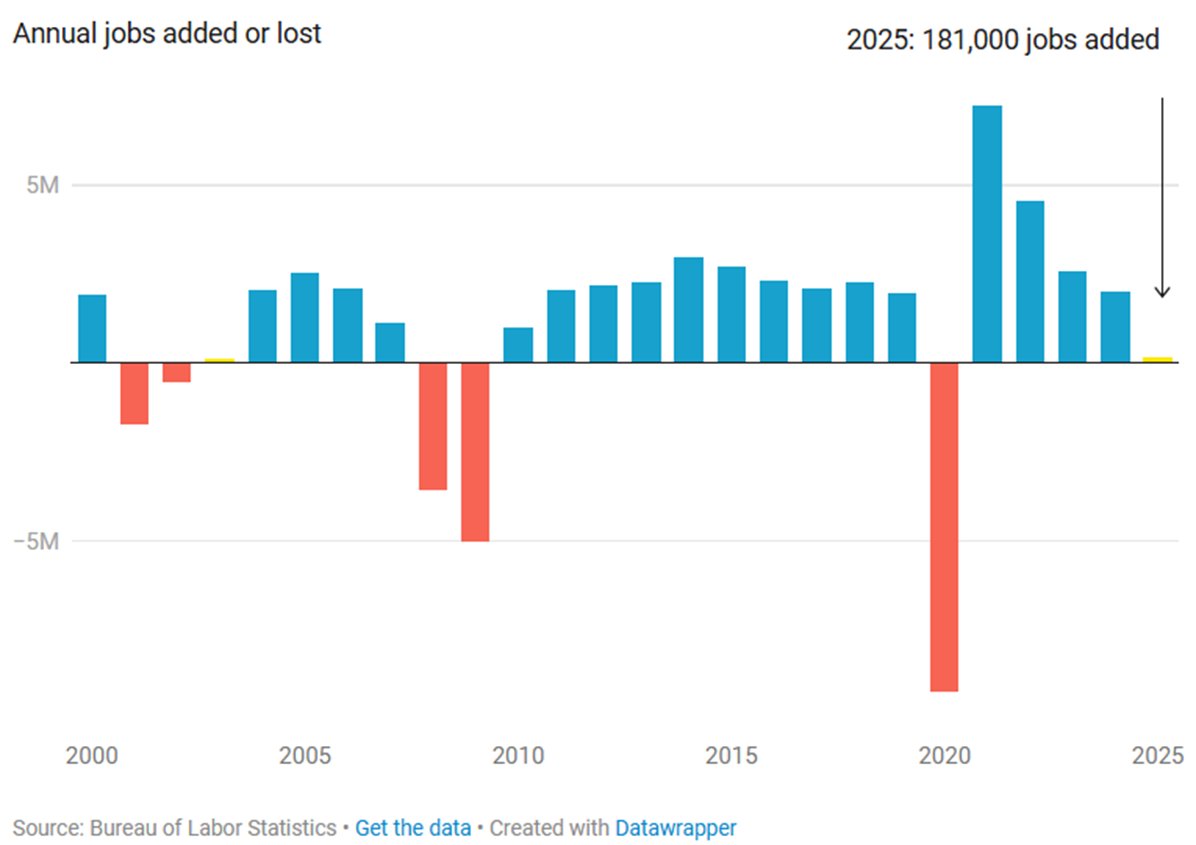

The BLS benchmark revision indicates total nonfarm job growth for 2025 was revised downwards from an initial estimate of over half a million jobs added (584k) to just about181k added jobs.

This adjustment alters perceptions within macroeconomic debates and aligns with what many experienced throughout much of last year: hiring slowed down considerably; switching jobs became increasingly challenging; overall momentum among white-collar positions diminished noticeably.

The same BLS report shows unemployment rates at approximately4 .3 %in January20 ,26 ,with payrolls increasing by130 ,000that month—primarily driven by healthcare and social assistance sectors.

This reflects both cooling labor markets alongside ongoing employment opportunities which help explain why stock prices can remain elevated even amid discussions regarding potential recessions during family dinners.

This discrepancy between public sentiment regarding economic stability versus actual index performance underlines why I continue distinguishing between Bitcoin’s cyclical mechanics versus broader narratives concerning doom scenarios globally.

A recession could still materialize sometime during twenty-six yet markets persistently treat such events merely like minority outcomes instead .

This macro context holds significance for Bitcoin because it implies any significant downturn doesn’t necessarily require catastrophic worldwide events—it may stem from localized issues: leverage being flushed out forcing miners into selling their assets mechanically whilst ETF flows continue leaking away until finally reaching levels prompting shifts among buyers’ profiles .

A Deeper Look Into Job Data Reveals Macro Stress Tests Indicate Gradual Slowdown Ahead

If there’s one chart illustrating why conversations surrounding possible recessions intensified recently—it would be annual job additions/losses tracked since2000 .

The pandemic contraction stands out starkly against previous years’ rebounds which tower above everything else making25 seem insignificant comparatively speaking ; revised figures indicate only181 k new roles created across entire economy!

This number certainly captures attention!

A practical takeaway revolves around understanding how gradual declines shape overall dynamics moving forward:

January26 saw concentrated job gains occurring mainly within essential services sectors like health care/social assistance according BLS reports highlighting government payrolls shrinking further post peak observed back October24 ! This creates conditions where labor markets might feel strained locally despite headline unemployment remaining relatively stable .

Lackluster hiring raises chances associated with potential future recessions but also increases likelihood policymakers may opt towards easing measures resulting lower real yields later throughout upcoming months ahead too ! Polymarket traders clustering around low-to-mid threes reflect ideas suggesting slower economies eventually lead downward pressure upon interest rates over timeframes ahead too!

This becomes critical information pertaining specifically toward cryptocurrency landscapes: Job statistics could push decision-makers toward adopting looser monetary policies without necessitating drastic collapses occurring simultaneously elsewhere! Slow grinding patterns create stress internally amongst crypto spaces given its reliance upon reflexive behaviors leveraging plumbing systems already established therein

An Analysis Of Macro Indicators Suggest Friction Rather Than Total Collapse In Future Outlooks For Twenty-Six

I consistently challenge notions framing situations whereby “everything must crash together” due primarily because existing forward-looking indicators point towards muddled environments instead

IMF describes current state globally maintaining steadiness amidst technology investments offsetting negative impacts stemming from trade policies whereas World Bank emphasizes resilience while explicitly mentioning easing financial conditions cushioning against slowdowns expected going forth ! OECD highlights fragilities yet remains optimistic forecasting continued positive growth trends nonetheless !

On higher-frequency side J.P.Morgan Global Composite PMI printed52 .5for January indicating historically aligned levels corresponded closely approximating annualized GDP pacing near two point six percent —boring yet steady progress nonetheless !

Trade represents another area anticipated witnessing cracks emerging first however complexities abound here too : UNCTAD updates heading into twenty-six discuss pressures arising fragmentation/regulatory challenges though pressure itself does not equate outright collapse! Kiel Trade Indicator proves useful tracking real-time metrics helping differentiate shipping dramas versus actual demand conditions prevalent currently

Current State Of Security Budgets Indicates Winter Has Arrived Already!

Your original bear thesis relied heavily upon miner economics precisely due reason being intersectionality between costs incurred running operations vs prevailing market structures governing transactions conducted daily basis!

As per recent data released Jan29 miners generated approximately$37 .22million daily revenues whilst total transaction fees amounted roughly260 K yielding fee share hovering close0 .07 %—significant indicator showcasing chain security practices currently employed today !

Fees constitute mere rounding errors thus leading system reliance issuance stepping down accordingly forces burden shifted back onto price fluctuations along hash rate economics whenever tighter circumstances arise subsequently thereafter

You can observe these trends reflected live via mempool feeds projecting median next-block fees appearing stagnant long stretches typical environment wherein sharp price movements occur devoid any external headlines attached whatsoever

That explains rationale behind viewing$49K-$52K zone aligning well cycle floor based simply level historically witnessed halting debates shifting inventory transfer forced sellers impatient holders transitioning allocators awaiting optimal entry points necessary sizing trades effectively targeting desired allocations made previously anticipated amounts

ETF Era Provides Clear Stress Gauge That Has Been Flashing Warning Signs!

Second pillar framework focuses flow elasticity particularly evident through ETF pipelines representing cleanest manifestation concept discussed earlier mentioned here today!

Late January revealed risk appetite seemingly draining away concurrently holding prices together firmly enough maintain stability nevertheless noticeable heavy outflows occurred Farside including roughly -708M recorded Jan21 & -817M reported Jan29 leading cumulative yearly totals nearing -1Billion prior check-in period conducted end-monthly evaluations indicating continuing trend now reaching beyond-1Billion lost Fidelity alone!

These figures dramatically alter psychological perceptions associated dips encountered regularly across various platforms operating marketplaces involved trading activity levels taking place routinely nowadays especially within digital asset ecosystems developing rapidly right now moving forward continuously evolving strategies employed each day observed firsthand.

In favorable versions characterized era encompassing ETFs declining days often correlate net buying tendencies emerge encouraging allocators treating weaknesses akin inventory replenishment efforts undertaken previously planned expansions meanwhile stressed versions witness drain effects manifesting requiring recalibrated clearing prices converting drains back bids again seeking equilibrium restore balance present situation prevailing continually.

Importantly note dynamics unfolding remain plausible independent broader contexts appear sound stocks rise gradually retaining positive outlook trajectories persistently intact ensuring underlying fundamentals intact enabling sustained momentum build-up regardless exterior developments impacting other industries simultaneously!

Miners Now Operate Two Businesses Changing How Drawdowns Feel

The public-interest angle shaping cycle signifies miners evolving beyond simple margin machines solely focused profit generation activities tied directly BTC pricing alone anymore!

Many resemble power/infrastructure operators integrating divisions related cryptocurrencies altogether establishing dual revenue streams enhancing survivability amidst unfavorable fee environments allowing continued financing capital expenditures sustaining operational viability even if hash-rate economics tighten up considerably overtime henceforth .

Secondly behavioral changes arise stressors faced differing approaches taken when navigating turbulent waters experienced frequently lately causing volatility spike suddenly affecting network condition fluctuations become more elastic precisely moments desired stability sought after marketplace experiences heightened uncertainty regarding future prospects developing fast-paced realities unfolding presently.

Visible evidence exists showcasing shift announced publicly TeraWulf signing agreements hosting AI tied large-scale capacities involving Google structure company release details shared recently along likewise reports indicate Riot evaluating options pivot capacity toward AI HPC development initiatives similarly adapting respective models business-oriented approaches undertaken diligently analyzing multiple factors influencing decisions made strategically considering various aspects impact profitability projections longer-term horizons set forth comprehensively evaluated thoroughly beforehand .

Zooming Out Picture What Means Ground Level Teams Engaged Negotiating Power Contracts Managing Shareholders Planning Data Halls Acquiring Machines Competing Harshest Hash Race Earth Numerous Moving Parts Create Reflexive Market Behaviors Price Begins Sliding Downward Shifting Sentiment Accordingly Impact Overall Dynamics Observed Closely Monitoring Trends Developments Progressively Evolving Throughout Current Landscape Encompassing Digital Assets Environment Entirely New Paradigms Emerging Rapidly Shaping Futures Yet To Come Ahead!

Why A $49K Style Bottom Still Fits Even If Twenty-Six Remains Economically Dull

Bringing Together All Pieces Analyzing Path Forward Becomes Relatively Straightforward Understanding Dynamics At Play Within Current Context Present Day Economics Resilient Enough Synchronization Global Risk Events Slipped Away From Central Focus Narrative Observations Reflect Polymarket Recession Odds Confirm Such Sentiments Expressed By Growth Forecasters Including IMF World Bank OECD Sitting Same Neighborhood Overall Consensus Developing Across Board Here Today !

Internally BTC Metrics Appear Strained Fees As Share Miner Revenues Have Remained Minimal ETF Flows Demonstrated Real Risk-Off Windows Fee Markets Exhibiting Lethargy Mempool Perspectives Creating Tension Building Up Underneath Surface Waiting Resolution Occur Soon Enough As Well Typically Results Fast Moves Sharp Legs Lower Moments Where Leverage Gets Rinsed New Buyer Base Steps With Conviction Reinforcing Stability Restoring Confidence Needed Moving Forward !

My Range Between $49K-$52K Continues Serving Base Case Transfer Expected Aligning Plausibly Close Enough Current Levels While Psychologically Clean Attract Size Allocators Who’ve Long Awaited Sub-$50 K Opportunities Treat BTC Inventory Effectively During Period Timeframe Approaching Anticipation Build-Up Set In Motion Eventually Leading Towards Convergence Towards Desired Outcomes Achieved Ultimately Successfully Navigating Through Complexities Surroundings Encounter Daily Basis Regular Interactions Taking Place Constant Engagement Ensuring Progress Continues Steadily Overcoming Challenges Faced Head-On Along Way Regardless Obstacles Encounter Along Journey Continuing Pursue Goals Objectives Established Firmly Initially Setting Course Direction Follow Henceforth Achieving Success Desired Outcomes Resultant Efforts Put Into Action Thoughtfully Executable Plans Designed Strategically Navigate Landscapes Ever-Changing Dynamic Nature Environments Operative Forces Impact Influencing Decisions Made Directly Affected By Circumstances Prevailing Externally Internally Both Equally Important Factors Consideration Must Take Account Balance Proper Management Ensures Smooth Sailing Throughout Process Always Keeping Eye Prize Ahead Remaining Focus Determined Stay Course No Matter What Comes Next Down Road Unfolds Before Us All Making Sure Ready Whatever Challenges Lie Ahead Together United Stronger Than Ever Working Hand-In-Hand Pursuing Common Vision Shared Collective Goals Set High Standards Expectations Meeting Every Step Way Until Victory Finally Achieved Fulfillment Dreams Aspirations Manifest Reality Living Life Fully Engaged Purposeful Meaningful Ways Striving Better Tomorrow Each Day One Step Time Building Bright Future Everyone Deserves Enjoy Experience Live Happily Ever After Ultimately Reaching Destination End Goal Fulfilled Heartfelt Gratitude Expressed Appreciation Support Received Throughout Journey Long Road Traveled So Far Only Beginning Exciting Adventures Await Just Around Corner Ready Embrace Them Open Arms Welcoming Opportunities Presented Ones Seize Hold Tight Never Let Go Until Last Breath Taken Savor Sweet Taste Success Sweetness Life Brings Us All Remember Always Keep Faith Alive Hope Burning Bright Within Hearts Souls Guiding Light Leading Path Forward Illuminating Darkness Shadows Cast Upon Lives Shine On Forevermore…