The price of Bitcoin has experienced a significant decline, dropping over 40% from its peak to reach its lowest point in nearly a year.

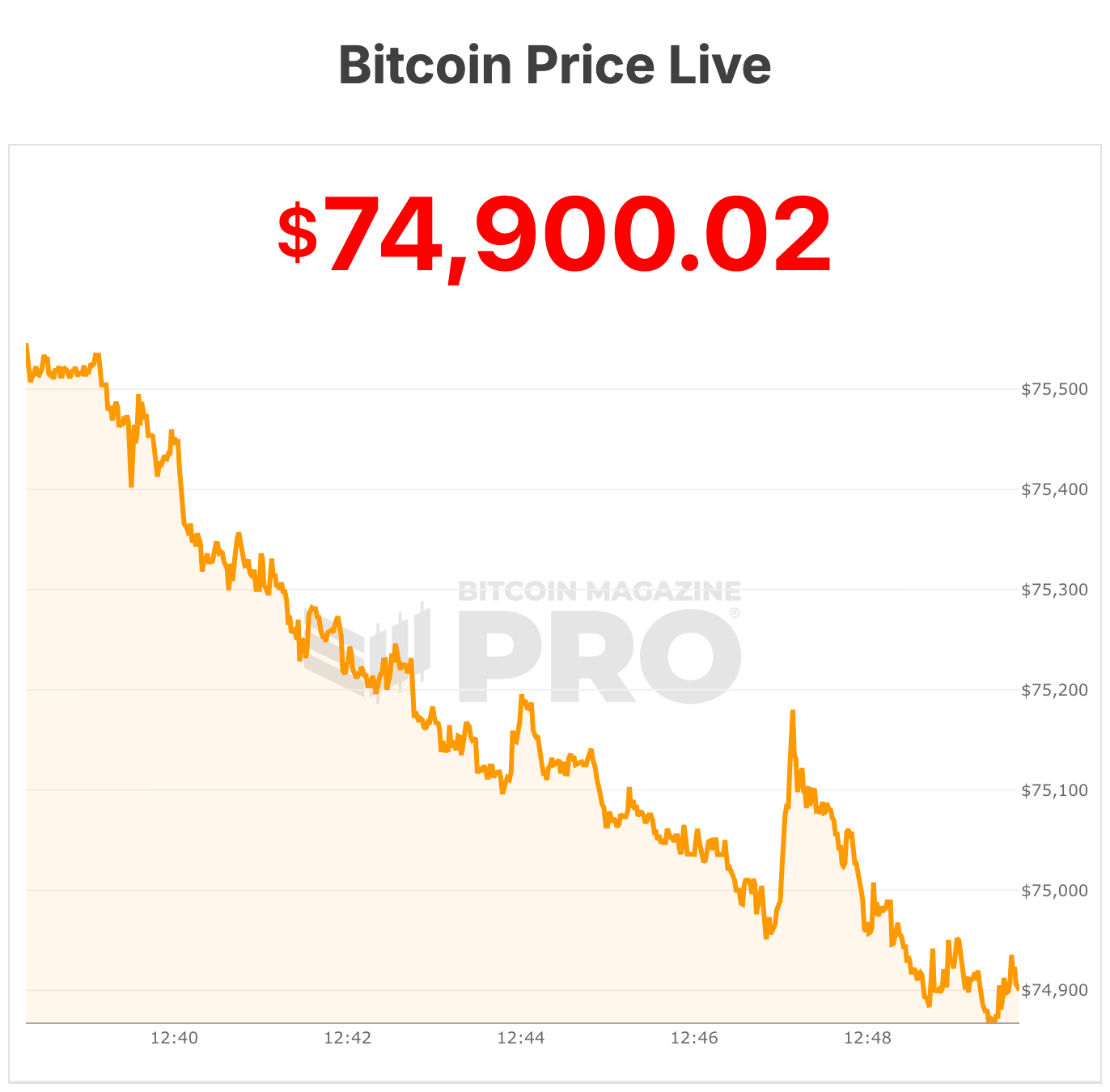

Today, Bitcoin fell below the $75,000 mark as the global cryptocurrency market faced persistent selling pressure due to broader financial uncertainties and changing investor sentiment. The current low for Bitcoin stands at approximately $74,747, closely approaching this one-year minimum.

Recent trading activity indicates that Bitcoin has breached critical technical support levels. This situation has led to forced liquidations within derivatives markets and increased downward pressure on prices. In just the last day alone, around $2.56 billion worth of Bitcoin positions were liquidated according to market reports.

This trend follows several weeks of risk-averse behavior across various asset classes worldwide.

The downturn in cryptocurrencies is occurring alongside challenges in other sectors such as precious metals and technology stocks, along with declines in equity markets.

Institutional Investors Face Losses Amid Uncertain Policies

<pThe ongoing market decline is having real consequences for major players within the industry. Galaxy Digital—a prominent crypto investment firm helmed by Michael Novogratz—reported a staggering loss of $482 million for Q4 2025 earlier today.

This loss was attributed to falling digital asset prices coupled with a dramatic drop in trading volumes exceeding 40% compared to the previous quarter. Following this earnings announcement, Galaxy’s stock saw a decrease as investors expressed concerns regarding both Bitcoin’s value and the overall crypto market slump.

Currently priced below $76,000, Bitcoin trades significantly lower than Strategy’s average acquisition cost for its holdings of $BTC, which means many coins are now valued less than their purchase price—leaving much of their inventory “underwater.”

Market analysts have pointed out that developments related to U.S. monetary policy are crucial factors driving this sell-off.

The recent nomination by President Donald Trump of Kevin Warsh as chairperson of the U.S Federal Reserve has raised expectations for tighter monetary policies ahead.

A strengthening dollar resulting from these shifts is also putting additional pressure on Bitcoin; typically making non-yielding assets like it less appealing and diminishing inflows from investors looking for currency-neutral hedges. Analysts noted that recent dollar performance created technical barriers exacerbating declines within cryptocurrency markets.

The Trump administration continues discussions with industry leaders about digital asset regulations while seeking clarity through legislative efforts like the Digital Asset Market Clarity Act; however these conversations have slowed considerably over recent months without stabilizing effects on current pricing trends yet realized amidst prevailing conditions.

A True ‘Crypto Winter’?

In spite of these challenges Bitwise CIO Matt Hougan recently indicated via memo that we may be experiencing an authentic “crypto winter,” beginning early 2025 rather than merely facing temporary corrections during this period.

Hougan emphasized persistent bearish sentiment illustrated by high fear levels shown on Crypto Fear & Greed Index despite positive changes such as appointing pro-Bitcoin Federal Reserve leadership.

This bearish environment was somewhat masked by institutional flows where U.S.-based spot bitcoin ETFs alongside treasury vehicles acquired more than 744k $BTC, equating roughly $75 billion worth demand—helping cushion potential losses which he estimates could have reached close towards almost sixty percent without such backing.

The current climate mirrors past downturns seen back during both years’ eighteen & twenty-two when optimism failed despite incremental favorable news emerging throughout those times too .

Looking forward Hougan suggests historical patterns indicate crypto winters conclude not through exuberance but exhaustion instead stating “It’s always darkest before dawn.”

At present time ,Bitcoin hovers around seventy-four thousand eight hundred dollars ($74 ,800) accompanied by twenty-four hour trading volume hitting fifty-five billion (55B). Over last day BTC remains down five percent (-5%) from seven-day all-time highs recorded at seventy-eight thousand nine hundred ninety-four ($78 ,994).

This article titled “Bitcoin Price Plunges 40% From All-Time Highs To One-Year Lows,” originally appeared on Bitcoin Magazine and was authored by Micah Zimmerman.