Justin Bons, the founder and chief investment officer of Cyber Capital, has forecasted a potential collapse of Bitcoin (BTC) within the next 7 to 11 years.

He highlights concerns such as shrinking security budgets, an increasing threat of 51% attacks, and difficult decisions facing the network. Bons cautions that these critical weaknesses could undermine confidence in Bitcoin and even cause splits in its blockchain.

Scrutinizing Bitcoin’s Economic Security Framework

Experts have long voiced worries about various risks to Bitcoin, including quantum computing’s potential to break current cryptographic protections.

Nevertheless, Bons presents a distinct perspective focusing on Bitcoin’s economic security model as its greatest long-term vulnerability.

“Bitcoin will face collapse within 7 to 11 years! Initially, mining operations will decline due to reduced security budgets. This decline will open the door for attacks such as censorship and double-spending,” he asserted.

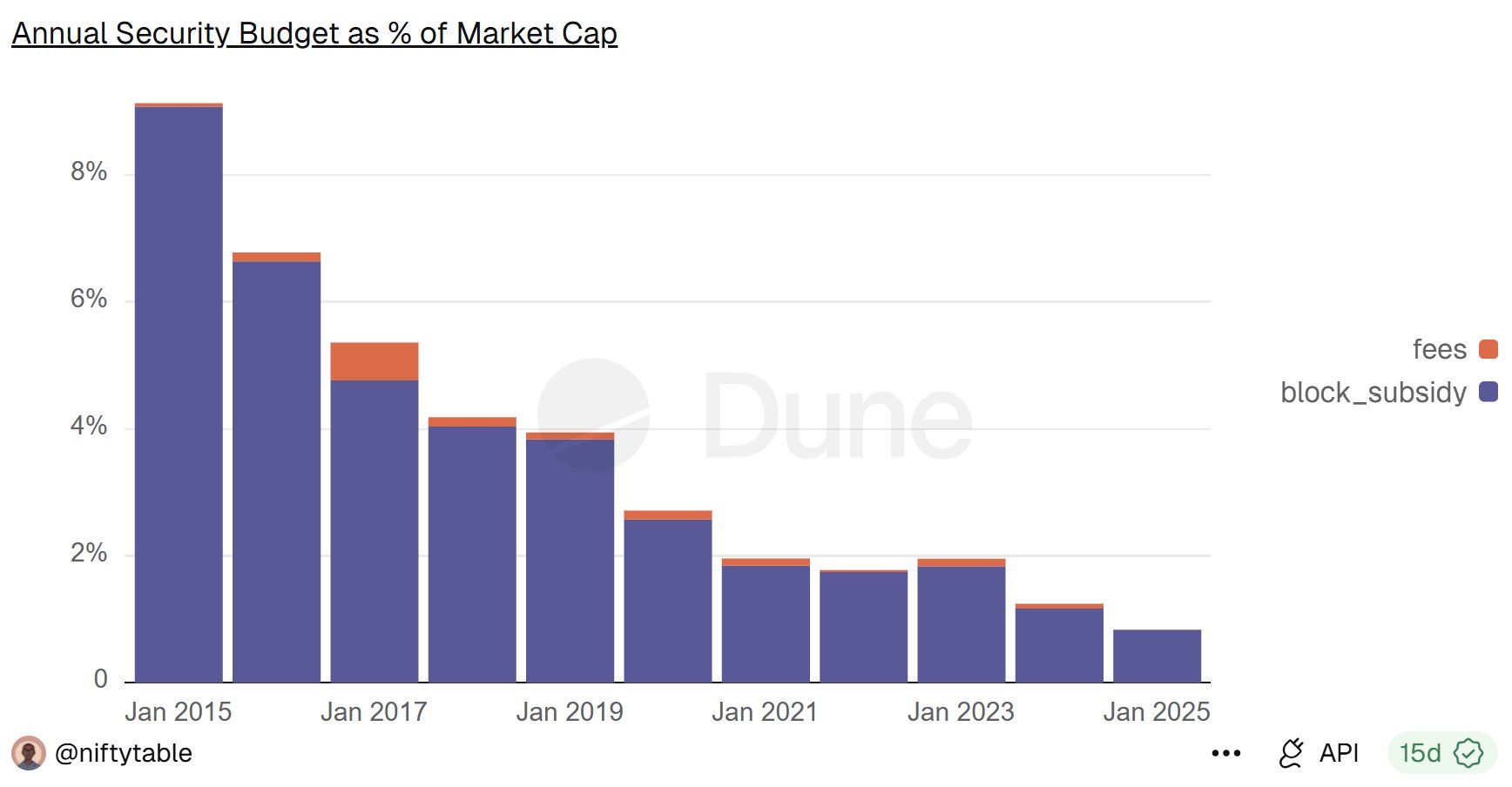

The core issue revolves around diminishing miner rewards following each halving event—where payouts are cut by half—thereby lowering incentives for miners who secure the network.

The latest halving occurred in April 2024 with subsequent halvings scheduled every four years. According to Bons, maintaining current security levels would require either continuous exponential price increases or consistently high transaction fees—both scenarios he deems improbable.

Bitcoin's Declining Security Budget. Source: X/Justin Bons

Dwindling Miner Income Raises Attack Vulnerability

Bons argues that miner revenue is a more accurate indicator of network security than raw hashrate alone. He explains that improvements in hardware efficiency can increase hashrate while reducing costs per hash, making hashrate an unreliable measure against attacks.

A decrease in miner income lowers the financial barrier for executing attacks on the blockchain. When expenses for launching a 51% attack drop below expected profits from activities like double-spending or disruption tactics, such assaults become economically sensible choices for attackers.

“Crypto-economic game theory depends on incentives through rewards and penalties. Miner revenue directly influences attack costs because lucrative targets like exchanges make double-spending via majority control highly attractive,”

Currently transaction fees contribute only marginally to miners’ earnings. As block subsidies diminish over coming decades toward zero, securing Bitcoin would increasingly rely on fee income—which is limited by constrained block capacity restricting total transactions per second and thus fee volume.

Bons also points out that persistently high fees are unlikely since users tend to leave during fee surges—a dynamic preventing reliable replacement of subsidy revenues over time through fees alone.

Panic-Induced Congestion Risks Triggering Death Spiral

Beyond budgetary concerns regarding network protection levels, Bons warns about possible “bank-run”-like situations:

“Even conservative estimates show if every existing BTC holder made just one transaction simultaneously,the backlog could stretch up to nearly two months,”

This bottleneck means during periods of panic withdrawals may be delayed by congestion combined with rising fees,trapping users much like traditional bank runs.

Bons also highlights how bitcoin’s biweekly difficulty adjustment mechanism can exacerbate problems.In sharp price drops,miners operating at losses might cease activity,reducing block production speed until difficulty adjusts again.

“pandemonium causes prices plummet leading more miners offline slowing chain further triggering additional panic price crashes causing even more shutdowns ad infinitum.This vicious cycle known as negative feedback loop or death spiral poses serious systemic risk,”

This scenario makes self-custody risky under stress conditions,because users may find themselves unable exit promptly when demand spikes sharply.

An Inescapable Crossroad For The Network

Bons concludes bitcoin confronts an unavoidable dilemma.One path involves increasing total coin supply beyond fixed cap at twenty-one million,to sustain mining incentives &; thus maintain robust security.But this would compromise bitcoin’s foundational value proposition potentially causing chain splits. &br/>

The alternative requires accepting gradual weakening of economic defenses against threats,increasing susceptibility towards censorship &.attack vectors.

“Most likely outcome includes simultaneous emergence both options described plus others within next seven-to-eleven years,” wrote bons .</ p > ;

beyond technical issues bons ties problem governance legacy stemming from past block size conflicts which limit protocol evolution politically until crisis forces change.By then,it may already be too late .</ p > ;

The article originally appeared on BeInCrypto titled “Bitcoin Faces Possible Collapse In Seven To Eleven Years,Warns Cyber Capital Founder.”</ p > ;