Bitcoin has surged past its previous all-time high of $125K, indicating a robust upward momentum.

The market is now at a critical juncture, where it may either consolidate or experience a short-term pullback that could determine the next major trend direction.

Bitcoin Price Analysis: Technical Insights

By Shayan

The Daily Chart Overview

On the daily chart, Bitcoin has successfully broken out of the flag pattern that had been restricting its price movement since July. This breakout confirms a strong continuation of the upward trend. The price’s rise above this pattern coincided with increased momentum, pushing it into the previous supply zone between $124K and $126K, where sellers are beginning to show some resistance.

The bullish outlook remains intact due to the golden cross formed by the 100-day and 200-day moving averages acting as dynamic support levels. As long as Bitcoin stays above $120K, this broader uptrend is expected to continue. A decisive daily close above $126K could pave the way for further gains toward $130K–$132K in the near term.

If Bitcoin fails to maintain its position above $120K, it might undergo a healthy correction toward mid-range support around $115K. This level aligns with both breakout structures and key Fibonacci retracement levels (0.618).

The 4-Hour Chart Analysis

In examining the 4-hour chart, we see that BTC recently climbed past an important decision point at $118K—turning it into what traders call a breaker block—and quickly advanced towards its ATH region near $125 K. The rapid nature of this ascent created an imbalance with potential retracement zones identified between approximately$115 K.and$113 K., which align closely within certain Fibonacci confluence ranges (0 .618-0 .702)

This area serves as short – term re – accumulation territory ; maintaining prices here would confirm continued bullish dominance . Currently ,the market consolidates around liquidity-rich regions suggesting any brief dip may attract renewed buying interest before another leg higher occurs .

Should prices fail defending both breakout blocks at $1&#&59;&##49;;&##51;;&##53;;(Fibonacci range),next demand lies roughly around $& ##48 ;;& ##57 ;;where strong buy orders previously initiated breakouts earlier on .

Sentiment Analysis Overview :

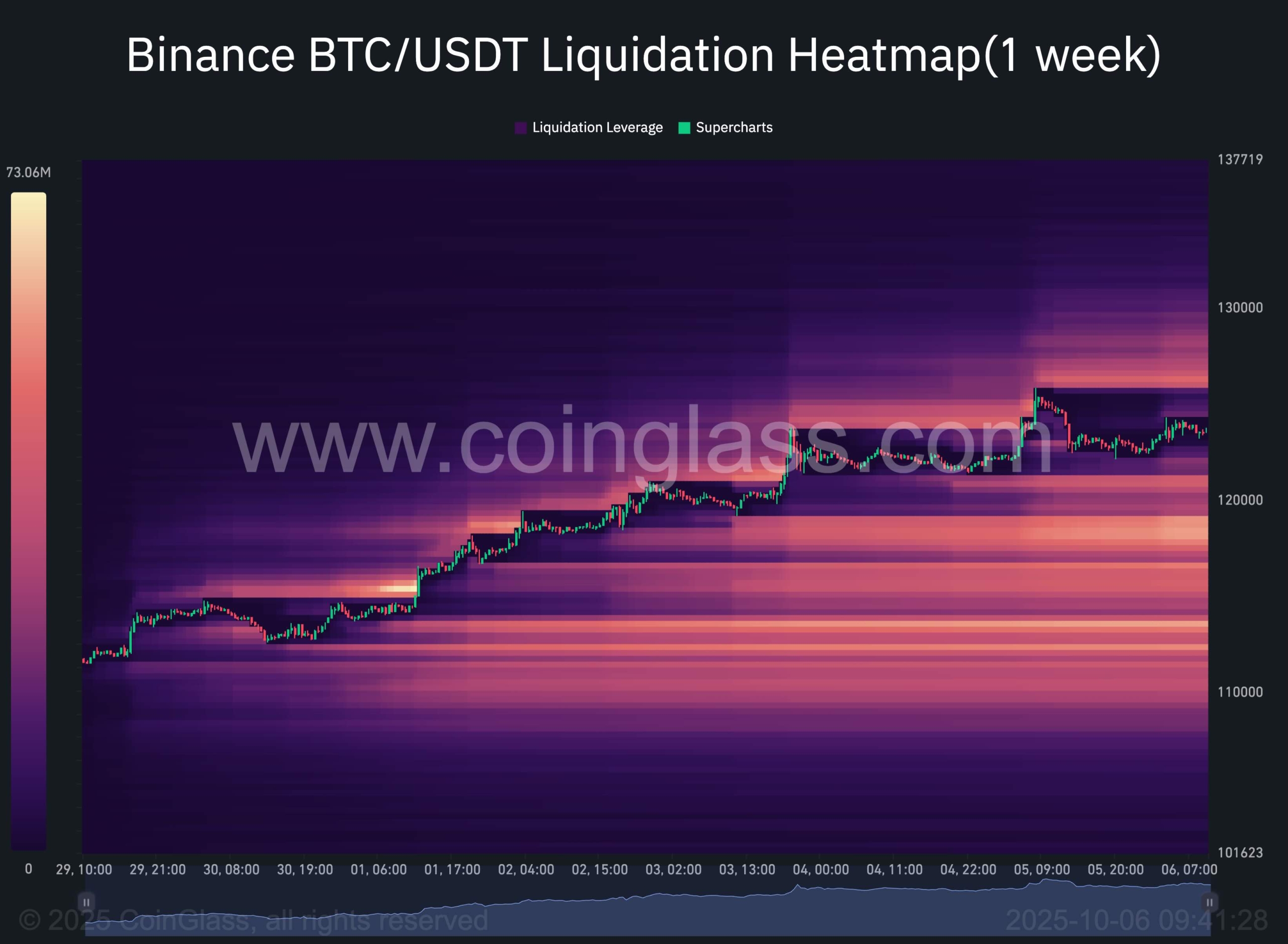

During recent rallies spanning from approximately110k upwards over123k levels observed steady absorption lower-level liquidities clearing prior shorts each time consolidation occurred afterward.This presence major pockets below current pricing especially focused near&$ amp& ; #120,k highlights downside risks remain present suggesting possible corrections pullbacks still likely upcoming movements take place next period ahead us today!’