Since the start of this month, Bitcoin has been on a notable upward trajectory, steadily approaching significant resistance levels.

Nevertheless, this momentum may soon face challenges as investors begin to exhibit caution. A shift in short-term sentiment could jeopardize Bitcoin’s stability around the $115,000 support level.

Bitcoin Investors Consider Selling

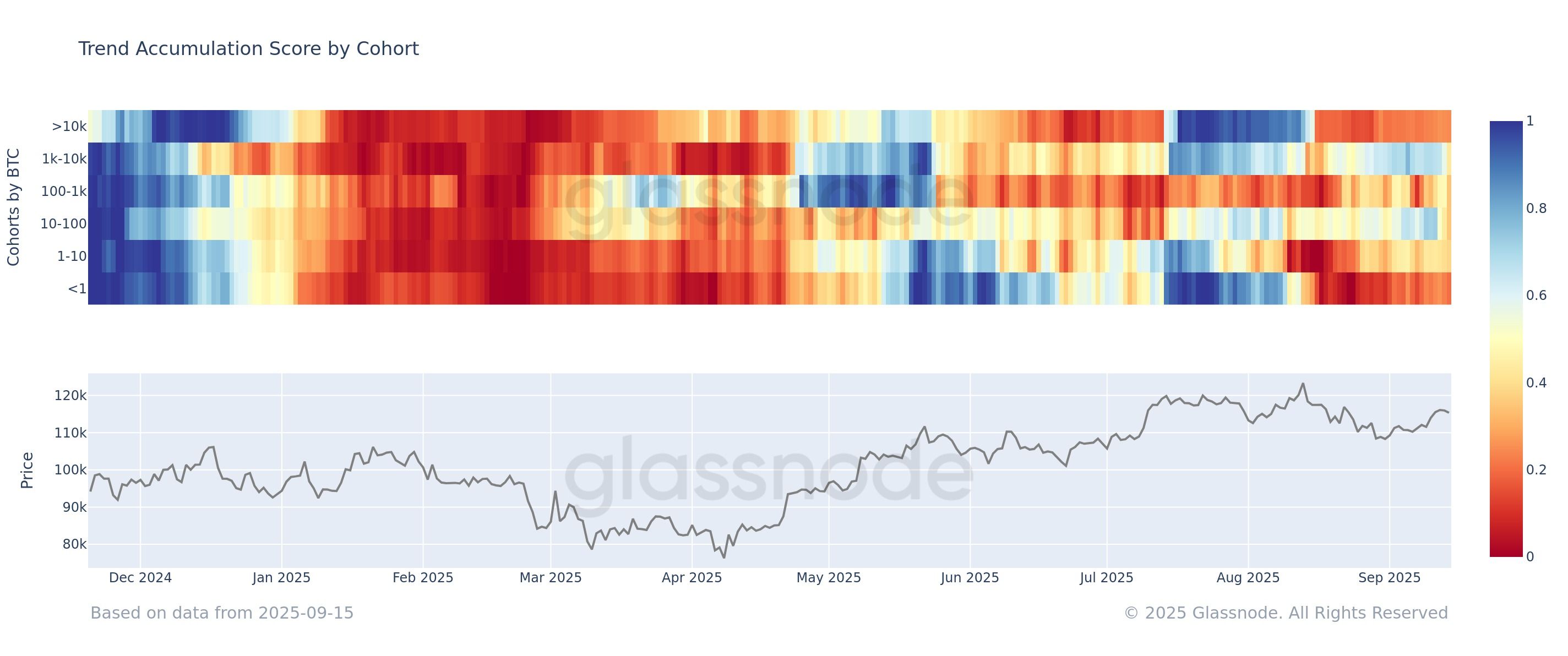

The distribution patterns among Bitcoin holders indicate that selling pressure continues to be a major influence in the market. The majority of investor groups are maintaining positions below the 0.5 threshold, which points to a limited interest in accumulating more assets. This trend aligns with an overall sentiment focused on profit-taking rather than expanding holdings.

Additionally, no segment of Bitcoin holders is demonstrating accumulation levels exceeding 0.8—a figure typically associated with strong conviction buying behavior. In the absence of substantial investments from long-term holders or large-scale investors (whales), the market remains ensnared in a neutral-to-distribution phase that restricts any potential for significant price surges.

If you’re interested in more insights about tokens like these, subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

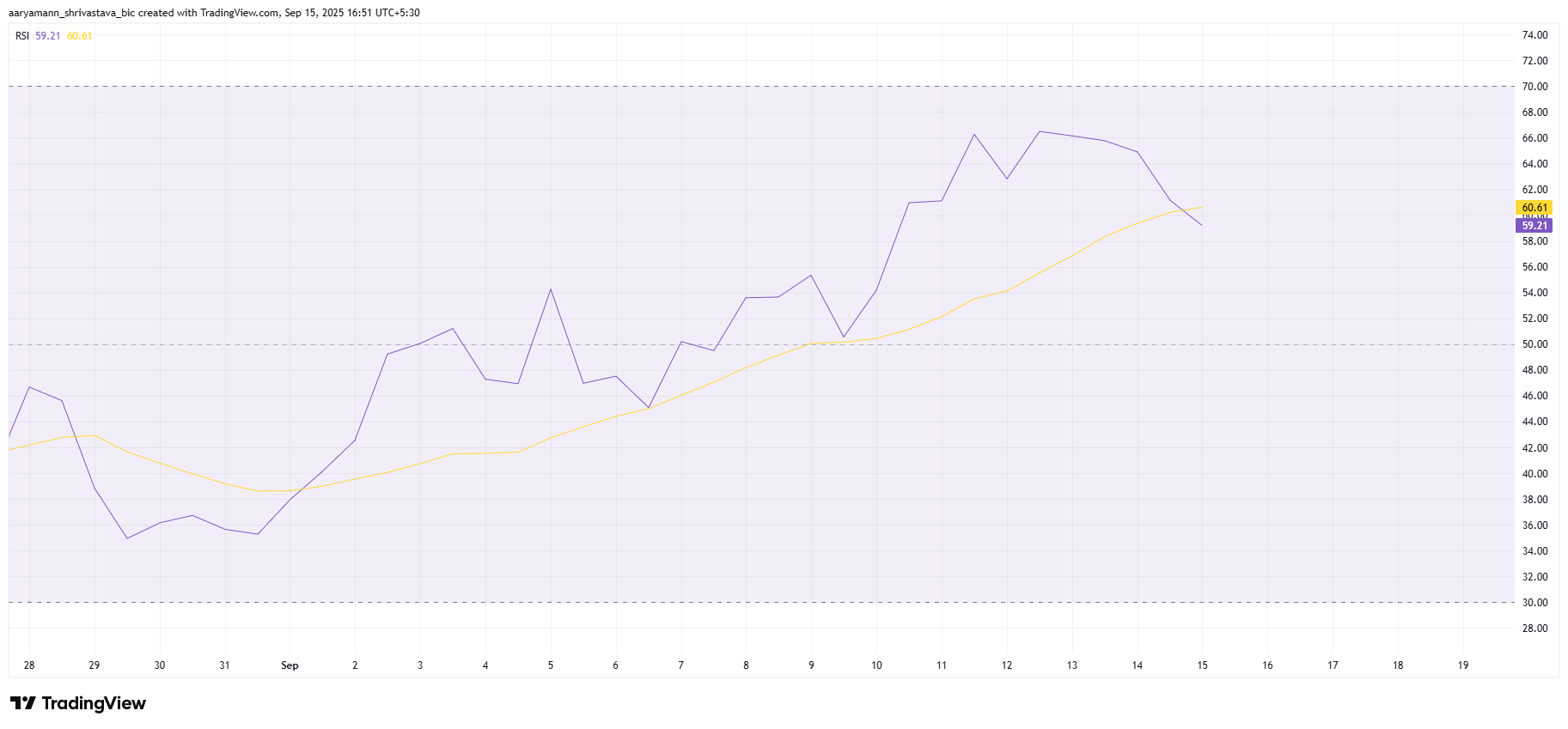

The technical analysis reveals that Bitcoin’s momentum is beginning to show signs of weakness. The relative strength index (RSI), which had recently remained within bullish territory, is now experiencing a slight decline. Although it still supports an uptrend overall, this gradual decrease suggests diminishing strength among buyers.

If this downward trend in RSI persists, we might see Bitcoin undergo a temporary pullback before regaining its upward momentum again. Traders often view such signals as indications that bullish activity may be waning—potentially leading to short-term price dips for BTC as it retests lower support levels before attempting another rise.

Potential Recovery for BTC Price

Currently trading at $114,770 and dipping below the crucial $115,000 support level indicates potential bearish sentiment ahead; if this trend continues unchecked,BTC might further decline and test its uptrend line established since early this month—a pivotal moment for traders and investors alike.

If selling pressure escalates significantly,Bitcoin could struggle even more at maintaining $115K as support and slide down towards $112K—marking an important setback while reinforcing ongoing distribution trends observed among holders which would limit near-term upside prospects for BTC significantly

<pConversely ,if bitcoin manages absorb current selling pressures successfully reclaiming back above$115k could spark renewed rallies targeting approximately$117261in subsequent days thereby reaffirming positive outlooks whilst boosting investor confidence .

This article titled “The Weakening Hold on $115K by Bitcoin – Understanding Its Causes” first appeared on BeInCrypto .