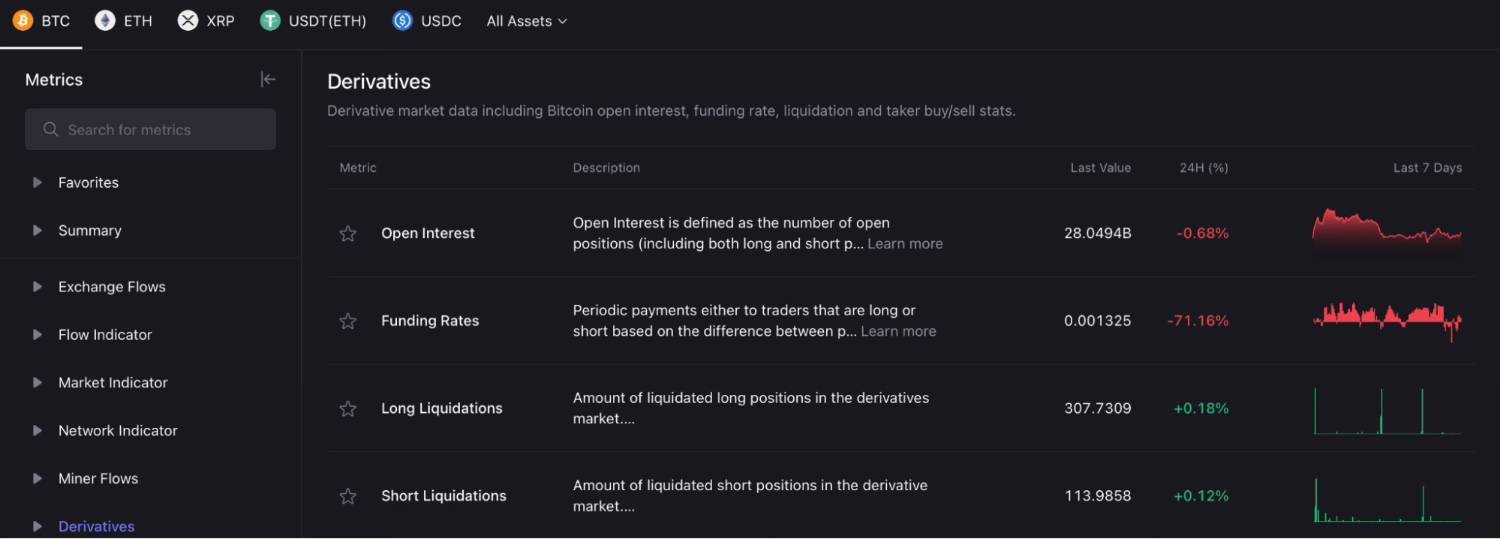

The Bitcoin (BTC) derivatives market experienced a significant downturn on Tuesday, December 9, with BTC funding rates plummeting by over 71% within the past 24 hours, according to data from CryptoQuant. This sharp decline indicates that traders are reducing their leveraged long positions, stepping away from heightened risk exposure.

If this downward trend in Bitcoin’s funding rate persists, it may point to a stronger shift toward bearish sentiment. Such scenarios often lead to increased volatility since even minor price drops can trigger rapid liquidation cascades.

The steep fall in BTC funding rates also coincided with a slight 0.66% decrease in Bitcoin’s open interest, indicating that some leveraged long positions have already been liquidated.

Bitcoin Funding Rates Decline Ahead of Crucial Macroeconomic Events

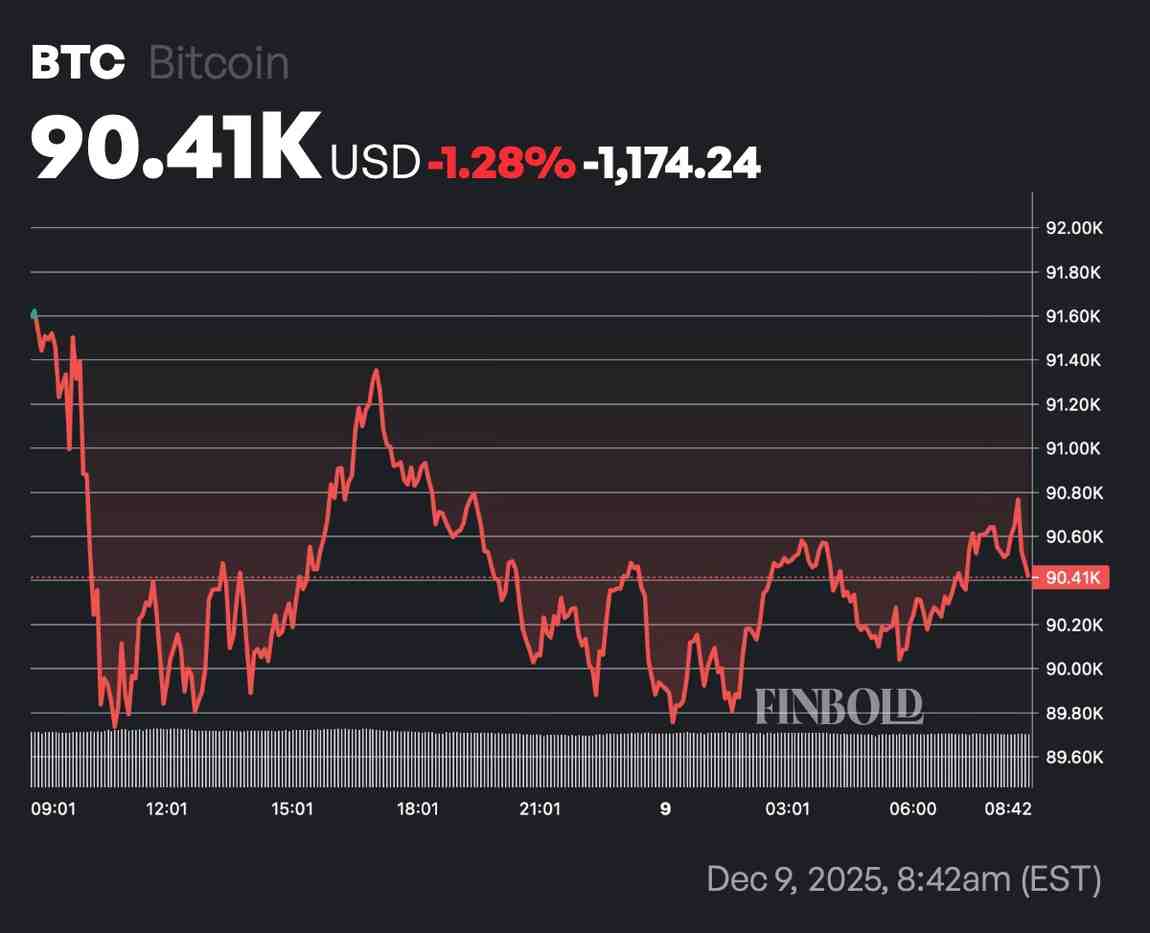

Bitcoin’s waning optimism mirrors the broader cryptocurrency market’s performance, which saw nearly a 2% drop early on amid concerns about the Federal Reserve’s upcoming decision scheduled for tomorrow.

A more hawkish stance from the Fed could strengthen the US dollar and tighten liquidity conditions further. This environment would likely increase pressure on risk assets like Bitcoin and encourage traders to reduce their leveraged bets even more aggressively.

Adding to this uncertainty is Bitcoin’s lackluster technical outlook—showing weakness across multiple indicators—which has fueled additional apprehension among investors.

At press time, “digital gold” was trading at $90,410—a decline of 1.28% for the day—with a confirmed bear flag pattern suggesting potential correction toward the $70,000 level.

This ongoing slump in Bitcoin funding rates reflects several factors: aggressive unwinding of long positions and diminished speculative interest ahead of key macroeconomic announcements being chief among them.

While initially appearing as negative news for investors, this situation might offer some hope by paving the way for greater market stability once volatility subsides—similar patterns were observed during August and October earlier this year.

Traders will be closely watching whether reduced leverage leads into consolidation phases or if fresh bouts of volatility arise as futures markets adjust accordingly.

Featured image via Shutterstock