The recent decline in Bitcoin’s value has highlighted the challenges posed by a bearish market climate.

As Bitcoin slipped beneath crucial levels, concerns about an impending bear market have emerged. Investors are keenly observing for any signs of recovery, yet the future remains unpredictable.

Bitcoin’s Critical Threshold

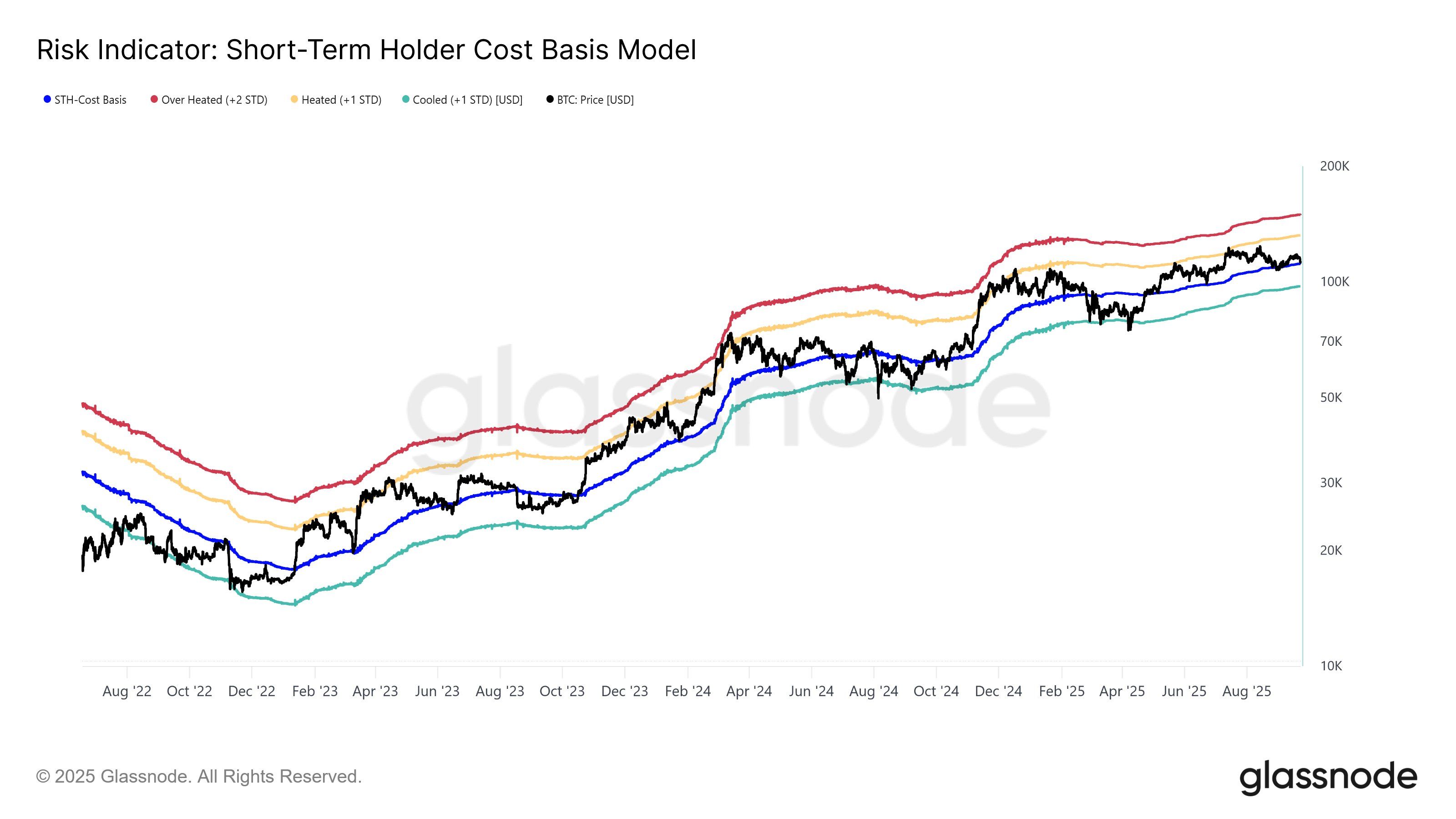

The Short-Term Holder (STH) Cost Basis Model underscores Bitcoin’s current fragility. With the STH cost basis positioned at $111,400, trading consistently below this mark could intensify downward pressure. Staying above this level is essential to prevent further structural weakening.

A clear drop below the cost basis would likely confirm a bearish trend, potentially leading to significant losses for Bitcoin and delaying its recovery across the crypto sector.

Interested in more token insights? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin STH Cost Basis Model. Source: Glassnode

Social sentiment regarding Bitcoin reveals an increase in “buy the dip” mentions on major platforms. This indicator reached its peak activity level over 25 days, indicating rising optimism among retail traders; however, such trends often predict contrary price movements.

Historically speaking, when retail traders expect swift recoveries, Bitcoin tends to move against these expectations. If enthusiasm remains high around $112,200, the market might still encounter additional declines. Once sentiment cools and panic selling ensues, richer accumulation opportunities may arise.

Bitcoin Social Volume And Dominance. Source: Santiment

A Potential Rebound for BTC

Currently priced at $112960 ,&”>,&;BTC holds slightly above its support level of $112500 . Over a 24-hour period ,&”>;BTC fell from

$115100 reaching an intra-day low of

$111478 . This volatility underscores maintaining present levels’ importance . &”>

The crypto king has so far managed staying atop

$111400 -the STH cost basis-“, securing support at

$112500 provides potential bouncing back towards

$115000 preventing bear-market formation taking shape .