On December 17, Bitcoin experienced a dramatic two-hour rollercoaster, swinging sharply up and down by approximately $3,000. This intense volatility triggered the liquidation of both short and long positions in rapid succession.

The analytics group Bull Theory highlighted this event, noting a swift $3,300 surge in Bitcoin’s price within just 30 minutes. This sudden rise forced the closure of $106 million worth of short positions—a classic short squeeze scenario. However, the rally was quickly reversed as Bitcoin plunged by $3,400 over the next 45 minutes. This drop liquidated an additional $52 million in long positions, signaling a long squeeze according to their analysis.

“The level of manipulation seen here is extraordinary,” Bull Theory remarked.

🚨BREAKING: In half an hour, Bitcoin surged by $3,300 causing shorts worth $106 million to be liquidated.

Then it dropped by $3,400 over 45 minutes wiping out longs valued at $52 million.

This kind of manipulation is staggering within crypto markets. pic.twitter.com/5zrlnsIhgj

— Bull Theory (@BullTheoryio) December 17, 2025

Other market observers also documented this turbulent episode from various angles. DEGEN NEWS described it as “two consecutive volatile hourly candles” on Bitcoin’s chart while zerohedge reinforced their theory about a recurring “10am slam algorithm,” characterizing this event as a massive “$5,000 swing” occurring within one hour prior to their report.

Related Read: Bitcoin ETFs Witness Another Outflow Totalling $277 Million Amid Long-Term Holder Sales

This isn’t the first time zerohedge and Bull Theory have pointed fingers at what they suspect is orchestrated market manipulation timed around 10:00 AM EST—the opening hours for U.S. markets—as previously reported by Coinspeaker on December 12.

An Examination of Price Movements and Liquidations Surpassing $100 Million

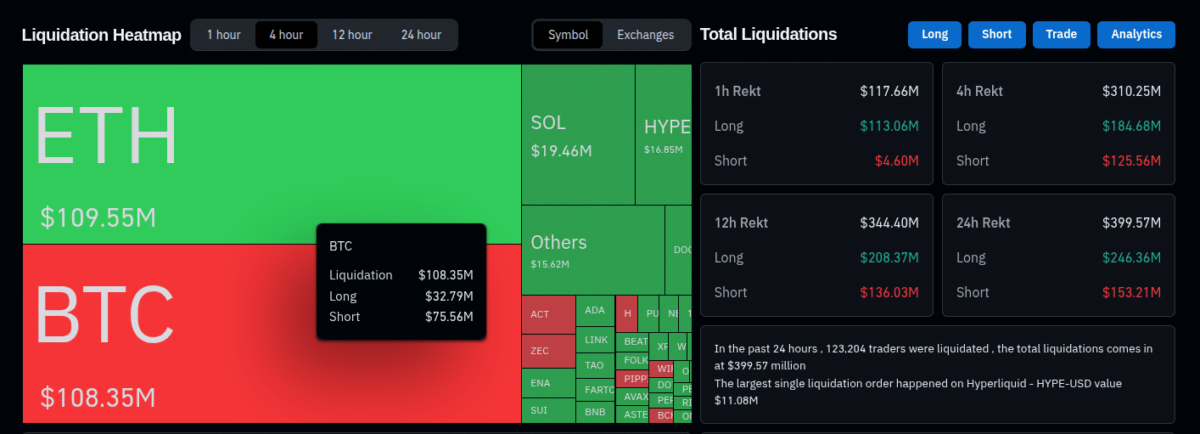

The recent volatility led to more than 120 thousand traders being liquidated across nearly four hundred million dollars during the past day alone. Notably concentrated activity occurred in just twelve hours with over three hundred forty million dollars wiped out; specifically within four hours leading up to this report saw liquidations totaling three hundred ten million dollars—closely matching the pump-and-dump cycle noted earlier from multiple sources.

Diving deeper into specifics for Bitcoin itself—the dominant cryptocurrency—it faced roughly one hundred eight million dollars’ worth of position closures during those four hours per CoinGlass data: seventy-five million came from shorts while thirty-two million were longs that got squeezed out.

Ethereum (ETH), trading near two thousand eight hundred forty-seven USD with higher intraday volatility (~3.3%), recorded comparable liquidation figures but skewed heavily towards long position losses instead.

Heatmap illustrating liquidation events along with total amounts cleared as captured on December seventeenth | Source: CoinGlass

A closer look at TradingView’s indexed price chart reveals how between nine o’clock and eleven o’clock Eastern Standard Time (EST), BTC underwent its notable pump followed immediately by dump reflected across two distinct hourly candlesticks—from lows near eighty-seven thousand one hundred USD climbing above ninety thousand three hundred before retreating back close to eighty-seven thousand two hundred USD levels again.

Bitcoin price movement visualization | Data courtesy TradingView

At present time , bitcoin trades around eighty-six thousand six-hundred US Dollars representing an intraday decline close to -1 .35 % . Meanwhile , spot bitcoin exchange-traded funds (ETFs) recorded net withdrawals amounting approximately two-hundred seventy-seven-million USD on december sixteenth , primarily driven by blackrock ‘ s ibit product , highlighting how institutional investors are adjusting exposure toward bitcoin .

Disclaimer : coinspeaker strives for impartiality & transparency when reporting news . although every effort has been made herein towards accuracy & timeliness , none should interpret these insights or analyses contained herein as financial advice or investment recommendations . given rapidly evolving market dynamics readers must independently verify facts & consult qualified professionals before making decisions based upon content presented above .