Bitcoin’s price journey has never been a straightforward ascent. Each significant surge has inevitably been followed by a challenging correction, while every pronounced bear market eventually lays the groundwork for renewed growth. As we approach 2026, investors are once again pondering: is Bitcoin gearing up for another substantial upward move, or should we brace for an extended period of stagnation?

To address this question effectively, it’s essential to review Bitcoin’s historical behavior across its bullish and bearish cycles.

The Cyclical Nature of Bitcoin’s Long-Term Price Movements

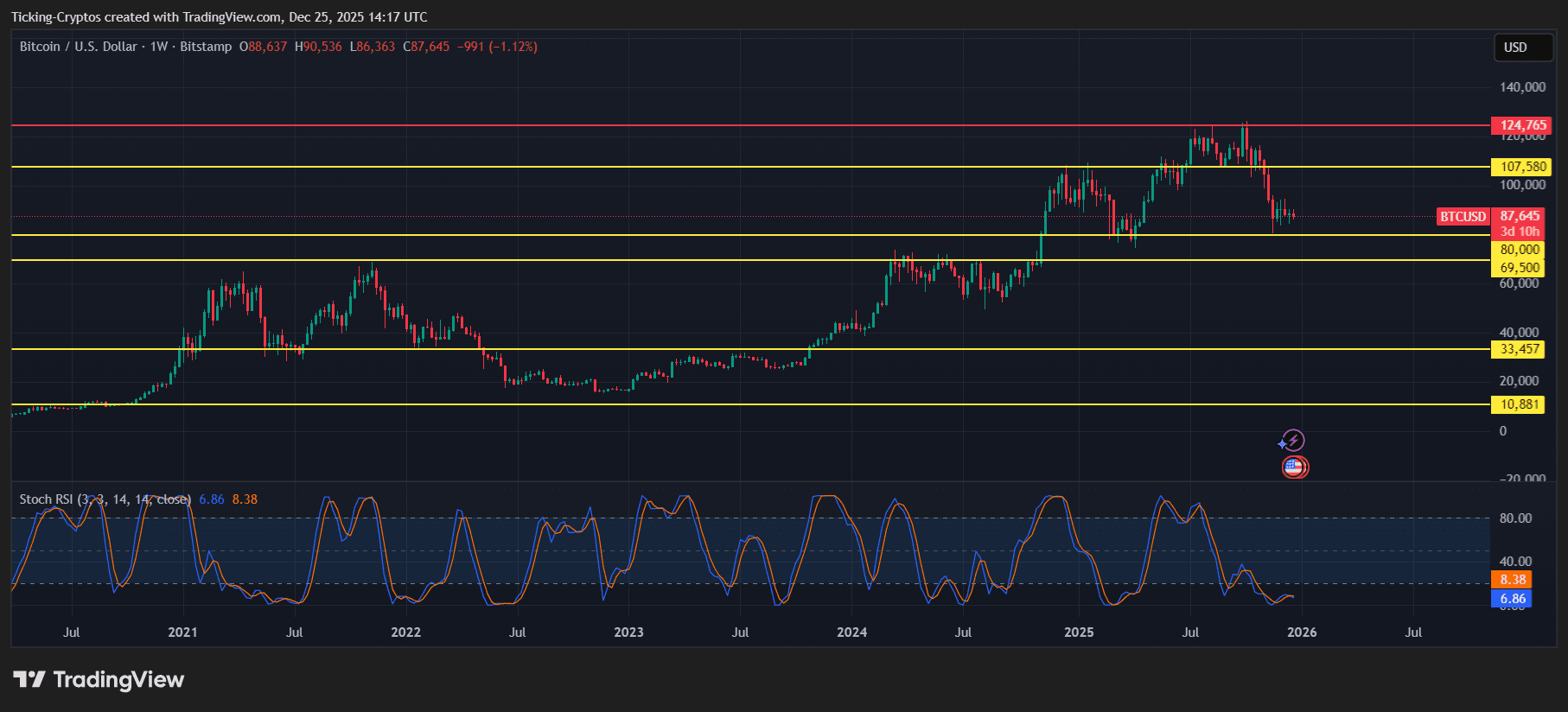

A close examination of Bitcoin’s weekly price chart reveals a clear pattern: rather than following endless trends, Bitcoin operates in distinct cycles.

BTC/USD Weekly Chart – TradingView

Historically, several factors have influenced these cycles including liquidity availability, macroeconomic conditions, and halving events:

- Strong multi-year rallies tend to be succeeded by sharp pullbacks.

- Periods of prolonged consolidation often precede explosive upward moves.

- Key support levels have consistently held firm across multiple market phases.

The long-term charts demonstrate that psychological price barriers play a pivotal role over time. Once surpassed, these levels frequently transform from resistance into enduring support—a trend likely to impact expectations as 2026 unfolds.

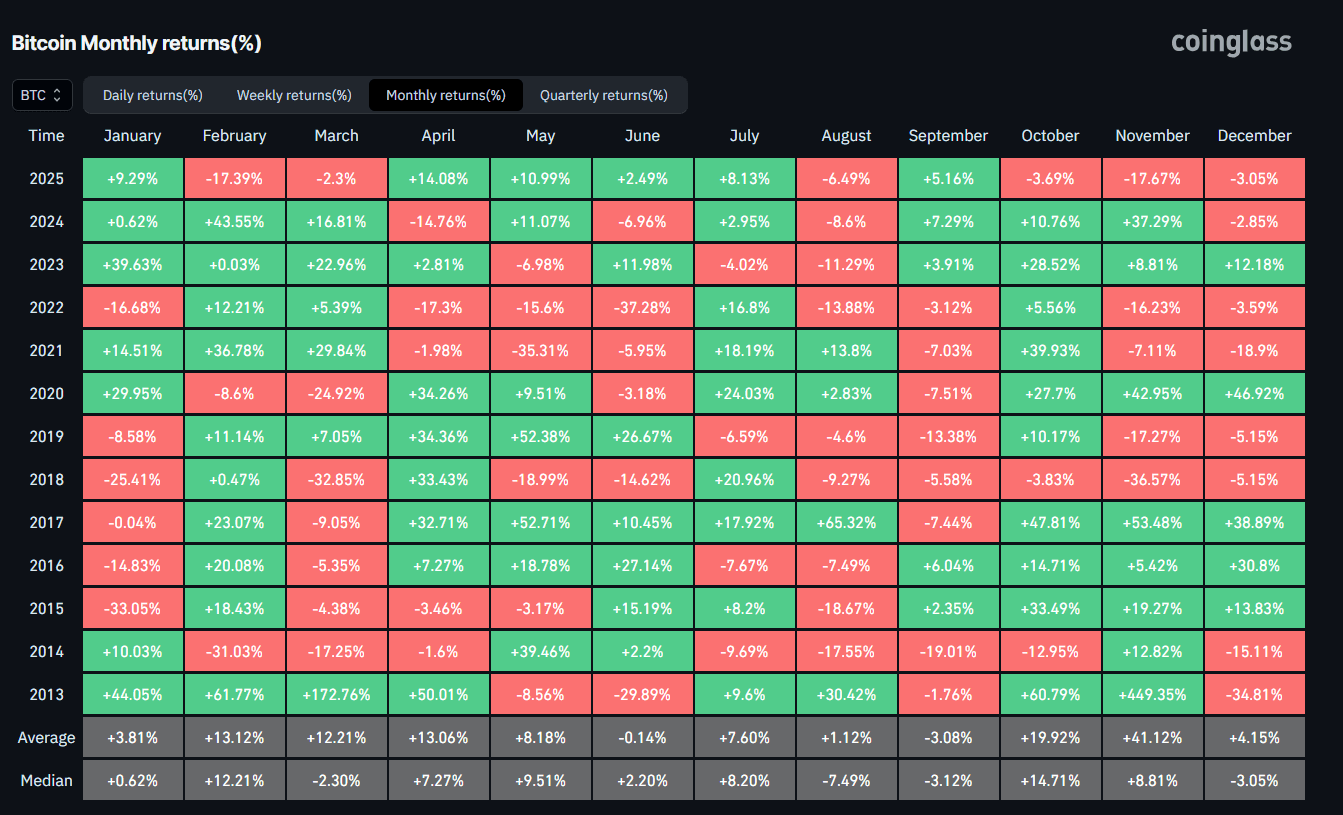

A Clear Pattern Emerges from Monthly Returns

The heatmap illustrating monthly returns further underscores Bitcoin’s cyclical tendencies.

Bitcoin Monthly Returns Over Recent Years – Coinglass

- Bull markets feature clusters of strong positive months with frequent double-digit gains.

- Bear markets are characterized by prolonged negative periods and steep declines.

- Certain months like October and November historically deliver exceptional returns compared to others which show mixed results.

An important takeaway is that even during bullish years, deep corrections exceeding 20–30% occur regularly. This volatility isn’t an anomaly but rather an intrinsic aspect of how Bitcoin behaves—something crucial when considering the outlook for 2026.

The Current Position as We Enter 2026

Technically speaking, entering 2026 finds Bitcoin after an extended phase of consolidation following significant growth. The current price dynamics indicate:

- Loyal long-term investors continue defending critical support zones;

- The momentum seen during peak rallies has diminished;

- A compression in volatility is evident—historically signaling potential upcoming major moves;

This configuration typically appears mid-cycle instead of at absolute market tops or bottoms.

Forecasting bitcoin's trajectory in 2026: Optimistic vs cautious outlooks

Optimistic Outlook

If liquidity improves alongside increased risk tolerance:

- bitcoin might break above key resistance areas pushing toward new all-time highs;

- steady accumulation near vital supports could ignite another growth phase;

- a favorable macroeconomic environment may spark the second powerful leg within the bull cycle.

In such circumstances ,the year could mirror previous continuation phases rather than signaling final peaks .

Cautious Outlook

If macroeconomic challenges persist coupled with tighter liquidity :

- bitcoin may trade sideways or face deeper downward adjustments ;

Previous cycle supports would regain focus;

Sideways trading might dominate much of the year.

Historically ,bitcoin has also endured lengthy consolidations before resuming its long-term ascent.

What History Indicates About The Year Ahead

Examining past patterns suggests:- Bitcoin seldom reaches peaks only to collapse immediately afterward;

- The years following rallies often alternate between gradual progressions and periods dedicated to consolidation;

- Diligent holders usually increase their positions amid uncertainty;

The implication? Rather than chasing rapid parabolic surges in 2026,

success will depend on strategic positioning,

patience,

and disciplined risk management.

- bitcoin may trade sideways or face deeper downward adjustments ;