The price of Bitcoin has surged over 4% since February 19, climbing back above $68,200. This uptick provided a momentary respite following several weeks of downturns. Nevertheless, emerging technical indicators and on-chain data suggest that Bitcoin might be nearing a precarious threshold for the year 2026.

A combination of bearish chart formations, significant supply zones beneath the current price level, and escalating leverage risks indicate that a more substantial correction could be imminent.

Bearish Patterns and Major Supply Zones Pose Immediate Threat

The current 8-hour chart for Bitcoin reveals a head-and-shoulders formation—a bearish reversal pattern characterized by three peaks where the middle peak is higher than the others. This pattern indicates diminishing buying momentum coupled with increasing selling pressure.

Simultaneously, there has been a hidden bearish divergence between February 6 and February 20; during this timeframe, while Bitcoin’s price made lower highs—indicating an incomplete recovery to its previous peak—the Relative Strength Index (RSI) registered higher highs.

Bitcoin Price Risk: TradingView

If you want more insights into tokens like this one, consider subscribing to Editor Harsh Notariya’s Daily Crypto Newsletter here.

The RSI serves as an indicator of buying and selling momentum on a scale from zero to one hundred. An increase in RSI without corresponding gains in price suggests weakening buying power. Such patterns often precede declines or pullbacks in prices.

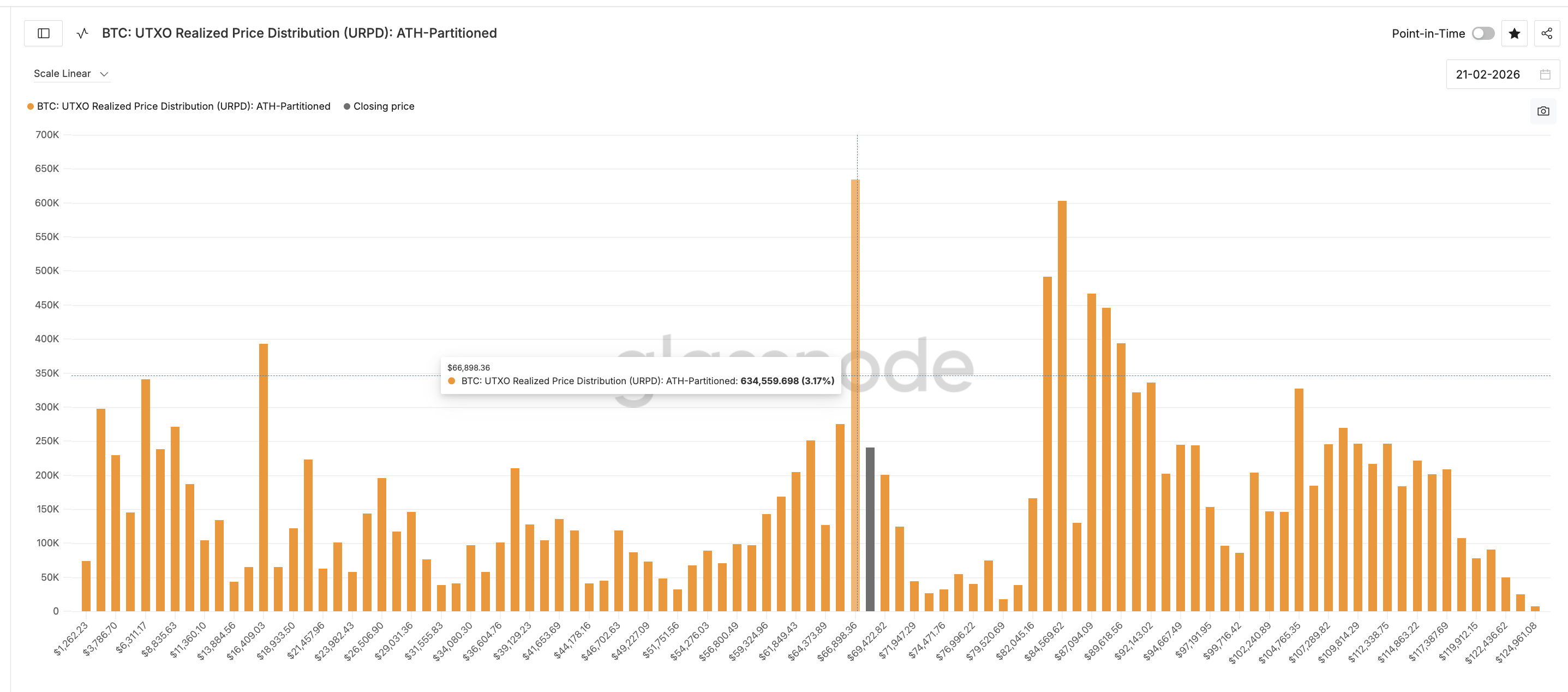

Currently, the most significant risk stems from Bitcoin’s on-chain cost basis levels. Data sourced from UTXO Realized Price Distribution (URPD) indicates that the largest supply cluster exists just above $66,800—this level accounts for approximately 3.17% of Bitcoin’s total circulating supply.

Biggest Supply Cluster: Glassnode

An additional notable cluster is located at $65,636 which contains another 1.38% of supply.

These levels are crucial as they reflect prices at which numerous investors acquired their Bitcoins; should it drop below these thresholds, holders may opt to sell off their assets to mitigate losses—potentially accelerating any downward trend swiftly.

<img decoding="async" src="https://cnews24.ru/uploads/292/2923431164e47e914657695670ddd48e73602161.jpg" size="1570×1122"

alt="$BTC Cluster Under Current Price’>” >

$BTC Cluster Under Current Price: Glassnode

Together these clusters represent over 4.5% of Bitcoin’s total supply concentrated just below its current trading value creating an area with heightened risk directly under its support level—which highlights serious pricing warnings ahead

If Bitcoin closes beneath this zone,the realizationof head-and-shoulders pattern could gain traction further downwards

Increasing Leverage and ETF Withdrawals Heighten Liquidation Risks

The derivatives market data reveals growing liquidation risks coinciding with recent rebounds in bitcoin value . Open interest , measuring active futures positions , rose from $19 .54 billion on february nineteenth up until about twenty point seventy-one billion today during recovery period .

This signifies that more traders have entered leveraged positions amid bounce back phase .

OI And Funding Rate : Santiment

Simultaneously funding rates have turned positive indicating payments exchanged between long & short traders ; positive funding suggests greater bets placed upon potential increases in pricing leading towards perilous circumstances arising out thereof .

Rising Long Positions : Santiment

If bitcoin starts declining , those holding leveraged long positions may face forced closures triggering what is known as ‘long squeeze’ pushing bullish traders out quickly causing cascading liquidations amplifying sell pressure thus accelerating downward trends even further !

Institutional sentiment remains weak too evidenced by spot bitcoin ETFs recording five consecutive weeks worth net withdrawals indicating institutional investors still pulling capital instead accumulating it thereby reducing support available during declines !

Bitcoin ETFs : SoSo Value

This diminishes overall backing when prices take dips.

Critical Test Ahead For The BTC Below Institutional Resistance Levels!

Additionally BTC trades below monthly Volume Weighted Average Prices (VWAP), situated around seventy thousand dollars representing average costs weighted based upon trade volumes widely used proxy among institutions themselves.

<P When BTC stays underneath VWAP it implies average institutional holdings currently incur losses prompting them either reduce exposure or refrain new purchases explaining lackluster ETF activity observed lately!

Recovery beyond seventy thousand would signal renewed strength among institutions but remaining under such levels limits attempts at recoveries keeping broader structure firmly within bear territory!

On downside first key supports found near sixty-seven thousand three hundred followed closely thereafter by sixty-six thousand five hundred then finally sixty-five thousand three hundred aligning closely major mentioned earlier supplies failure hold these lines trigger larger breakdown near neckline situated around sixty-thousand eight-hundred!

To stabilize short term structures reclaiming eighty-two-hundred becomes essential however full recoveries necessitate regaining seventy-thousand VWAP levels!

The post title reads “Is A Drop To Fifty-Six Thousand Imminent? Warning Signals Flash For BTC In Twenty-Twenty-Six!” appeared first time BeInCrypto.