The cryptocurrency market is exhibiting a cautious approach as the holiday season affects liquidity and uncertainty looms. While Bitcoin has shown resilience, the increasing outflows from ETFs and diminishing momentum cannot be overlooked.

Table of Contents

At this juncture, it remains uncertain whether Bitcoin’s price will decline or if it is merely consolidating in anticipation of a future surge.

Summary

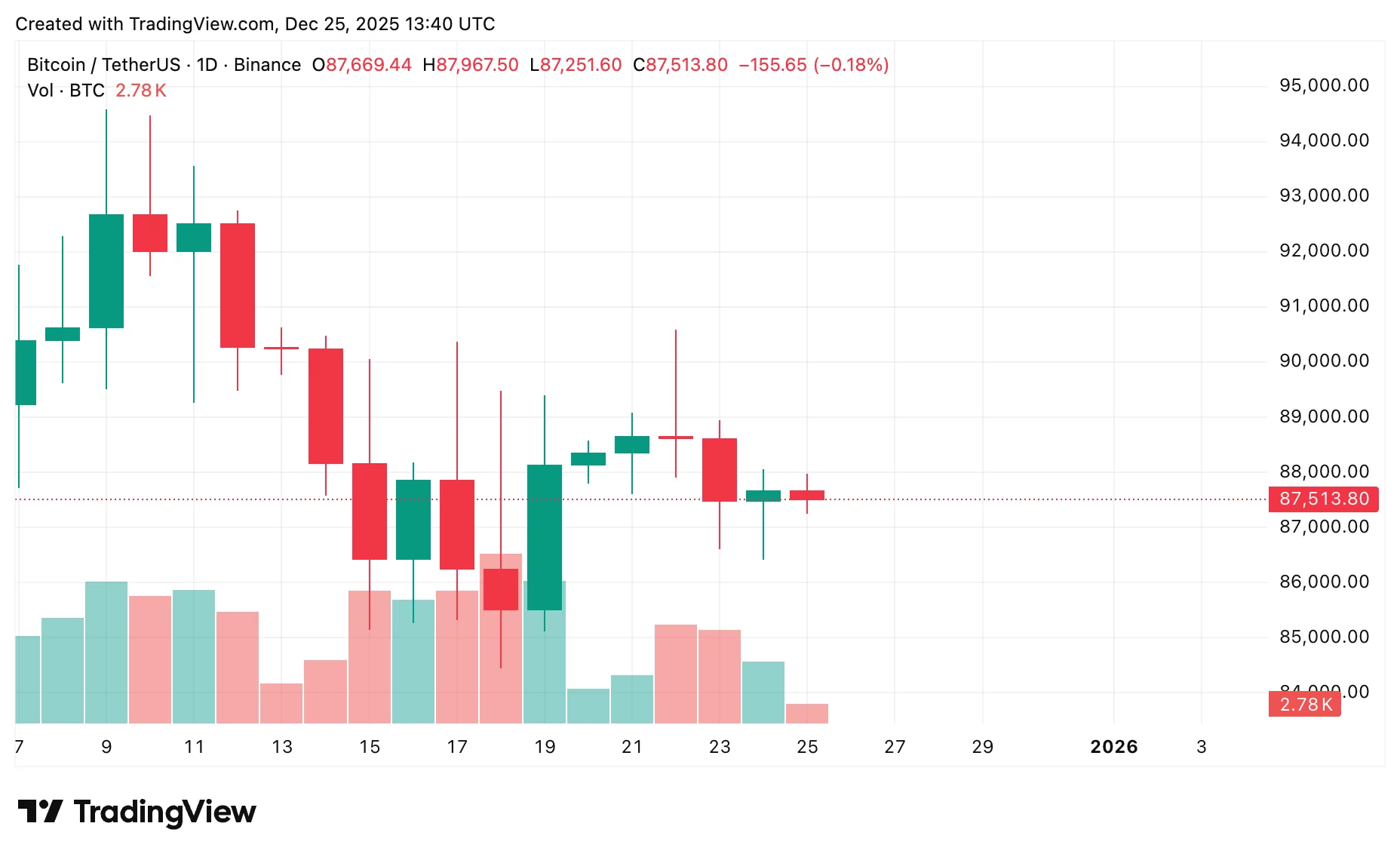

BTC is currently trading around $87,500, oscillating within the $86,400–$88,000 range during this cautious holiday period.

Support levels between $86,400 and $86,700 are holding firm; however, the recent ETF outflows totaling $175 million are impacting market sentiment.

A breakout past the resistance at $89,000–$90,000 could propel BTC towards the range of $93,000–$94,000—indicating renewed bullish momentum.

If support fails to hold up against selling pressure there are potential pullbacks to consider at levels like $85,500 or even down to ranges between $84K-$82K or as low as $80K in a bearish scenario.

Current Market Scenario

This Christmas season finds Bitcoin (BTC) maintaining stability near the price point of approximately $87.5K with a slight increase of about 0.3% over the last day. The price appears confined within a range from around 86.4K to 88K—suggesting consolidation rather than panic-driven sell-offs.

BTC daily chart for December 2025 | Source: crypto.news

The support zone located between prices of approximately 86.4K and 86.7K continues to exhibit robustness by attracting buyers whenever prices dip into this area—helping sustain overall market confidence.

Nevertheless, ETF outflows have dampened overall sentiment; on December 24 alone spot Bitcoin ETFs saw net withdrawals amounting to roughly $175 million—and should this trend persist it may place additional short-term pressure on BTC’s value.

Upside Outlook

The technical setup for Bitcoin remains positive with its pricing consistently above short-term support which keeps bullish hopes alive; however,a decisive move past resistance at $89-90k is essential for regaining upward momentum since that level has historically served as an effective barrier.

If prices manage not only to break through but also close higher by day’s end—it could lead toward improved market sentiments targeting ranges around $93-94k where previous selling pressures were noted indicating that ETF-related withdrawals might no longer dominate pricing dynamics.

Downside Risks

<

A stable appearance in Bitcoin’s immediate future does not eliminate downside possibilities altogether; should it fall below ( text{USD} ) ( text{USD} ) ( text{USD} ) ( <underline{text{USD}},), while ongoing ETF withdrawals continue—it could accelerate downward movements with first key supports being watched closely around (85,500.)

You might also like:

Bitcoin stalls under USD(88, k), while over USD(825M) shed amid five-day streaks of outflow

In case selling persists further predictions become increasingly cautious targeting ranges near USD(84, k-82, k,)where buyers have previously entered during dips;in more pessimistic scenarios,BTC may even test lower thresholds approaching USD(80),.

Bitcoin Price Prediction Based On Current Levels

Overall,this analysis indicates that BTC’s current situation lies precariously balanced between critical supports & resistances.The behavior seen thus far suggests consolidation rather than outright liquidation despite robust buying interest surfacing close-to-the-support line set earlier.(USD)( ) ,yet persistent withdrawal trends pose notable risks ahead .

If these supports maintain integrity,the outlook stays neutral-to-slightly-bullish eyeing possible gains reaching towards targets marked earlier ;however failure here leads us back down toward possible lows approaching either target zones stated before i.e.,around (82)( )or even potentially dropping further closer still beneath these marks heading straight into danger territory beneath sixty thousand dollars itself!For now best course seems remaining patient allowing markets dictate their next moves!

Please read more: