BTC closed out one of its toughest weeks this year, experiencing a decline of over 5%, marking it as the third-worst week for the largest cryptocurrency. As we wrap up Week 38, the third quarter shows a modest gain of about 1%, while September has remained relatively stable.

This period is traditionally seen as one of the weakest times for cryptocurrencies, and several factors may have influenced this downturn.

On Friday, options worth more than $17 billion expired. The max pain price—where option holders incur maximum losses and writers see maximum gains—was set at $110,000. This acted like a magnet for spot prices.

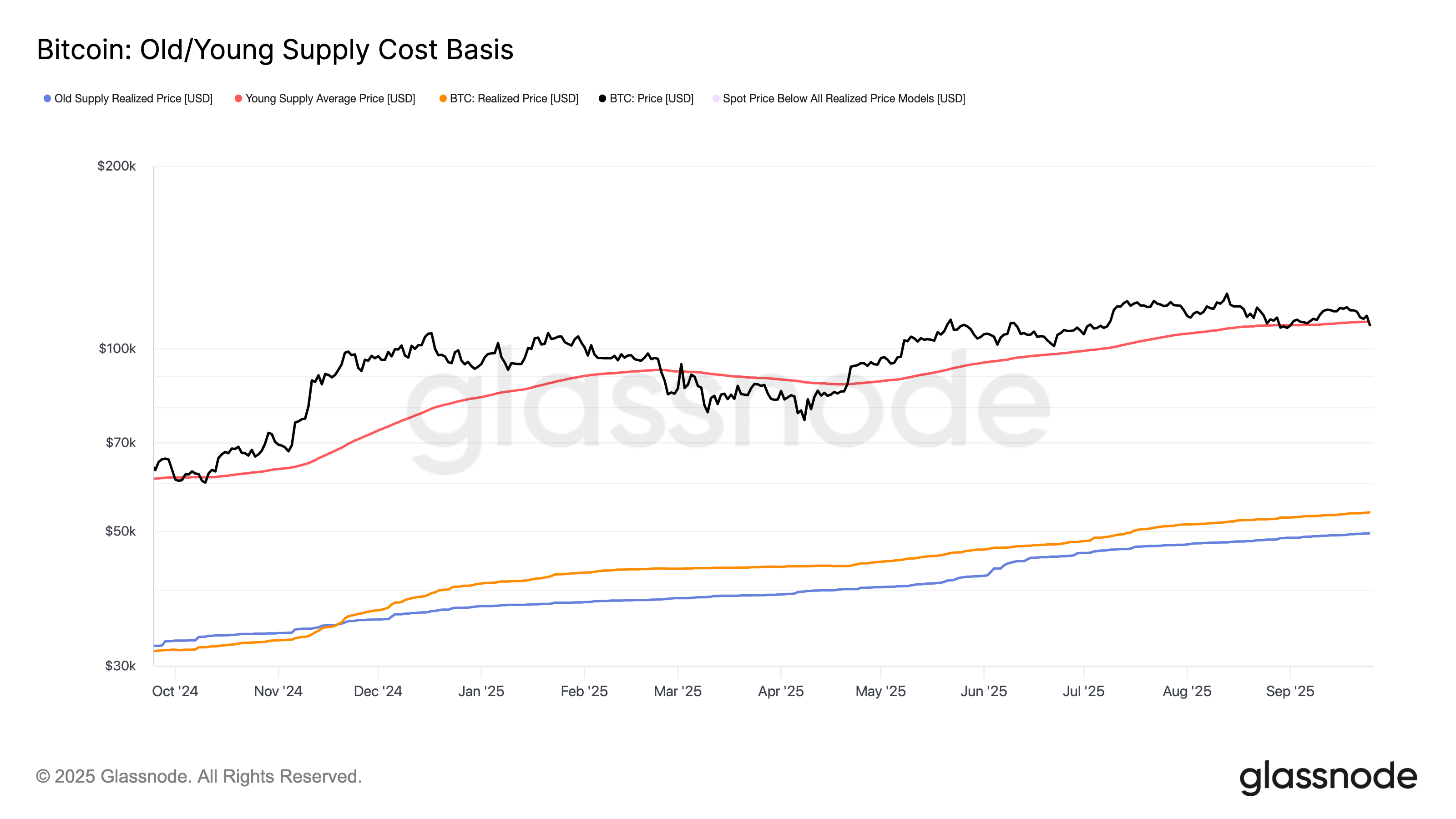

A significant technical aspect is the short-term holder cost basis at $110,775. This figure represents the average on-chain purchase price for coins moved in recent months.

Bitcoin tested this level back in August; during bullish phases, it usually gravitates towards this line multiple times. This year saw only one major dip below that threshold: during April’s tariff tantrum when prices fell to around $74,500.

Cost Basis (Glassnode)

Cost Basis (Glassnode)

Looking at broader trends helps determine if Bitcoin remains on an upward trajectory characterized by rising highs and lows—a key indicator of rally sustainability.

Analyst Caleb Franzen notes that Bitcoin has slipped beneath its 100-day exponential moving average (EMA), with its 200-day EMA positioned at $106,186. The last notable low was approximately $107,252 on September 1st; maintaining levels above this point is crucial to sustaining broader market trends.,

Macro Backdrop

The U.S economy expanded by an annualized rate of 3.8% in Q2—surpassing estimates—and marking its strongest performance since Q2-2023! Initial jobless claims decreased by14k reaching218k—the lowest since mid-July—and spending data aligned with market expectations.The US core PCE price index rose0 .2 %in August2025 comparedto previous month—a preferred inflation measure excluding food & energy usedby Federal Reserve

Yieldon10 -yearU .S Treasuries reboundedfrom4 %support now tradingnear4 .2 %.Dollar Index(DXY)continues hoveringaroundlong-term supportat98.Meanwhile metalsleadactionwithsilverapproachingall-timehighs near$45,lastseenin1980&2011.U.S equities remainjustshyofrecordlevels

Bitcoin standsout beingmorethan10 %belowitspeak

DXY(TradingView)

DXY(TradingView)

Bitcoin-Exposed Equities

Companies holding significant bitcoin treasuries face intense compression between their multiple-to-net-asset-value(mNAV).Strategy(MSTR)is barely positive YTD,having dipped below$300atonepoint,resultingina negative returnfor2025

Theratio betweenStrategyandBlackRockiSharesBitcoinTrustETF(IBIT)standsatthe lowestlevelsinceOctober2024at4 .8 illustratinghowmuchlargestbitcoin treasurycompanyhasunderperformedcomparedtobitcoinoverpast12months

MSTR / IBIT Ratio(TradingView)

Theenterprise mNAVfor Strategycurrently sitsaround144%(asoffriday)—considering allbasicshares outstanding,totalnotionaldebt,andtotalnotionalvalueofperpetualpreferredstockminuscompany’scashbalance.

MSTRfindssomehopeinthreeofthefourperpetualpreferredstocks— STRK , STRC ,& STRF — showingpositivelifetimereturnsasExecutiveChairmanMichaelSayloraimstoacquiremoreBTCusingthesevehicles.

AnemergingissueforMSTRisdecliningvolatilitywithinbitcoin itself.Cryptocurrency’sImpliedvolatility–ameasuremarket’sexpectationoffuturepricefluctuations–hasfallenbelow40,thelowestinyears.ThisisimportantbecauseSayloroftenpositionsMSTRasa“volatilityplay”onbitcoin.Forcomparison,MST R’simpliedvolatilityisat68.Itsannualizedstandarddeviationofdailylogreturnsoverpastyearwas89 %,whileoverthelast30daysithasdroppedto49%.Higher volatilityoften attracts speculators,generatingtradingopportunitiesanddrawinginvestorattention,sothedeclineislikelyactingasaheadwind.

The fifth-largest bitcoin treasury company Metaplanet holds25 ,555 BTC yetstruggleswithasharepricehoveringat517yen($345)—morethan70%belowitsall-timehigh.Metaplanet’smNAVhassharplydroppedfrom844June112nowstandsat394bncomparedtobitcoin NAV29bnaverageBTCacquisitioncost106065