In the final quarter of 2025, the pace at which companies incorporated Bitcoin into their treasuries decelerated significantly. While major corporate holders quietly expanded their Bitcoin reserves, smaller enterprises showed hesitation and reduced activity.

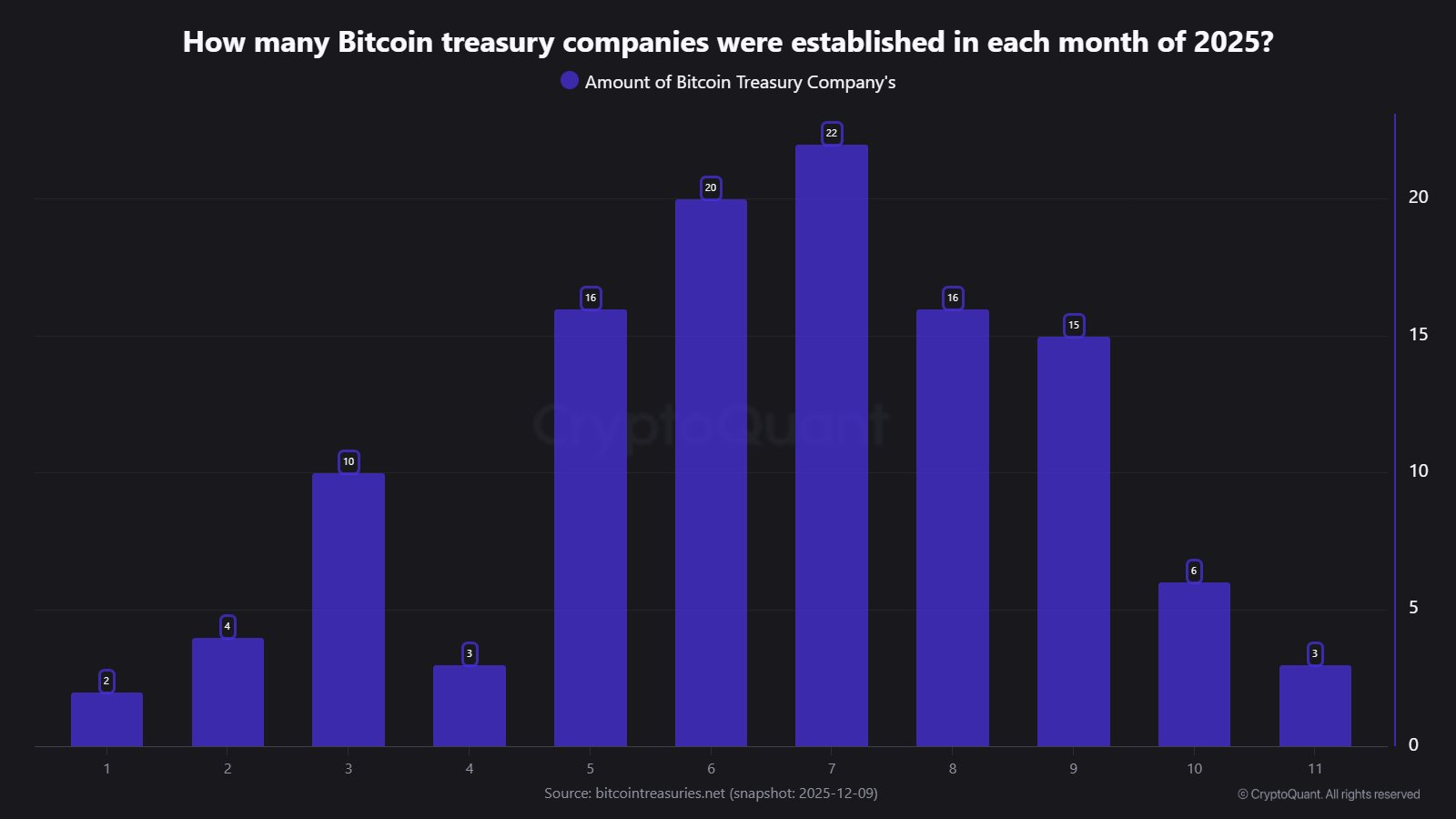

According to blockchain analytics firm CryptoQuant, the number of new firms adding Bitcoin to their balance sheets dropped sharply from a peak of 53 in Q3 to only nine in Q4 so far. Throughout 2025, a total of 117 companies have embraced Bitcoin treasury holdings.

CryptoQuant noted on X that although there was an overall increase in company numbers during the year, most entities hold relatively modest amounts of Bitcoin.

Nevertheless, data on accumulation reveals that well-capitalized corporate treasuries persistently acquire significant portions of available Bitcoin despite diminished buying interest from smaller businesses and retail investors.

Monthly count of new Bitcoin treasury adopters throughout 2025. Source: CryptoQuant

Certain firms have halted their recent accumulation efforts this quarter. For example, Japanese investment group Metaplanet has not purchased any additional Bitcoins for over two months.

A few companies are even liquidating parts of their holdings. UK-based crypto technology firm Satsuma Technology recently sold 579 Bitcoins for approximately $53 million, leaving them with a remaining balance sheet holding of 620 Bitcoins as announced midweek.

Related: Bitcoin remains steady near $90K while whales capitalize on Ethereum’s dip – Finance Redefined

The largest corporate holders maintain discreet but substantial BTC purchases

Despite an overall slowdown among newcomers and smaller players, some leading corporations continue accumulating large quantities of Bitcoin quietly but steadily.

The top holder known as Strategy made its biggest purchase since July by acquiring $962 million worth of BTC on Monday alone. This acquisition brings them within half a billion dollars short from matching last year’s total investment amounting to nearly $22 billion according to CryptoQuant figures.

Dollar value invested by Strategy over time. Source: CryptoQuant

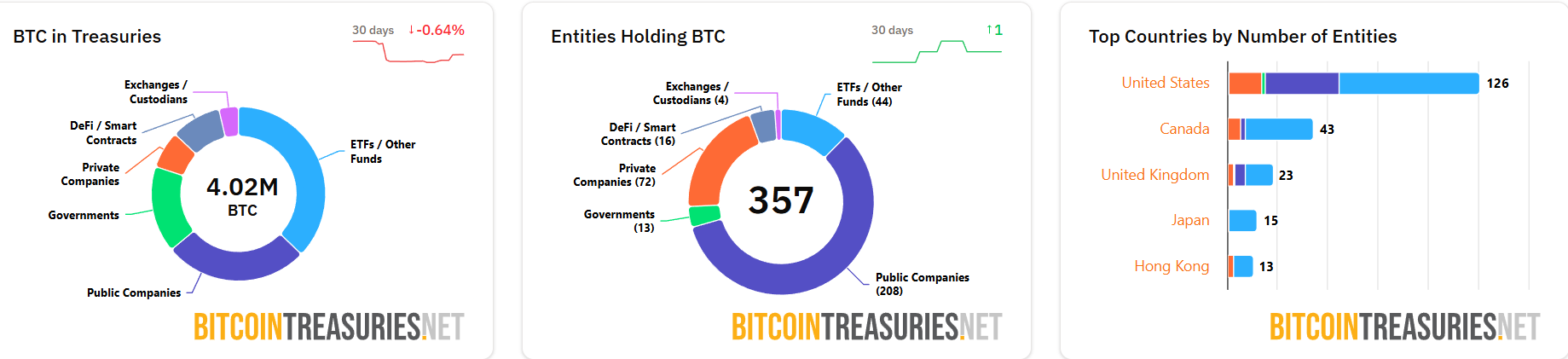

Currently public company treasuries collectively hold more than one million Bitcoins valued at around $90.2 billion — representing roughly 4.7% percent share out of all existing coins — based on data provided by BitcoinTreasuries.NET.

An additional estimated supply equal to about seven percent is held through spot exchange-traded funds focused exclusively on BTC assets totaling approximately 1.49 million coins under management worldwide.

Total bitcoin held across various corporate treasuries globally. Source: BitcoinTreasuries.NET

Digital asset treasury (DAT) acquisitions are also slowing down this quarter.

Ripple-backed Evernorth Holdings has remained inactive since late October after purchasing XRP tokens worth approximately $950 million.

Following these acquisitions amid market downturns and increasing pressure faced by DATs,ás XRP holdings experienced unrealized losses nearing $80 million within weeks.

BitMine Immersion Technologies – recognized as the largest Ether (ETH) holding corporation – drastically reduced its ETH purchases recently dropping from a high point near $2.6 billion in July down to just about $296 million acquired during December.

Over three months ending November saw cumulative investments made by Ether-focused treasury entities plunge dramatically—an eighty-one percent decline—from nearly two million ETH bought back in August falling below four hundred thousand ETH later that autumn season.&l t;br />