On Sunday, Bitcoin (BTC) slipped below the $87,000 mark, stirring a variety of signals from prediction markets that reveal a nuanced outlook. As traders place their bets toward the end of January 2026, there appears to be a tension between cautious short-term sentiment and optimistic long-term expectations.

Insights from Kalshi, Polymarket, and Myriad Markets Indicate Bitcoin Will Trade Within a Narrow Range

As of January 25th, 2026, prediction markets provide an insightful perspective on where market participants anticipate Bitcoin’s price trajectory. Despite BTC dipping under $87,000 and hitting an intraday low near $86,117 during Sunday trading sessions, forecasts remain divided.

The data does not suggest a single unified direction; instead it reveals layered sentiments: while optimism prevails in longer-term contracts betting on higher prices ahead, short-term contracts reflect caution with narrow expected price ranges and minimal appetite for volatility. Simply put—traders are hopeful but patient.

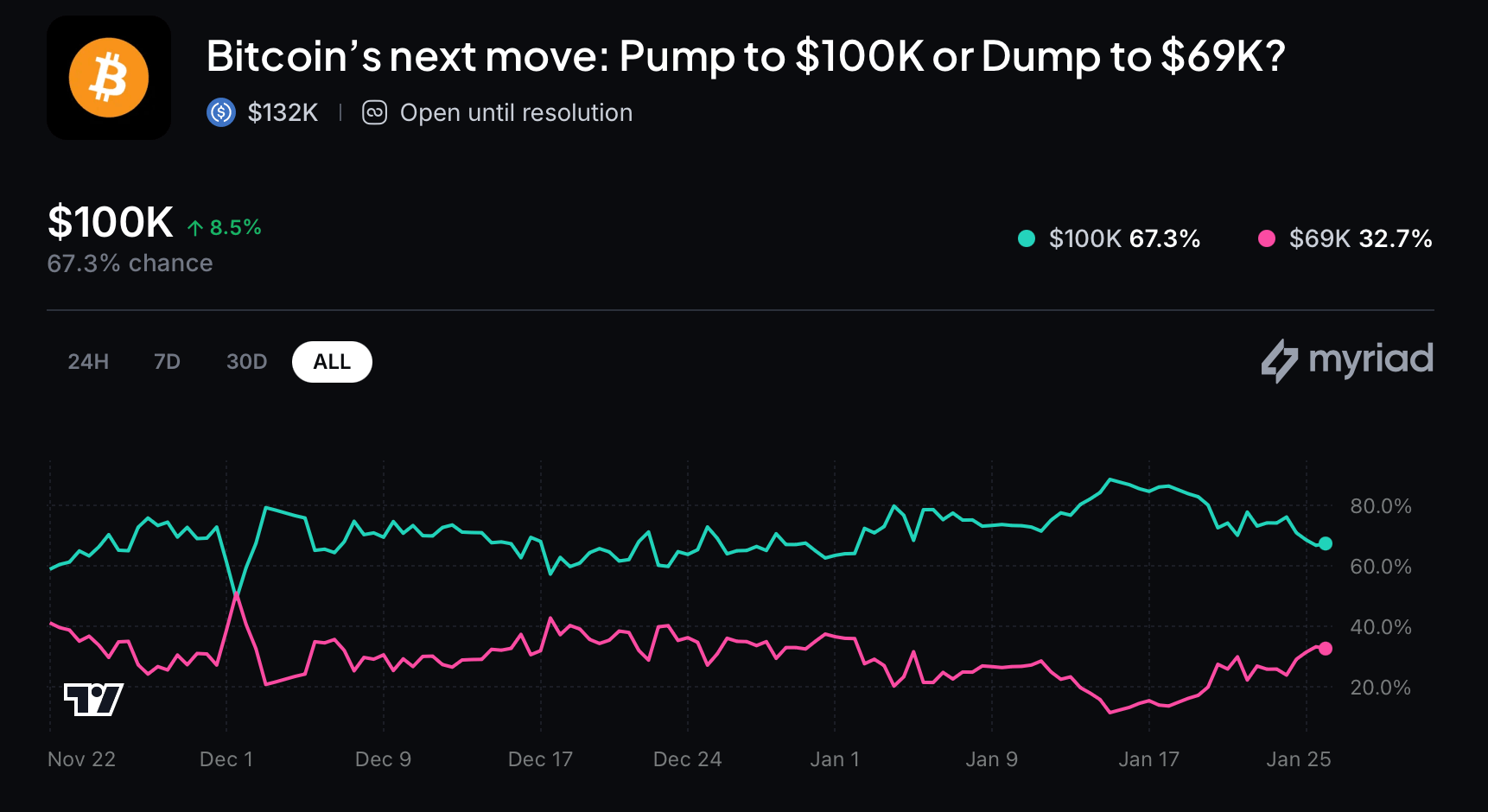

A particularly telling indicator comes from Myriad’s contract posing this straightforward question: will Bitcoin reach $100K first or drop to $69K? At the time observed by analysts, traders assigned approximately 67.3% probability to BTC climbing above $100K versus just 32.7% chance it would fall to $69K—demonstrating strong bullish bias. This contract remains open-ended until one target is hit based on Binance’s BTC/USDT one-minute spot price feed.

This open-ended structure is significant because it captures directional conviction without imposing timing constraints—suggesting that while immediate fireworks aren’t anticipated this week or next week specifically, market participants clearly lean toward higher prices over time.

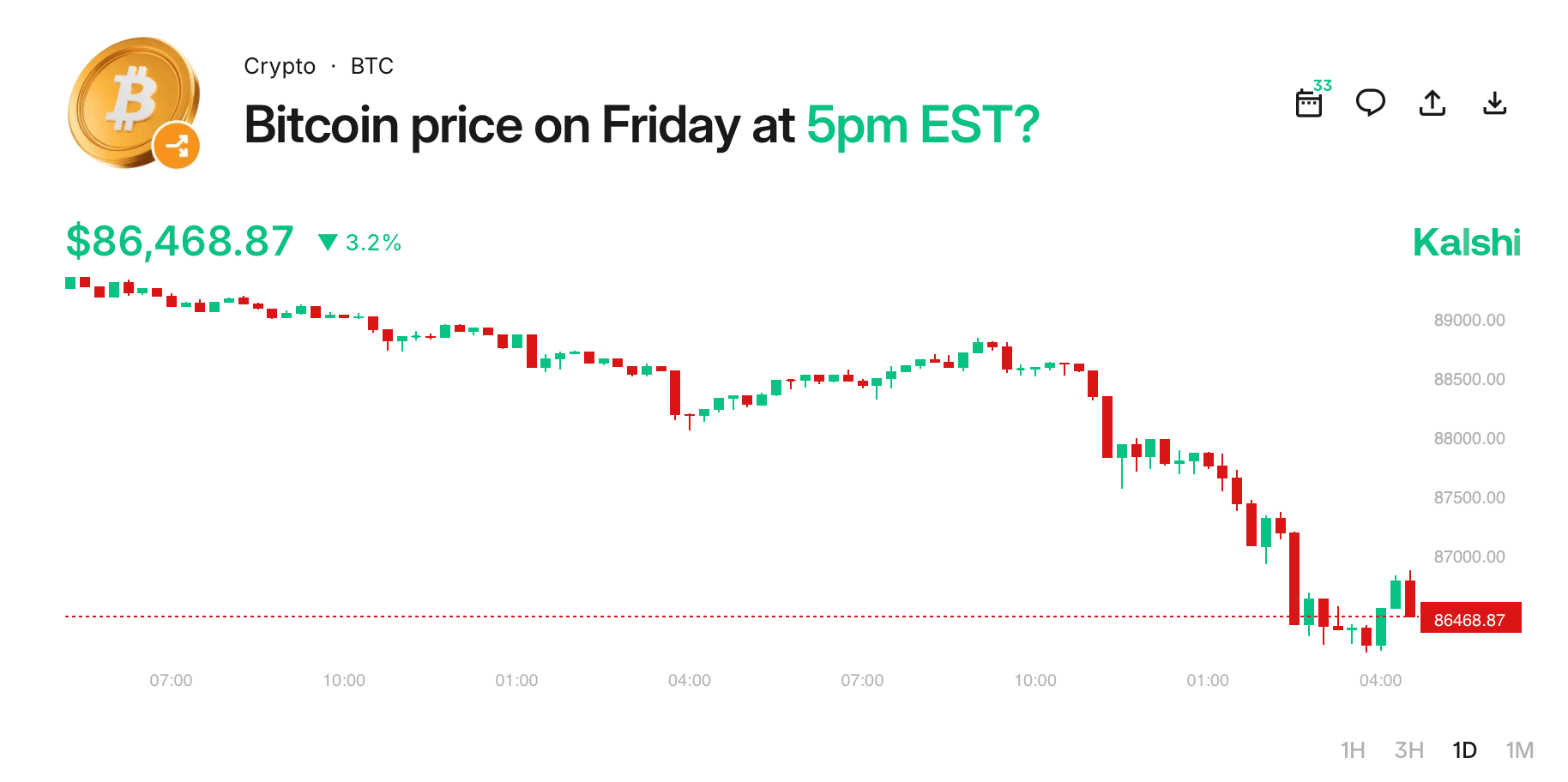

Conversely, shorter-duration contracts paint a more balanced picture. For example, a Kalshi contract assessing whether BTC will trade above $86,750 at 5 p.m. EST on January 30th shows nearly even odds: about 53% probability favoring the bullish side with “Yes” bids near 54 cents versus “No” bids around 50 cents—a virtual coin toss scenario.

The reference price lingering just below this threshold highlights how finely balanced near-term sentiment remains—there is neither panic pricing nor confident buying pressure at present. The takeaway? Bitcoin hovers close to key levels but lacks strong conviction among traders right now.

Polymarket’s upcoming noon ET contract for January 26 further reinforces this restrained outlook by assigning highest likelihood (43%) for BTC trading within the tight range of $86K–$88K followed by lower probabilities for adjacent brackets ($84K–$86K at ~25.8%, and $88K–$90K at ~20%). These probabilities collectively imply expectations for limited volatility within these bounds over the very short term.

Extreme scenarios barely register any weight: sub-$84k outcomes hold less than ten percent odds while surpassing $90k carries under six percent combined chance—even as total volume approaches healthy levels around $820, 775. This suggests active participation but no exuberance—the consensus favors consolidation rather than sharp moves or chaos in coming days.

A broader Polymarket wager spanning all of January tracks what peak level bitcoin might reach during the month—and offers perhaps its most sobering insight yet: roughly two-thirds (~69%) probability centers around an ~$85k high point with only modest chances (~15%) placed near ~$80k highs.

Bulls aiming beyond six figures face steeply declining odds under one percent across targets exceeding $100, 000.

The substantial volume exceeding $61 million invested here underscores widespread agreement that any rally topping out in January likely won’t breach six figures anytime soon—with big investors favoring realism over bold speculation.

Taken together, these four distinct prediction markets weave a consistent story:

Traders maintain faith in bitcoin’s long-run upside potential but view current conditions as suitable primarily for steady digestion rather than explosive growth.

The collective mood can be described as patient,pragmatic&”>,and avoiding unnecessary drama.

Prediction markets currently do not signal either imminent breakdowns or breakouts—they anticipate gradual movement instead with bullish ambitions parked just beyond immediate horizons.

Frequently Asked Questions ⏱️

What do prediction markets indicate about bitcoin’s short-term pricing?

They forecast constrained trading ranges centered mid-$80Ks rather than sudden large swings.

Are traders still optimistic about bitcoin’s future?

Absolutely — longer-dated bets strongly support eventual breakthroughs past $100,& 000.

Is there expectation of major rallies before February?

Not really — monthly-wide contracts show slim chances above six-figure marks within current month.

Might we see sharp crashes soon according to these predictions?

Unlikely — downside risks below low-$80Ks carry relatively minor probabilities compared with other outcomes.