On Wednesday, the Federal Reserve of the United States made a significant move by reducing its target for the federal funds rate by 25 basis points, marking the first adjustment of this kind in 2023.

Bitcoin Surges to $117K After Fed’s Rate Cut Announcement

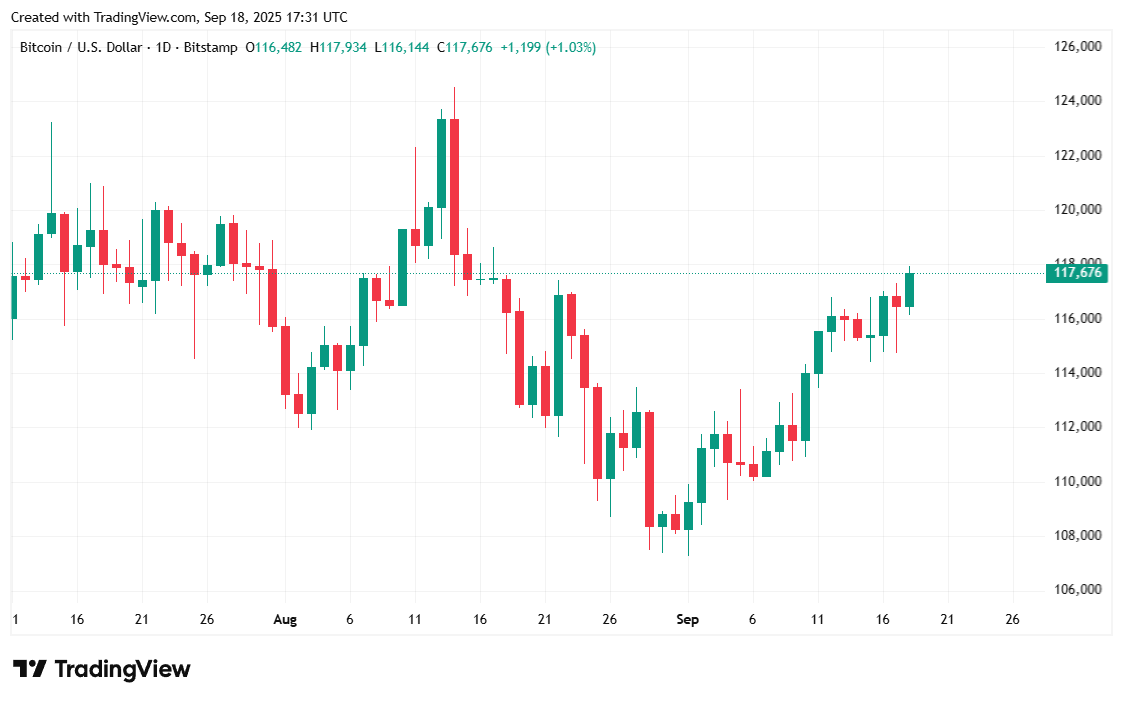

Initially, many were taken aback when Bitcoin (BTC) experienced a drop to $115K shortly after the Federal Reserve’s announcement regarding a 25 basis point interest rate cut. However, by Thursday morning, Bitcoin rebounded impressively to reach $117K. This pattern mirrored that of stocks which also seemed to respond with a delay and are now on track for another record-setting close.

The market may have anticipated a more substantial cut of 50 basis points; however, data from CME Group’s Fedwatch Tool indicated only a slim chance—around 4%—of such an outcome. Alternatively, it’s possible that traders needed additional time to process the Fed’s comprehensive insights into the U.S. economy presented in their Summary of Economic Projections (SEP).

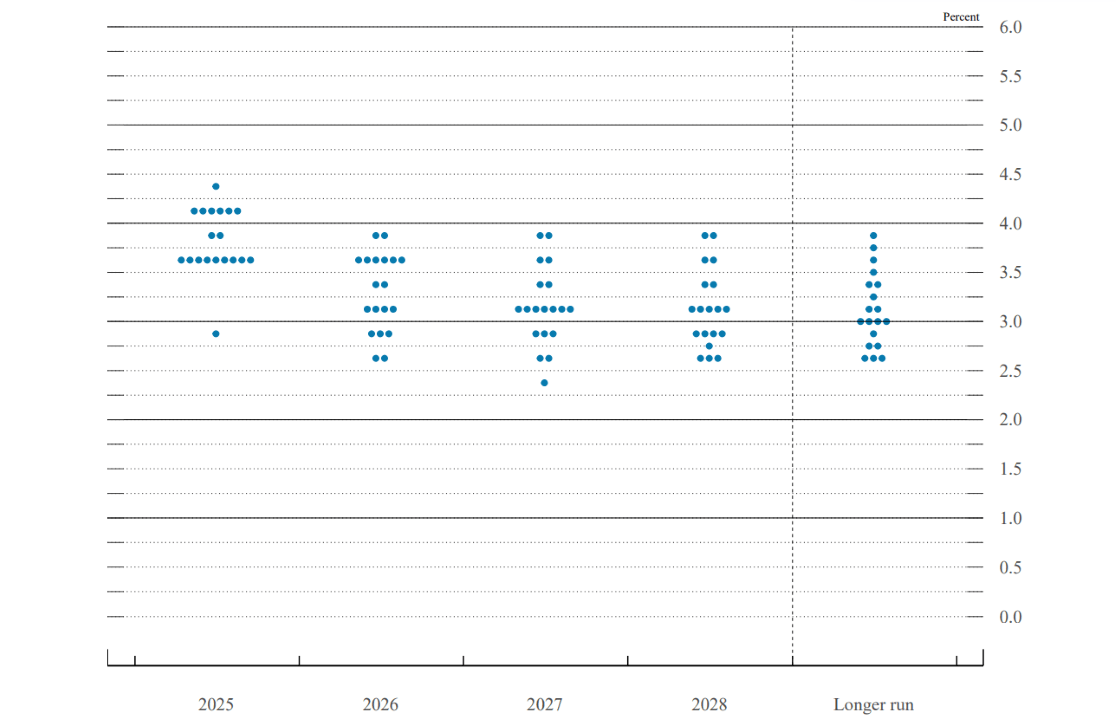

(The “dot plot” illustrates individual interest rate projections from members of the Federal Open Market Committee (FOMC) as well as presidents from each Federal Reserve Bank / federalreserve.gov)

The “dot plot,” featured in yesterday’s SEP report and displaying anonymized blue dots representing each FOMC member’s projected interest rates along with those from all Federal Reserve Bank presidents, indicates potential cuts extending through until 2027 when rates might stabilize at around 3.1%. It seems that Bitcoin investors took some time to reflect on this dovish perspective before becoming slightly more optimistic today.

Market Overview

As this article is being written, Bitcoin is trading at approximately $117,740.20—a rise of about 1.77% over the past day and an increase of roughly 2.9% over seven days. According to Coinmarketcap data, Bitcoin’s price has fluctuated between $114,794.97 and $117,860.80 since yesterday.

( BTC price / Trading View)

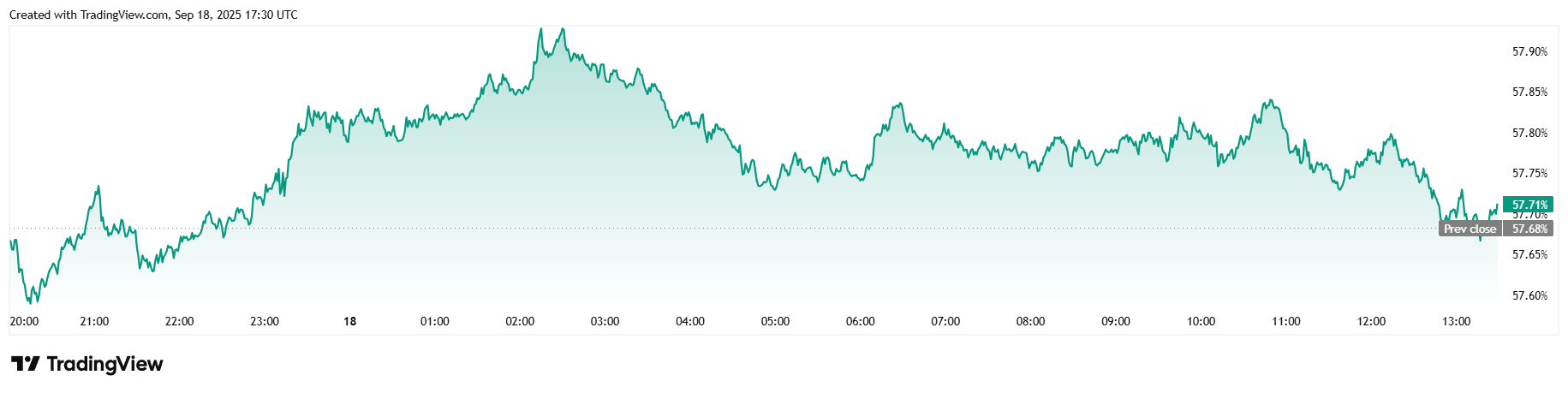

The trading volume within twenty-four hours surged by approximately 32.73%, reaching around $64.81 billion at reporting time while market capitalization increased by about 1.64%, totaling approximately $2.34 trillion; meanwhile bitcoin dominance remained relatively stable but saw a slight uptick of about 0.02%, resting at around 57.71%.

( BTC price / Trading View)

Total open interest for bitcoin futures rose significantly by about 5.01% since yesterday and reached approximately $87.29 billion according to Coinglass data reports.The total liquidations involving bitcoin over the last twenty-four hours spiked dramatically up to roughly $105 million primarily due to unsuspecting short sellers who faced liquidation amounting up towards nearly$79 million while long liquidations accounted for around$25 million—a smaller yet noteworthy figure.