Bitcoin experienced a significant surge, soaring past the $94,000 mark after lingering between $88,000 and $92,000 for several days without much movement.

This breakout happened abruptly on December 9th, with prices accelerating rapidly within minutes and breaking free from the nearly week-long trading range that had restrained the market.

Whale Buying and Short Liquidations Propel Price Rally

Analysis of trading activity reveals substantial inflows into key institutional wallets and exchange-related accounts during the hour preceding the price jump.

A number of large custodial addresses amassed thousands of bitcoins in a brief period, suggesting that major liquidity providers initiated buying before short sellers were forced to exit their positions.

🚨 BREAKING:

THE EXACT REASON BEHIND BITCOIN'S RECENT SURGE:

BINANCE PURCHASED 7,298 BTC

COINBASE PURCHASED 3,412 BTC

WINTERMUTE PURCHASED 2,174 BTC

BLACKROCK PURCHASED 1,362 BTC

A RANDOM WHALE BOUGHT 6,192 BTCTHIS IS THE LARGEST INSIDER-DRIVEN PUMP EVER!! pic.twitter.com/SImfFYuGT8

— ᴛʀᴀᴄᴇʀ (@DeFiTracer) December 9, 2025

The speed at which Bitcoin broke out indicates that order books quickly thinned once demand surpassed resistance levels. This led to a swift change in market dynamics as momentum intensified while short sellers scrambled to cover their positions under pressure.

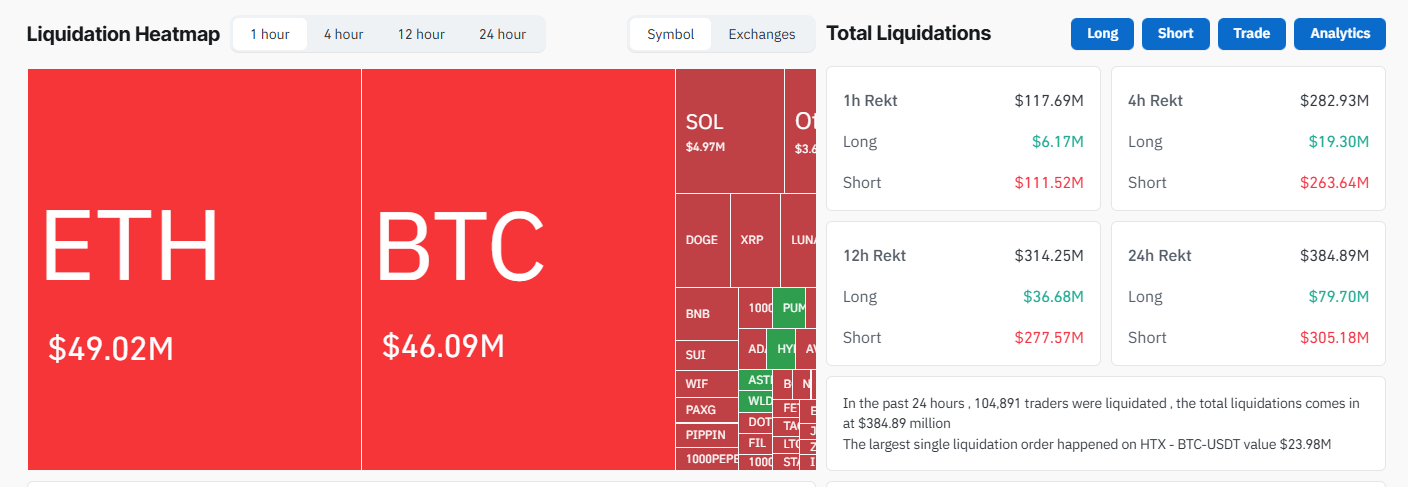

The liquidation statistics confirm aggressive absorption by futures markets. Over $300 million worth of crypto liquidations took place within twelve hours — Bitcoin alone accounted for more than $46 million while Ethereum saw liquidations exceeding $49 million.

The majority of these liquidations involved shorts being squeezed out rather than gradual accumulation by buyers. As stop-loss orders cascaded through the system, prices shot up sharply with minimal resistance from sell-side supply.

Regulatory Developments & FOMC Expectations Boost Market Optimism

This rally was supported by an important regulatory announcement from the US Office of the Comptroller of Currency (OCC), which clarified that banks are permitted to conduct riskless principal transactions involving cryptocurrencies. This means regulated financial institutions can facilitate crypto flows without needing direct custody over assets themselves.

This policy adjustment broadens institutional participation possibilities and its timing—mere hours before Bitcoin’s breakout—likely encouraged traders to position accordingly ahead of this move.

OCC Interpretive Letter 1188 confirms national banks may engage in riskless principal crypto-asset transactions as part of banking operations. https://t.co/gXirMExhCi pic.twitter.com/uPRFGqb2NZ

— OCC (@USOCC) December 9, 2025

Additionally, with an upcoming Federal Reserve interest rate decision on horizon, market participants anticipate potential easing measures if rate cuts are announced.

Bitcoin remains close to its intraday peak amid heightened volatility and adjustments in derivatives funding rates.

The community will closely monitor whether buying momentum sustains leading into the Federal Open Market Committee (FOMC) meeting or if profit-taking emerges at these elevated levels causing some cooling off afterward.