On Monday, Bitcoin surged past the $93,000 mark following the release of recent US inflation statistics indicating that price pressures are being kept in check. This movement suggests a resurgence in risk appetite after a period dominated by ETF-related sell-offs.

The Consumer Price Index (CPI) revealed that inflation is increasing at a steady yet moderate rate. Prices are stabilizing rather than experiencing dramatic increases or decreases. This equilibrium diminishes the likelihood of further interest rate hikes and bolsters assets that thrive on stable liquidity, such as Bitcoin.

US CPI Data Eases Market Concerns and Favors Risk Assets

The CPI report indicated an annual inflation rate of approximately 2.7%. While prices continue to rise, they do so at a significantly slower pace compared to the inflation spikes seen in 2022 and early 2023.

The US Inflation Rate (CPI) concluded 2025 at 2.7%, marking the 58th consecutive month above the Federal Reserve’s target level of 2%. The last time inflation persisted this high for such an extended period was back in 1997 when Fed Funds Rates exceeded 5%. The Fed should be increasing rates instead of reducing them. pic.twitter.com/7VsmAOG7ag

— Charlie Bilello (@charliebilello) January 13, 2026

This situation implies that while living expenses remain elevated for households, they are no longer escalating rapidly.

For financial markets, it indicates that the Federal Reserve can maintain current interest rates without tightening further.

This environment typically favors riskier assets; when inflation remains stable rather than fluctuating wildly, investors feel more secure holding onto stocks and cryptocurrencies alike.

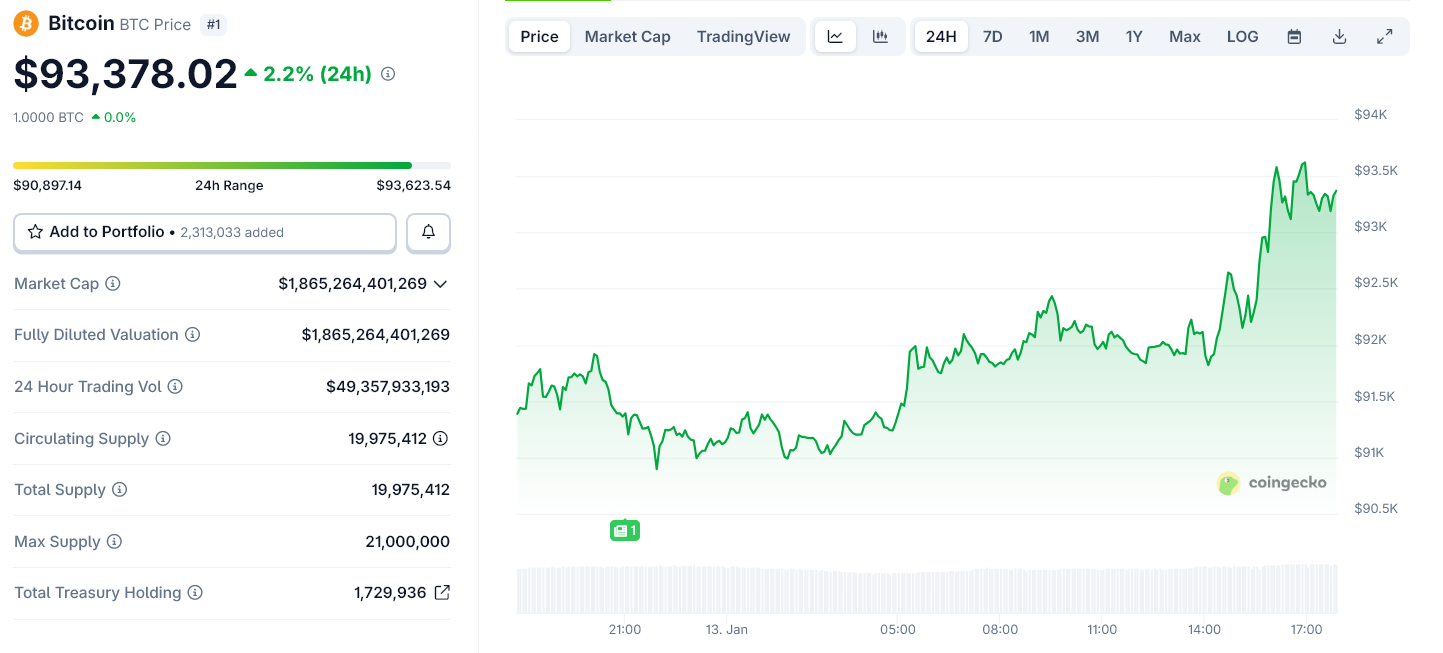

Bitcoin responded promptly to these developments. After hovering around $90,000 earlier in the day, its price climbed higher as concerns about renewed monetary tightening dissipated with CPI data release.

Bitcoin Price Surges Above $93,000 After US CPI Data. Source: CoinGecko

Bitcoin’s Recovery Reflects More Than Just Macro Stability

The uptick following CPI data did not occur independently; it coincided with Bitcoin already finding stability after experiencing significant selling pressure from ETFs earlier on.

In January alone, over $6 billion exited US spot Bitcoin ETFs due to investors who had purchased near October’s peak being forced out as prices fell sharply.

Nevertheless, those outflows have begun to taper off recently. Currently trading close to an average ETF cost basis around $86,000 often serves as support once weaker hands have sold off their holdings.

The demand from US buyers remains subdued according to metrics like Coinbase Premium Index; this indicates institutions have retreated following recent ETF liquidations.

Despite substantial supply hitting exchanges from ETFs’ releases though,Bitcoin has managed to hold its ground within its range,indicating global buyers are absorbing what is being released by ETFs。

Bitcoin Total Exchange Netflow. Source: CryptoQuant

A Path Back Towards $100K Soon?

>p</ p&g;

Now building support between $88k-$92k,the latest CPI data alleviates major macro risks while both on-chain analytics and ETF information indicate we’re well into recovery mode。If inflows stabilize along with renewed interest from U.S.buyer then reclaiming$95k could happen soon。As demand improves later this quarter,the prospect for returning towards$100k becomes increasingly likely。 For now today’s C.P.I.report reinforces belief that bitcoin is simply pausing before embarking on another upward trajectory instead starting anew bear market。