The value of Bitcoin has surged past $120,000 once more, providing a clearer market perspective beyond mere speculation.

On October 2nd, the spot price broke through the significant $120,000 threshold, closing at approximately $120,606 after a 5.5% increase since September 29th. This level is being maintained despite minor fluctuations. The rise in spot price is not an isolated event.

Bitcoin ETFs experienced substantial net inflows for two consecutive days: about $676 million on October 1st and another $627 million on October 2nd. This follows a turbulent period of outflows around September 25th-26th.

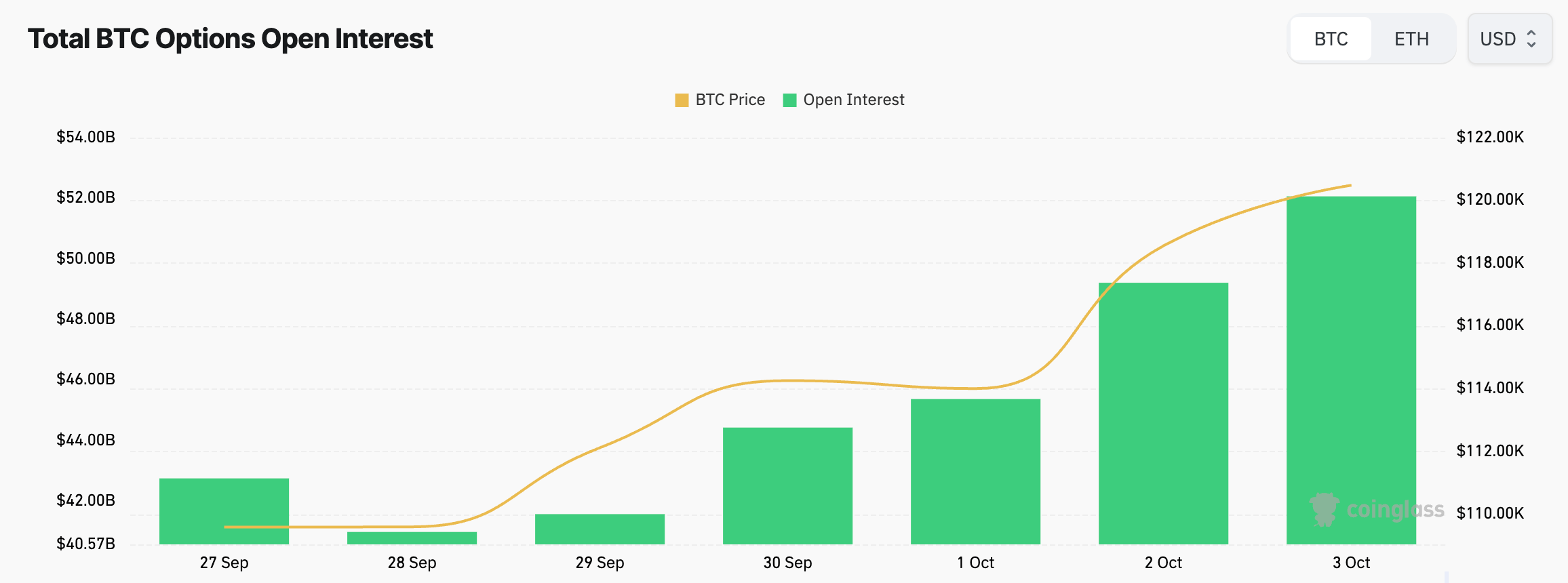

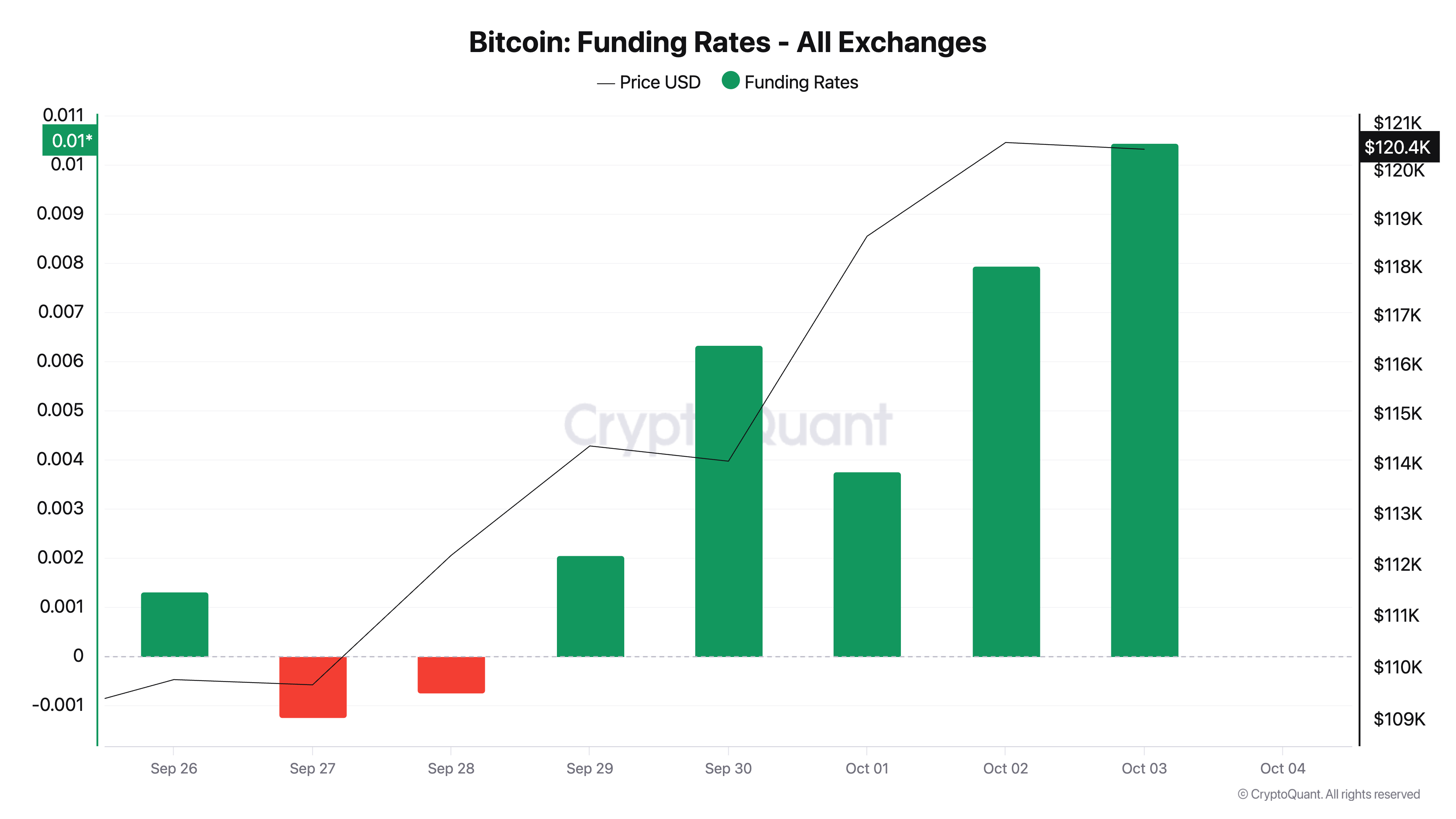

Simultaneously, futures and options markets quickly rebounded as October began: BTC futures open interest climbed from $77.22 billion on September 29th to reach $88.52 billion by October 3rd; options open interest increased from $41.58 billion to hit $52.06 billion during the same timeframe. Trading volume also surged with futures turnover rising from $48.59 billion on September 29th to an impressive $111.22 billion by October 2nd as exchange activity intensified mid-week.

This combination of demand in spot markets through ETF creations alongside new derivatives exposure and high trading volumes sets up potential gains for Q4.

The late-September ETF adjustments were crucial because they reset market positions before rapidly shifting back towards creation mode again—when net inflows exceed over half-a-billion dollars consecutively like this it compels primary markets into action forcing authorized participants into sourcing more BTCs themselves which tightens supply leading prices higher faster than news headlines can catch up while altering intraday liquidity dynamics such that spreads compress when active creation occurs turning arbitrage opportunities bi-directional once again

If positive flows continue throughout next week then sustaining above-$120k levels won’t require extraordinary measures merely consistent operation within existing systems will suffice keeping upward momentum intact without needing perpetual contract interventions

The increase in futures open interest during this period isn’t solely due to short covering; accumulating over +$11B across four sessions necessitates fresh position-taking coupled with heightened trading volumes exceeding hundreds-of-billions daily across multiple platforms suggests classic ‘adding-risk-during-strength’ scenario unfolding here too

What Factors Will Influence Future Price Movements?

- ETF Activity:

- Basis Between Spot & Futures Markets:

- Options Market Dynamics Mid-October Onwards: