The Bitcoin market is currently at a pivotal point, lingering just above the crucial psychological threshold of $85,000. This level not only carries psychological weight but also appears to have significant technical relevance. Its resilience will likely be tested before any clear market direction emerges. However, recent analyses suggest a bleak outlook for the leading cryptocurrency’s future.

Formation of a Descending Triangle Near $85,000 Support

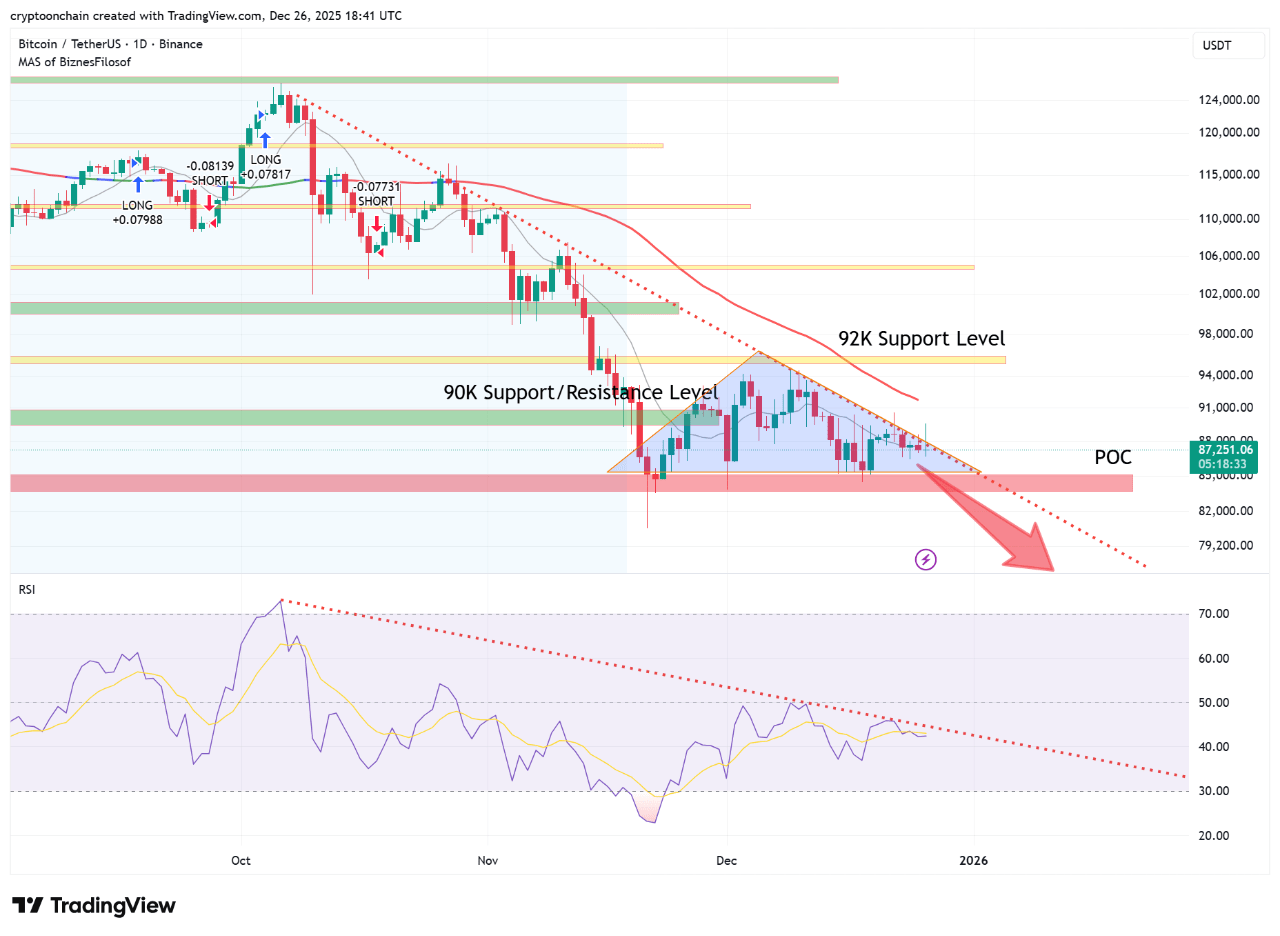

A recent update from QuickTake by CryptoOnchain indicates that a classic bearish continuation pattern has emerged in Bitcoin’s daily chart. This pattern is characterized by successive lower swing highs and price action compressing against horizontal support that forms the base of the triangle.

Notably, this critical price level coincides with what is known as the Point Of Control (POC), where trading volume peaks near the $85,000 support zone. This alignment further emphasizes its importance; should this level be decisively breached, we could witness swift downward movement in Bitcoin’s price due to potential liquidation and capitulation events. A notable increase in selling pressure may occur if demand fails to emerge to restore bullish momentum.

Exchange Activity Hits Multi-Year Lows

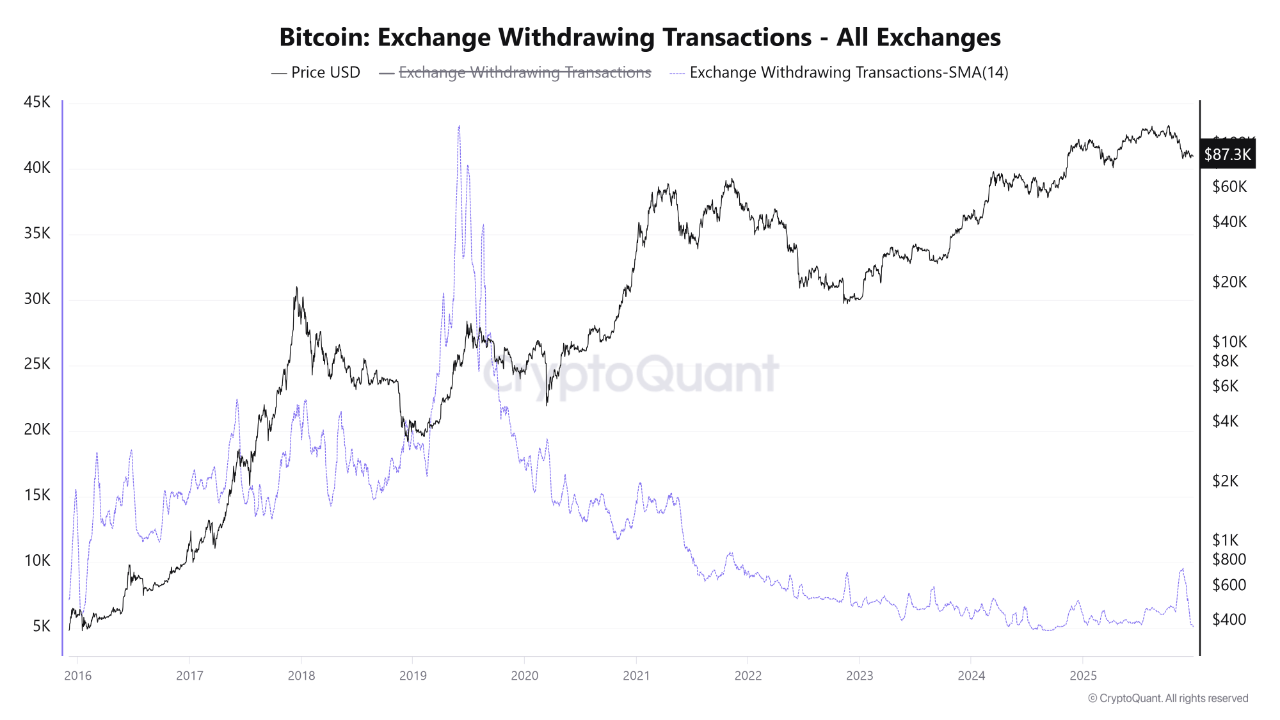

CryptoOnchain bolsters its bearish stance with another significant observation regarding on-chain metrics: specifically, the 7-day Moving Average of Bitcoin Exchange Withdrawing Transactions. This metric tracks withdrawal transactions from cryptocurrency exchanges over seven days.

The analyst points out that current readings have plummeted to around 5,000—marking levels not seen since 2016—approximately nine years ago. Interestingly enough, these figures are below those recorded during previous bear markets in 2018, 2020, and 2022. Withdrawal activity from exchanges serves as an indicator of investor sentiment and accumulation behavior; increasing withdrawals typically signify growing interest among investors who prefer storing their assets in private wallets rather than leaving them on exchanges.

Conversely, this drastic decline in exchange withdrawal activity suggests widespread apathy among Bitcoin investors or insufficient conviction necessary for long-term holding strategies. The lack of urgency to transfer coins into private wallets indicates that investors are not actively seeking BTC accumulation either. The analyst concludes that “the data implies pervasive skepticism or fatigue within the market context,” highlighting an absence of genuine non-speculative demand.

If support at $85,000 falters due to insufficient buyer interest, it could trigger a rapid decline in Bitcoin’s value. As reported recently,, Bitcoin stands at approximately $87,<strong410, showing minimal change over the last day.

Featured image sourced from Pexels; chart provided by Tradingview