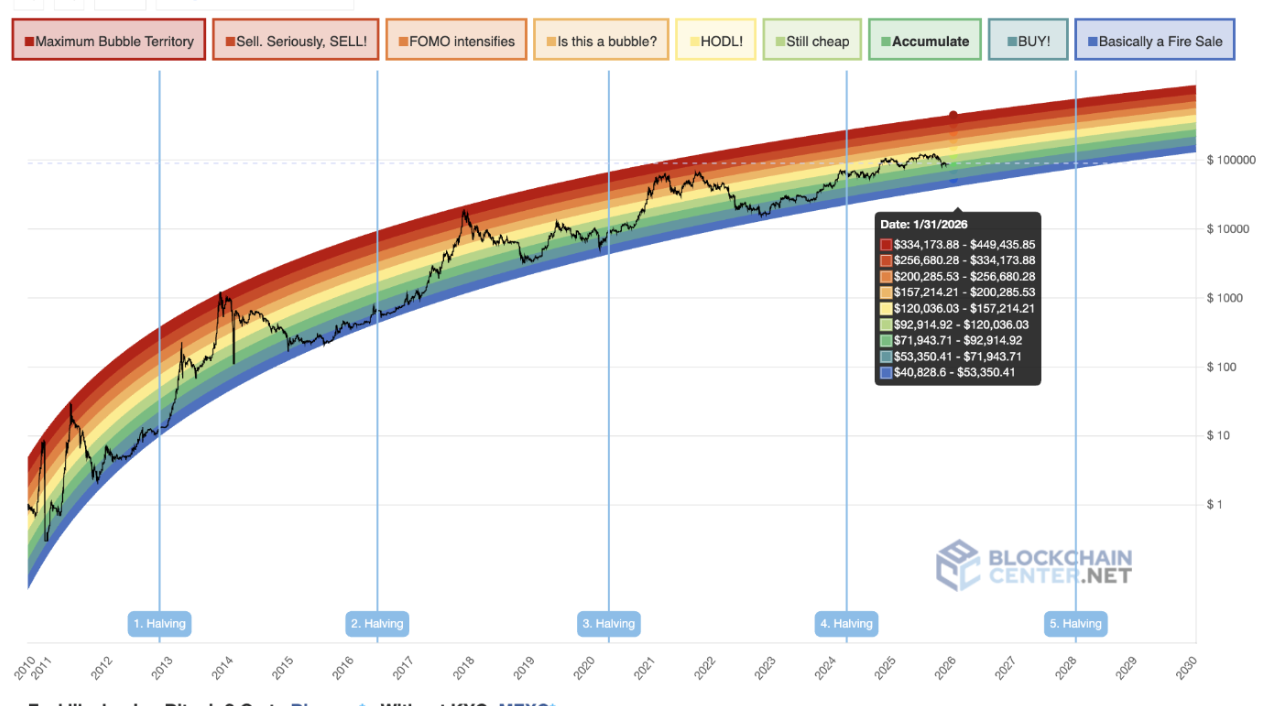

As Bitcoin (BTC) remains near the $90,000 mark, its Rainbow Chart reveals a broad spectrum of potential price levels projected for January 31, 2026.

The topmost segment on this chart, known as the ‘Maximum Bubble Territory,’ covers an estimated range from $334,173.88 to $449,435.85. Historically, this zone signals extreme overvaluation and typically corresponds with the late stages of market exuberance.

Just beneath it lies the ‘Sell, Seriously, SELL!’ region spanning roughly $256,680.28 to $334,173.88. This area has traditionally indicated weakening long-term returns and heightened risk of price declines.

The next band down is labeled ‘FOMO intensifies,’ placing Bitcoin’s value between approximately $200,285.53 and $256,680.28 — a phase marked by rising retail interest and momentum-driven buying activity.

Below that sits the ‘Is this a bubble?’ zone ranging from about $157,214.21 to $200,285.53 — prices here often spark debates regarding sustainability but don’t necessarily indicate market peaks.

The ‘HODL!’ band extends from roughly $120,036.03 up to around $157,214.21 and reflects valuation levels where long-term investors have historically held steady amid moderate optimism.

Further down is the ‘Still cheap’ category covering values between approximately $92,914.92 and $120,036.03 — these prices have in past cycles presented attractive risk-reward opportunities for patient holders.

The chart’s ‘Accumulate’ segment ranges from about $71,943.71 to nearly$92,'914 .92 , indicating periods when investors typically increase their holdings during low sentiment phases.

Next comes the ' ;BUY!& ;#39 category , which spans roughly & ;#36 ;53 ,350 .41 up to & ;#36 ;71 ,943 .71 . This range has been linked with significant undervaluation in previous cycles.

At its lowest tier is what&s called &; #39 Basically a Fire Sale&; #39;, encompassing values between around &; #36 40 ,828 .60 through & amp ;; #36 53 ,350 .41 – deep-value territory historically associated with prime entry points following major downturns.

Bitcoin&; s Potential Price Outlook for January 31st, 2026

Collectively, rather than predicting an exact figure, the Rainbow Chart outlines sentiment-based valuation bands that highlight possible upside gains or downside risks as we approach January 31, 2026.

Currently trading near & amp ;; #36 89 ,777 , BTC could plausibly remain within either the ‘Still cheap’ or ‘HODL!’ zones by late January next year, translating into an approximate range of & amp ;; #36;93 ,000~'157,000 if historical growth trends persist.& lt;/p>

<p>A more RemARKABLE POST-HALFING MOMENTUM COU LD PROPE LBTC’SPR iCES TO ’Is t h i S A B u b b l e?’ O R ’FOMO Intensifies’ ZONES, WHICH CORRESPOND TO APPROXIMATELY $157,000~256,000.R E AC H I N G T H E U P P E R M O S T L E V E L S W O U L D N E C ES SA R I LY D EMAN D M A R K ET C ONDITIONS SIMILAR TO PREVIOUS CYCLE PEAKS INSTEAD OF THE CURRENT TREND.</P>

<P> Image credit: Shutterstock