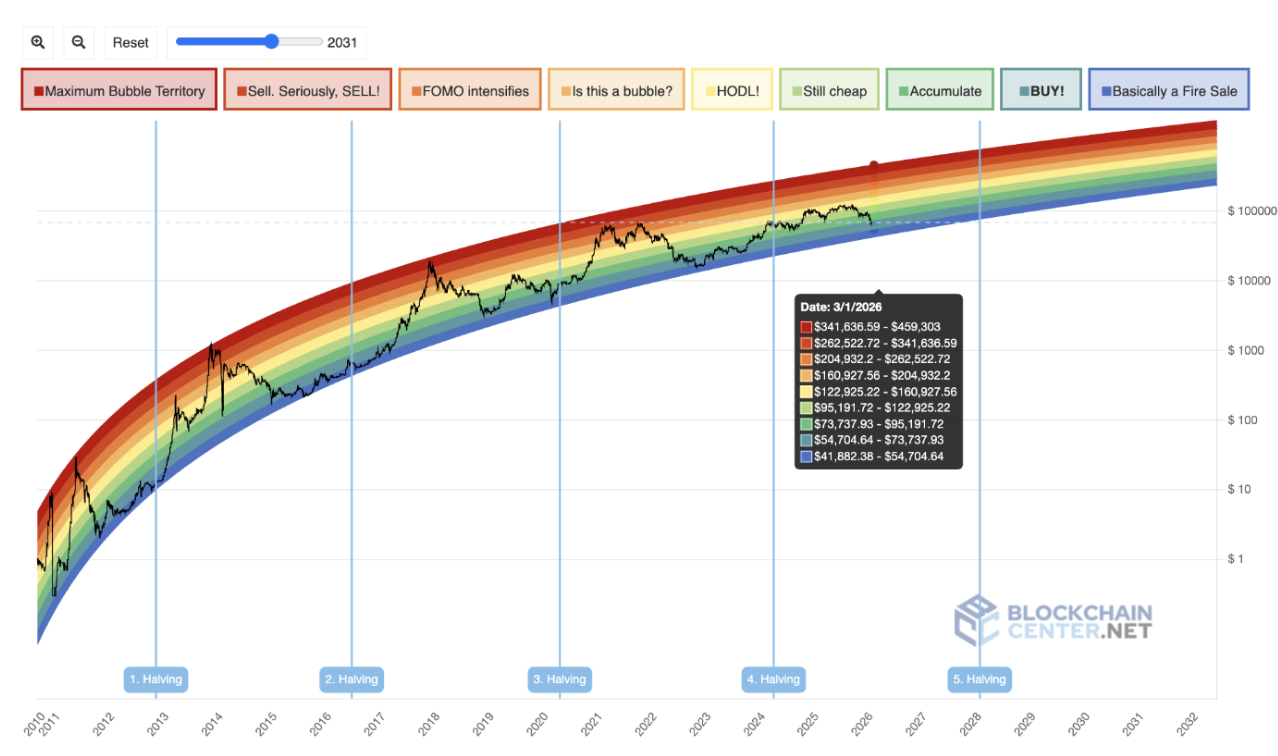

The most recent analysis from the Bitcoin (BTC) Rainbow Chart indicates that the cryptocurrency could fluctuate significantly between $41,882 and $459,303 by March 1, 2026.

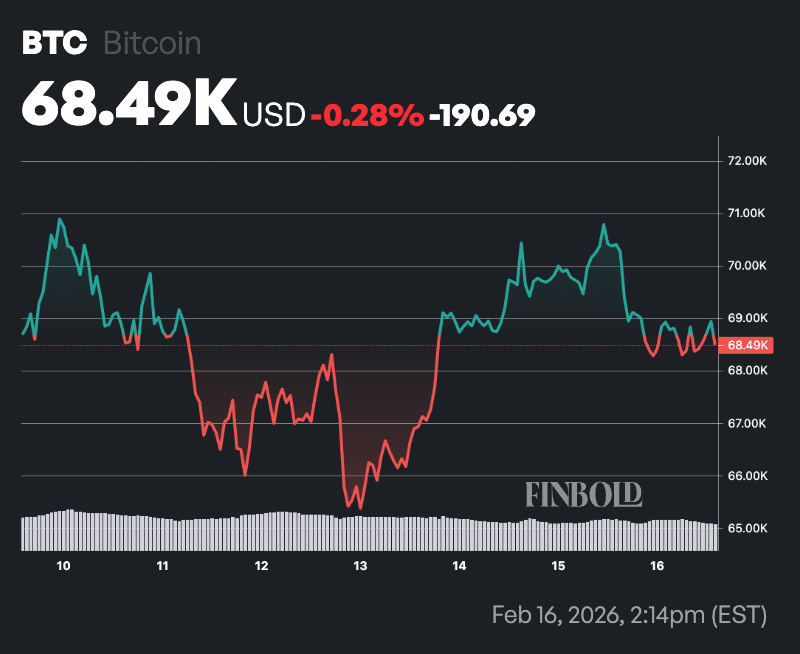

This forecast emerges as Bitcoin encounters significant resistance amid a broader downturn in the cryptocurrency market. As of now, Bitcoin is priced at $68,508, reflecting a decline of 2.5% over the last day and approximately 0.3% on a weekly basis.

The Rainbow Chart serves as a long-term valuation model rather than a tool for short-term predictions. It suggests considerable upside potential in the coming year based on current prices and historical cycle patterns—ranging from gradual increases to possible surges late in the cycle depending on market dynamics.

Forecast for Bitcoin Prices

For March 1st, the lowest tier labeled ‘Basically a Fire Sale’ ranges from $41,882 to $54,704. This area indicates extreme undervaluation where long-term investors have historically made significant purchases.

Next up is the ‘BUY’ zone which spans from $54,704 to $73,737; this region signifies strong value with favorable risk-reward ratios. The ‘Accumulate’ band falls between $73,737 and $95,191—indicating relatively low pricing within this broader cycle that often aligns with steady long-term investment strategies.

Simultaneously, there’s also a range labeled ‘Still Cheap,’ extending from $95,191 to $122,925—implying that while Bitcoin remains undervalued it is no longer significantly discounted.

The ‘HODL’ zone covers prices between $122,925 and $160927; this reflects fair value during bullish cycles where holding assets has been historically favored over aggressive buying tactics.

‘Is This a Bubble?’ runs from prices of$160927 to$204932 indicating growing speculative interest alongside heightened valuations. Meanwhile,’FOMO Intensifies’ spans$204932-$262522 signaling increasing investor enthusiasm along with momentum-driven purchasing behavior.

‘Sell Seriously SELL!’ extends across$262522-$341636 typically associated with euphoric phases late in cycles leading towards increased correction risks while at its peak,’Maximum Bubble Territory’ stretches across an impressive range of$341636-$459303 indicating extreme overvaluation conditions preceding major reversals historically speaking!

Potential Price Points for March 1

If we look back at February16th when bitcoin was trading around68k508 it currently sits comfortably within our BUY region according to our forward curve prediction intoMarch2026 just slightly above lower accumulation thresholds!

If bitcoin follows mid-range trajectories outlined earlier we might see movement towards either HODL or Is This A Bubble zones suggesting values ranging anywhere between120k-200k comeMarch01st2026!

A full speculative cycle akin previous halving-induced rallies could potentially drive values upwards into260K-340K territory whilst an extreme euphoric phase would necessitate surging past400K levels altogether!

<PConversely should macroeconomic pressures weaken demand causing slowdowns then expect bitcoins price remaining below95000 early20206 keeping us firmly planted within accumulation bands instead entering overheated territories altogether!

Featured image via Shutterstock