Bitcoin traded at $117,509 on Aug. 16, 2025, with a market capitalization of $2.33 trillion. The 24-hour trading volume reached $39.69 billion, with the intraday price fluctuating between $116,956 and $119,152.

Bitcoin

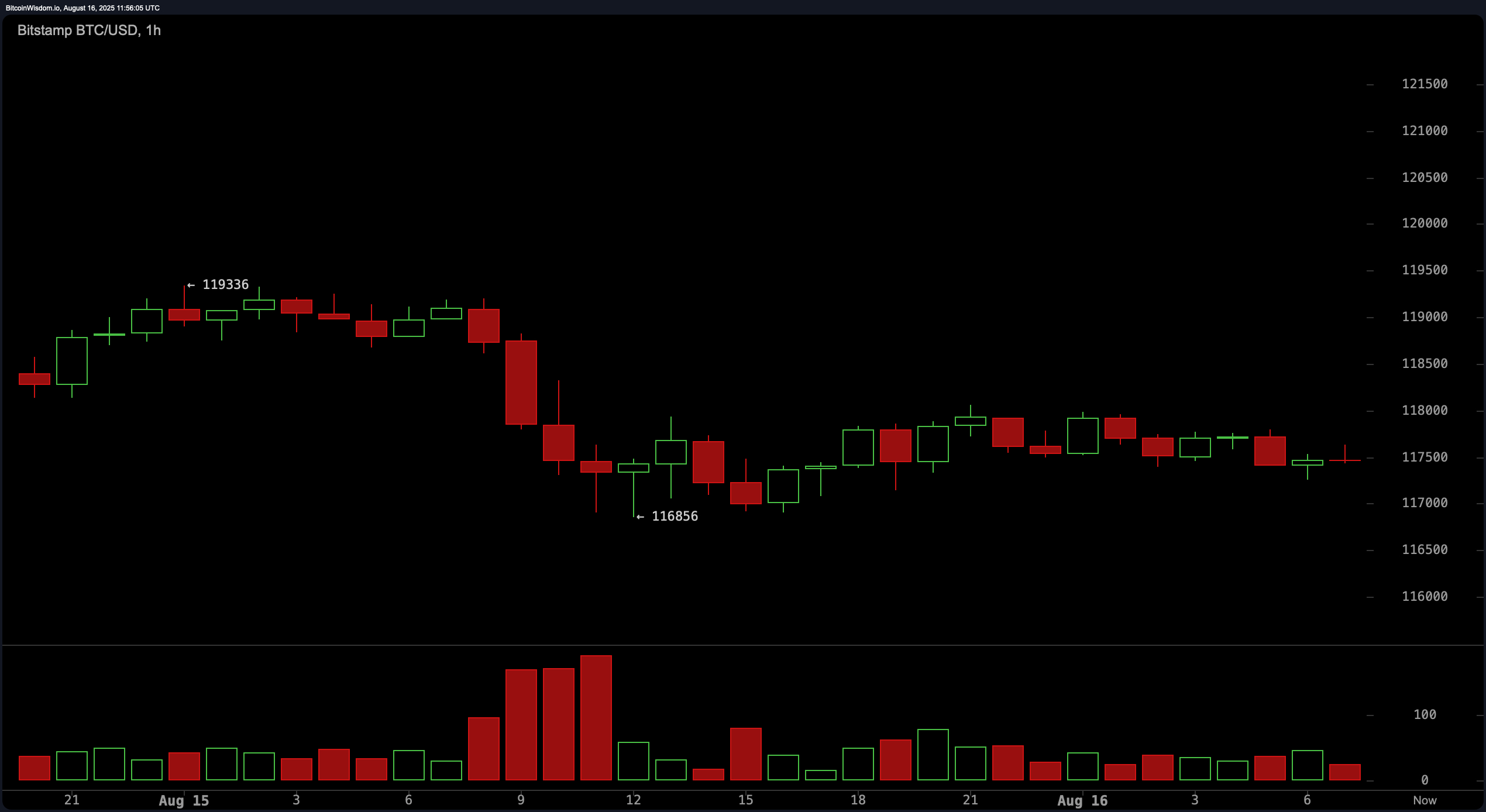

On the 1-hour chart, bitcoin displayed a weakening market structure, characterized by a sequence of lower highs and lower lows, following a local peak at $119,336. While a minor bounce occurred at $116,856, the lack of volume confirmed a weak bullish presence, reinforcing a bearish outlook. A break below $117,000 suggested an actionable short setup, targeting the $116,000 range. Conversely, reclaiming the $118,500 to $119,000 zone with convincing volume might invalidate the downtrend in this timeframe.

BTC/USD 1-hour chart via Bitstamp on Aug. 16, 2025.

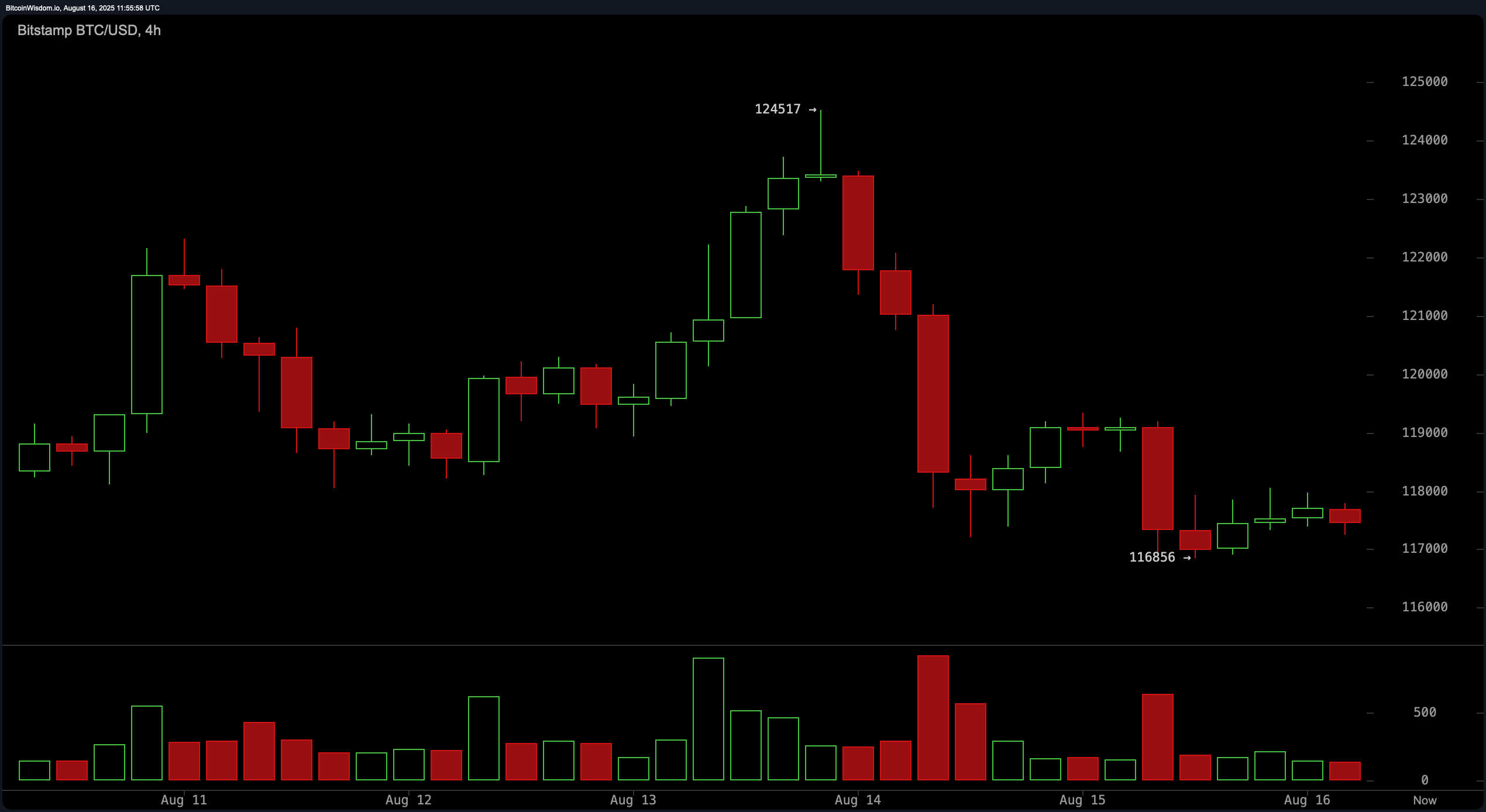

The 4-hour bitcoin chart reflected a pronounced sell-off from the $124,517 high down to $116,856, after which bitcoin entered a tight consolidation band between $117,000 and $119,000. This range-bound behavior indicated market indecision, typically seen as a digestion phase after strong momentum. A sustained breakout above $119,500 could signal a short-term rebound, with $121,000 as the immediate resistance. However, a breakdown below $116,500 on strong volume would likely accelerate the downside to the $114,000–$111,000 range.

BTC/USD 4-hour chart via Bitstamp on Aug. 16, 2025.

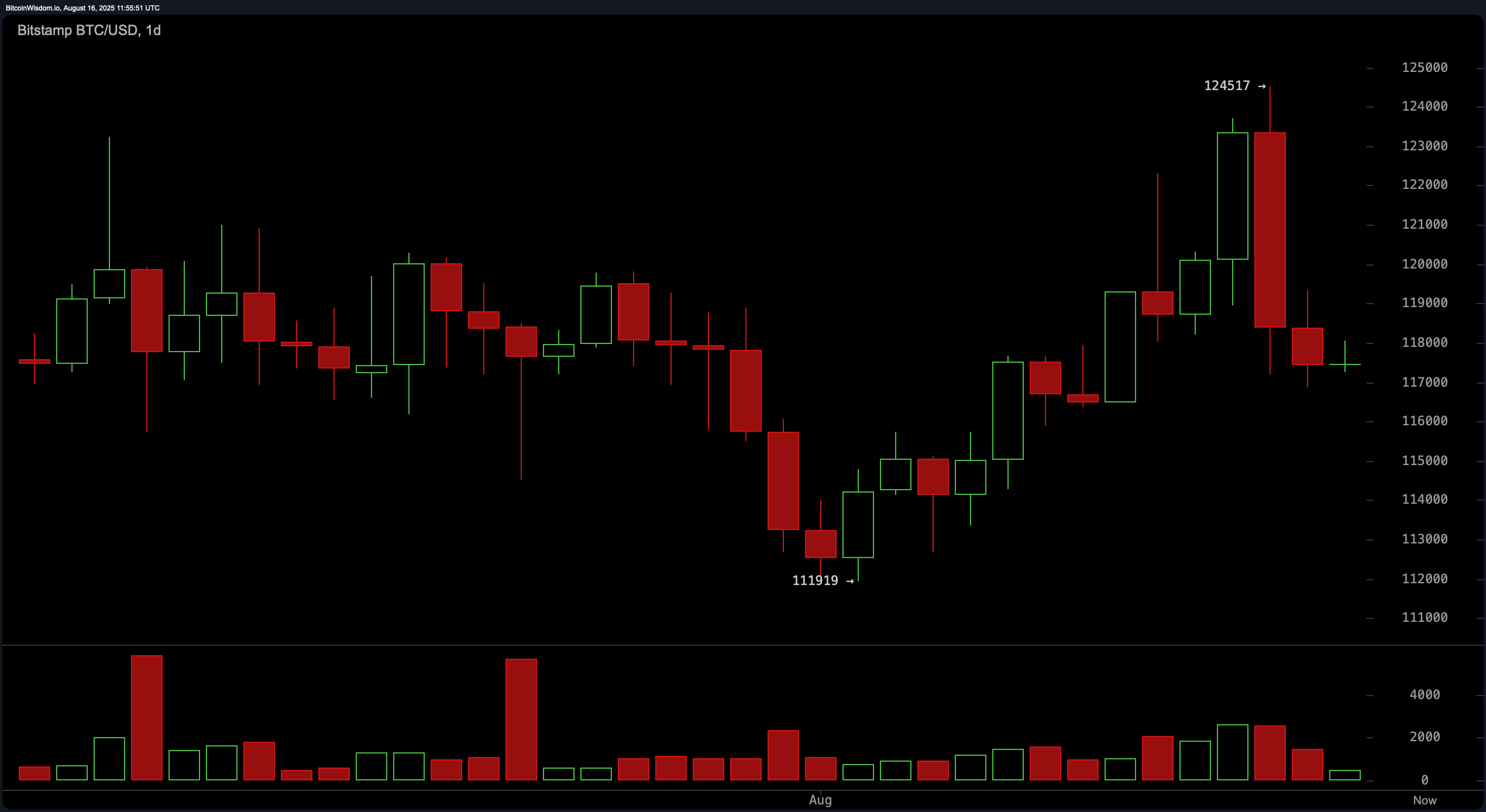

The daily bitcoin chart highlighted a swing high of $124,517 followed by a strong bearish engulfing candle, which often precedes trend reversals. Bitcoin’s failure to maintain its position above $124,000, coupled with volume spikes at the top, pointed toward distribution. A support zone emerged around $117,000, acting as a critical decision level. If price action resumes upward momentum and closes above $119,000 with significant volume, a renewed rally might materialize; otherwise, further deterioration toward the $114,000–$111,000 region is probable.

BTC/USD 1-day chart via Bitstamp on Aug. 16, 2025.

Oscillator data supported a cautious stance. The relative strength index (RSI), Stochastic oscillator, commodity channel index (CCI), average directional index (ADX), and awesome oscillator all signaled neutral conditions, suggesting equilibrium in market momentum. The momentum indicator alone leaned bearish, issuing a sell signal. Notably, the moving average convergence divergence (MACD) diverged from this sentiment, flashing a bullish signal, implying potential for mean reversion or short-term correction if validated by price action.

A breakdown of moving averages revealed a mixed technical landscape. Shorter-term averages, such as the 10-period exponential moving average (EMA) and 10-period simple moving average (SMA), positioned above the current price, signaled bearish conditions. However, mid- and long-term indicators were more favorable: the 30-period and 50-period EMAs and SMAs, along with the 100-period and 200-period variants, all issued bullish signals. This divergence suggested that while the short-term trend leaned bearish, the broader market context remained supportive of upward price potential, pending a decisive shift in momentum.

Bull Verdict:

While bitcoin currently trades below several short-term moving averages and struggles to regain momentum, longer-term technical indicators remain supportive. If buyers can reclaim the $119,000 level with strong volume confirmation, it could trigger a short-term reversal and a potential rally toward the $122,000–$124,000 range. Bullish momentum would be further supported by the buy signal on the moving average convergence divergence (MACD) and the alignment of longer-term moving averages pointing upward.

Bear Verdict:

Despite intermittent support around $117,000, bitcoin’s inability to hold higher levels, coupled with neutral-to-bearish oscillator signals and a weakening short-term structure, keeps the market vulnerable to further downside. If price breaks and closes below $116,500 with elevated volume, it opens the door to a drop toward $114,000–$111,000. Until bitcoin decisively reclaims the $119,000 resistance zone, bearish momentum continues to dominate in the near term.