On September 14, 2025, Bitcoin was valued at $115,927, boasting a market cap of $2.30 trillion and a trading volume of $25.20 billion over the last 24 hours. The price fluctuated between $115,304 and $116,183 during that period.

Bitcoin Analysis

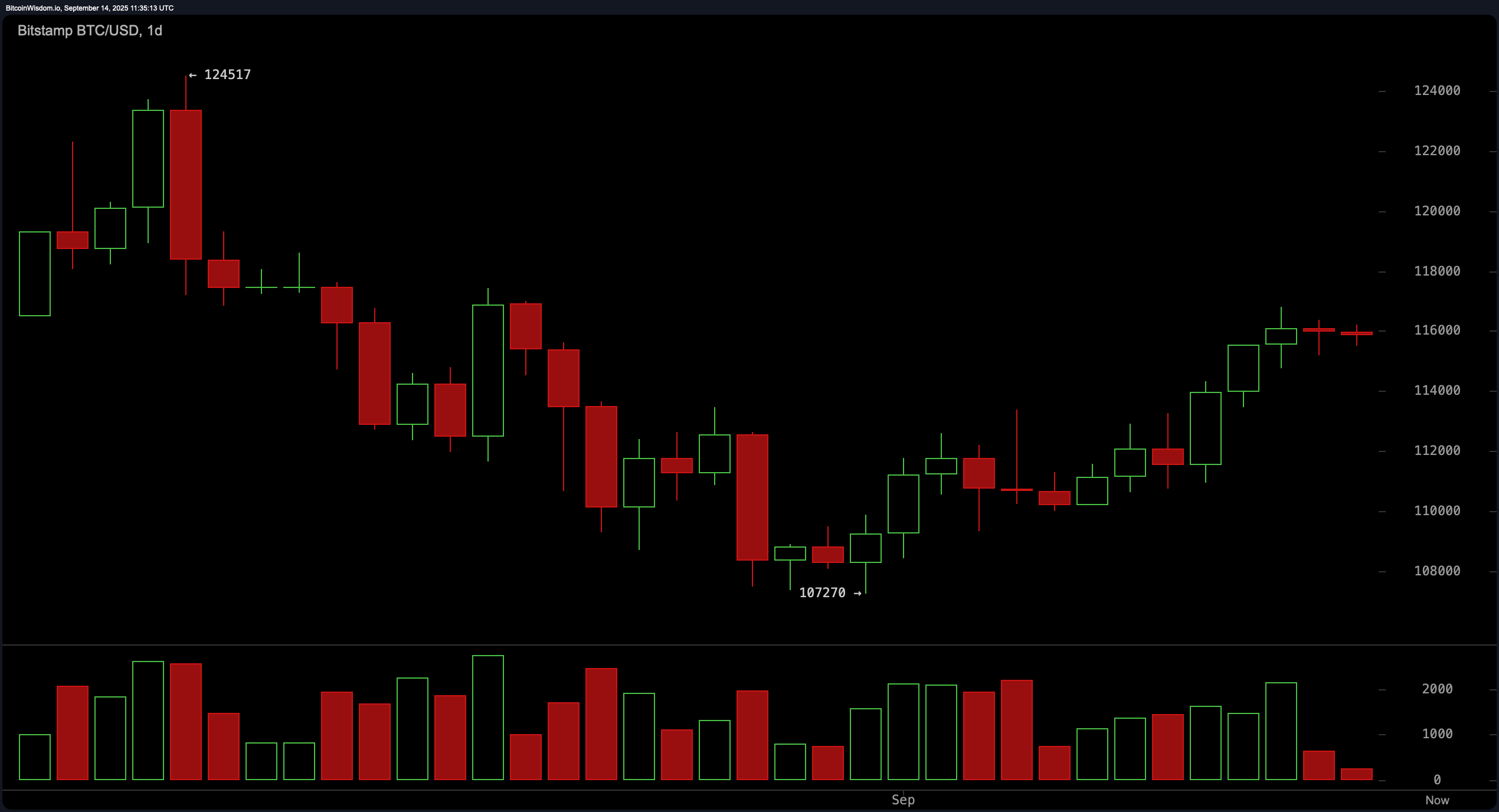

The daily chart for Bitcoin indicates a bullish rebound from a low around $107,270. This has resulted in higher highs and higher lows as the price approaches resistance levels between $116,000 and $116,500 while trading volume decreases—an indication that may suggest an upcoming pause or reversal in trend. Current strategies should focus on anticipating a pullback to the range of $112,000 to $113,000 alongside the formation of a bullish reversal candle while recognizing indecision as prices challenge resistance levels. Caution is advised against making purchases at this moment due to potential overbought conditions indicated by the relative strength index (RSI) along with indecisive candlestick patterns.

BTC/USD Daily Chart via Bitstamp on September 14, 2025.

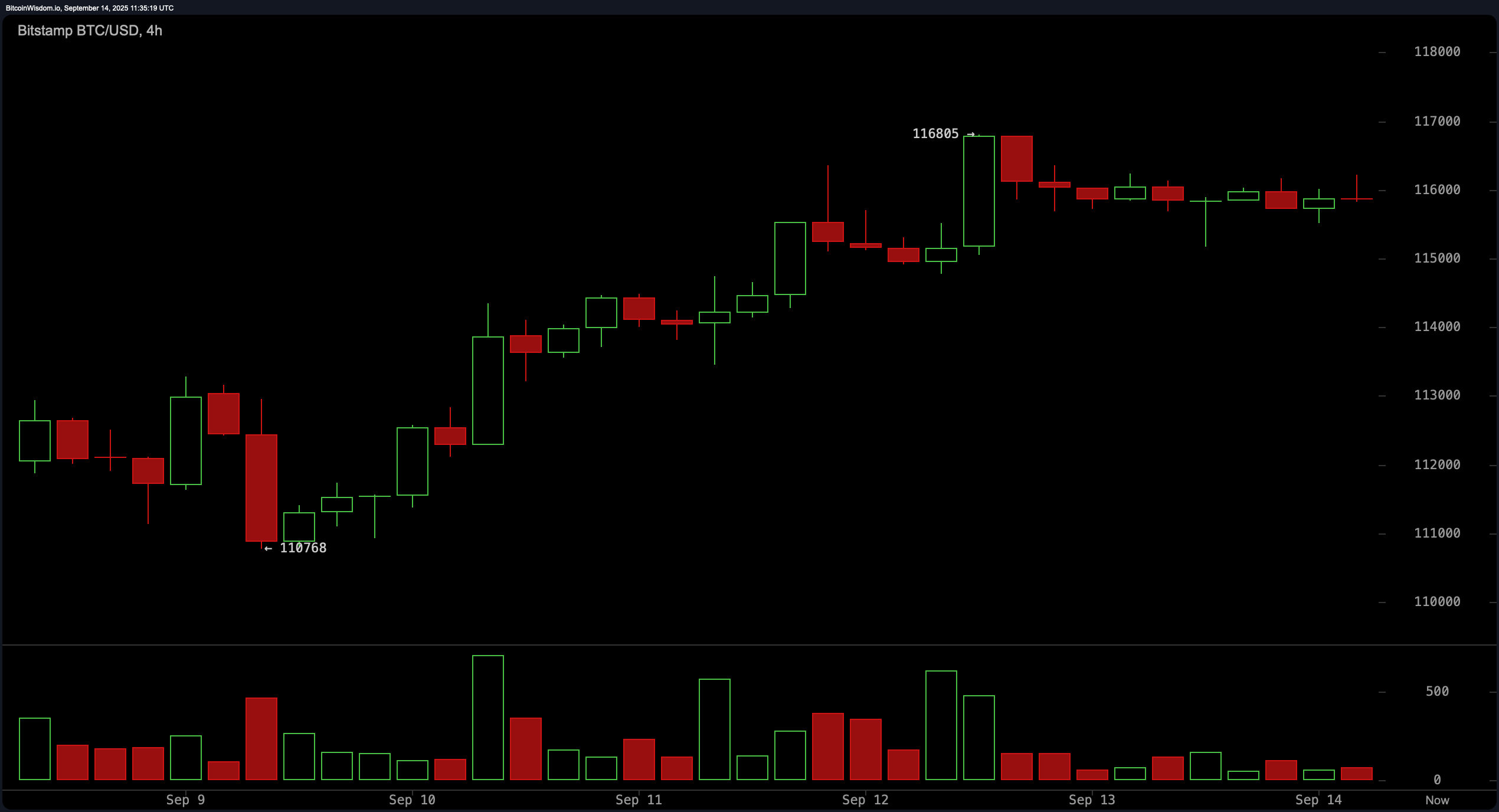

The four-hour analysis reveals that Bitcoin’s price surged from support around $110,768 but faced challenges just below its recent peak at approximately $116,805; momentum appears to be slowing down with diminishing volume following an earlier breakout spike. In this context, traders should keep an eye out for possible pullbacks into the range of about $114,500 to $$115,,000 for potential bounces while considering profit-taking near the level of $$117,,000; any strong closing above this threshold accompanied by increased volume could signal another breakout opportunity. Collectively these mid-cycle indicators suggest that although there is constructive market activity present it is also showing signs of fatigue near current resistance levels.

BTC/USD Four-Hour Chart via Bitstamp on September 14th ,2025.

Looking at the one-hour chart shows prices consolidating within tight ranges between $$115,,177 and $$116,,364 characterized by reduced volatility and light participation which may indicate an impending expansion in range . The intraday strategy suggests monitoring for long positions if prices break above $$116,,400 with stops set below $$116,,000 or short positions if they drop below$$115,,100 targeting around$$114,,,600 area ; given narrow profit margins tight stop-losses are recommended . In summary execution tactics remain critical until clear movements breach established ranges.

BTC/USD One-Hour Chart via Bitstamp on September 14th ,2025.

The oscillators present mixed signals overall leaning towards non-confirmation: RSI sits neutral at reading58; stochastic indicator shows bearishness registering91 ; commodity channel index (CCI) reads156 indicating bearishness too ; average directional index(ADX )is17 reflecting neutrality whilst awesome oscillator stands positive reaching1327 . Despite these softer notes momentum remains robust sitting positive at5082 alongside moving average convergence/divergence(MACD )level being386 also indicating positivity.

Moving averages display uniformly supportive trends across all metrics examined including exponential moving average(EMA)(10)at$$113,,,994 simple moving average(SMA)(10)at$$113,,,308 EMA(20 )at$$113,,,305 SMA(20 )at$$111,,,858 EMA(30 )at$$113,,,381 SMA (30)around112796 EMA50@111243 SMA50@114503 EMA200 @105193andSMA200 @102508 demonstrating bullish designations throughout.This broad spectrum support contrasts sharply against heavy resistances hovering near$$(16),00;if volumes continue remaining weak then ranging actions or minor retracements could materialize without significant bearish reversals detected yet!

Bullish Outlook:

Bitcoin maintains its position above essential moving averages across major timeframes showcasing structural integrity conducive towards longer-term upward trends.If buyers manage reclaiming sustained hold past$$(17),00with conviction pathways will open up leading further toward new all-time highs!The breadth provided through various bullish-moving averages implies dips into supportive zones represent opportunities rather than threats!

Bearish Outlook:

Despite underlying trend strength pricing presses firmly against thick bands situated closely around$$(16),00while fading momentum coupled mixed oscillator signals creates cautionary signs.A rejection occurring here particularly if volumes fail expanding might prompt pullbacks targeting closer regions like$$(13),00or even further down towards.$$12.,00short term.Traders must remain vigilant regarding overextensions since bearish divergences still have potential asserting themselves!