Bitcoin is making strides beyond $115,000 as it seeks to rebound from its recent downturn. The leading cryptocurrency is currently evaluating this threshold as a support level while attempting to escape a two-month downward trajectory.

Encouraging on-chain indicators suggest that sellers may be losing steam, potentially paving the way for further upward movement.

Signs of Bitcoin’s Potential Rebound

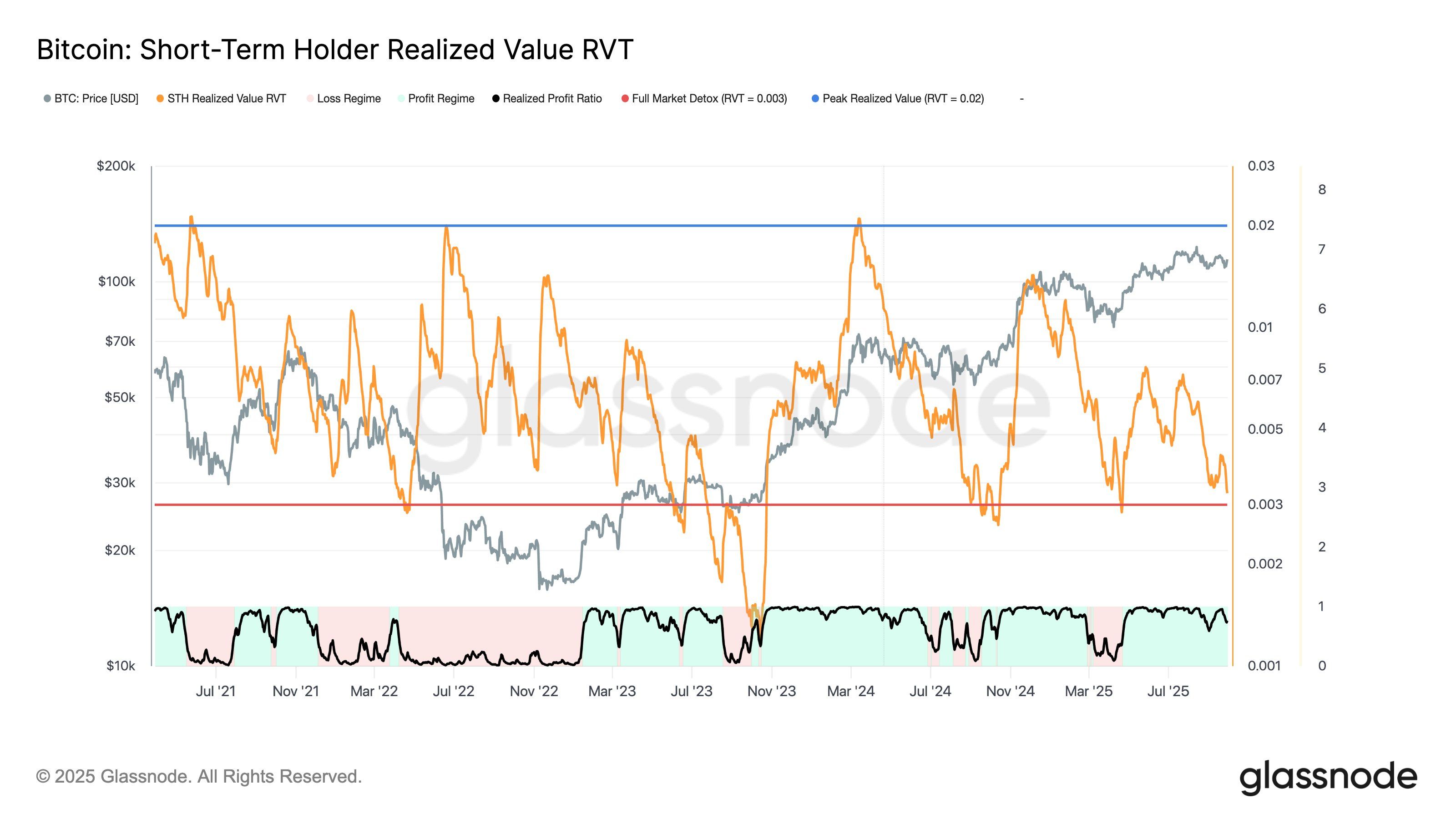

The Short-Term Holder Realized Value to Transaction Volume (STH RVT) ratio has contracted towards cyclical lows. This indicates that realized profits are subdued relative to Bitcoin’s network value. Historically, such resets occur during market cleansing phases, setting the stage for more sustainable price recoveries.

This trend implies a cooling off in investor activity and less speculative trading fervor. When realized profits decline, it often suggests market participants are waiting for better conditions.

Interested in more insights like these? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin STH RVT. Source: Glassnode

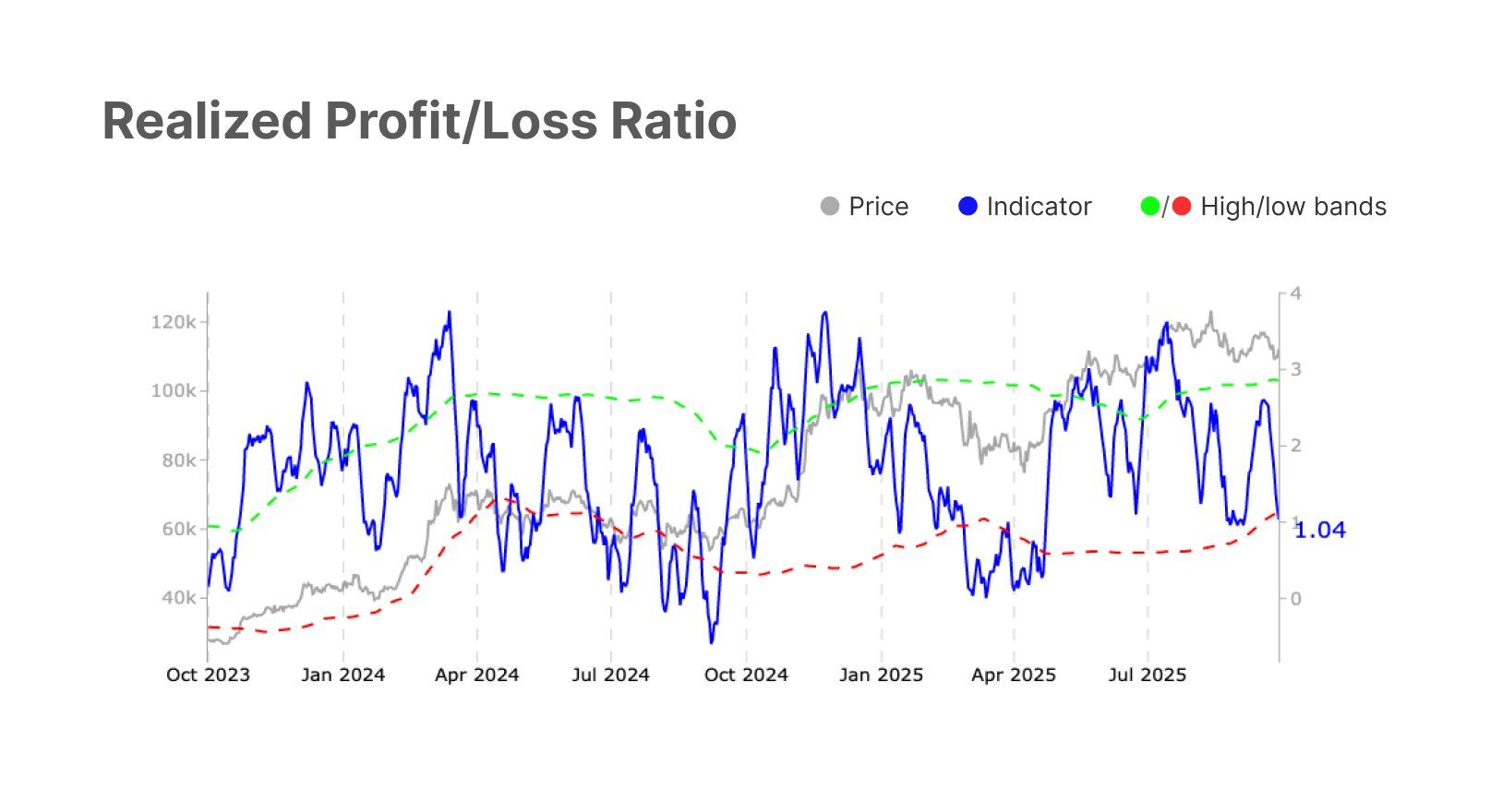

Larger macro signals also support this perspective. Data from Glassnode reveals that the Realized Profit/Loss Ratio has decreased from 2.2 to 1.0, hitting its lower boundary. This shift aligns with the RVT reset and indicates an equilibrium between realized gains and losses in Bitcoin’s current trading scenario.

This balance suggests Bitcoin might be entering a neutral phase where selling pressure diminishes and buyers start gaining influence again over the market dynamics.

Bitcoin Realized Profit/Loss Ratio Source: Glassnode

A Possible Breakout for BTC Price

Currently priced at $115,151, Bitcoin aims to establish $115,000 as new support while trying to overcome a two-month downtrend limiting its ascent since midsummer.

If conditions improve favorably, Bitcoin could surge past $116,096 towards $117,261 or even reach up toward $120k—a development likely boosting confidence among traders anticipating further appreciation of this digital asset giant’s value proposition within financial markets globally .

BTC Price Analysis.Source :TradingView

However , failing hold present levels would negate bullish outlook causing potential retreat back downwards either around $112500 possibly even lower nearing $110k thus prolonging bearish sentiment negatively impacting world largest crypto currency overall perception stability reliability amidst investors community worldwide.

The post “Bitcoin price rise expected hit $120 k soon amid seller exhaustion fueling optimism appeared first BeInCrypto”.