A recent technical evaluation indicates that Bitcoin has revisited its “Crash Line,” sparking discussions about a potential bullish reversal. The analyst responsible for this insight believes that this occurrence is not coincidental but rather a strategic movement that may herald the onset of Bitcoin’s next upward trajectory.

Bitcoin Price Returns to Notable Crash Line

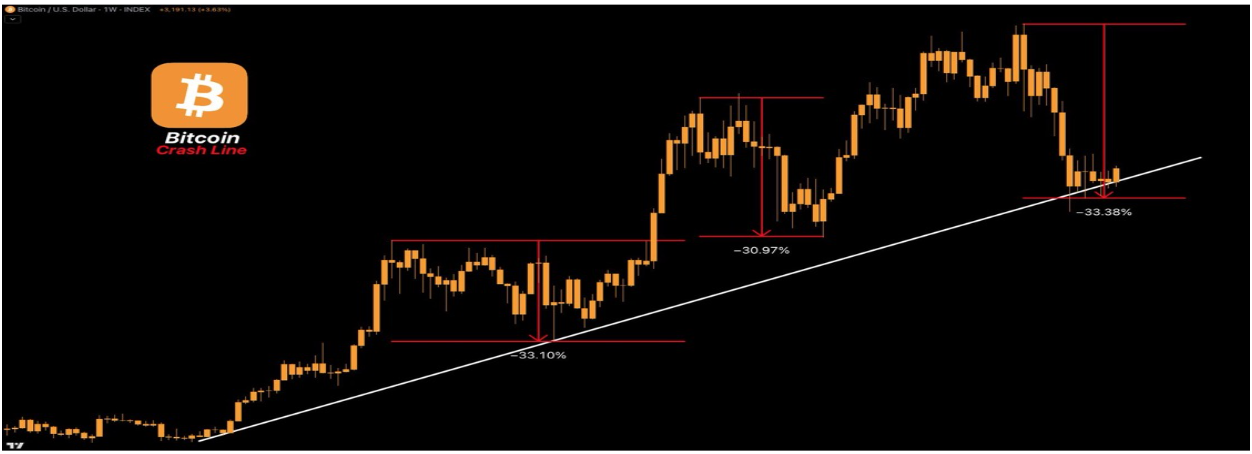

In a recent update on X, market analyst Crypto Tice revealed that Bitcoin has once again reached the Crash Line, which has historically served as an essential reload point during the ongoing bull cycle. This trendline has been associated with significant price surges for BTC in the past. Crypto Tice pointed out that throughout this bull market, Bitcoin tends to follow a consistent pattern whenever it approaches the Crash Line.

The cycle begins with an overheating momentum phase where buyers rapidly drive prices up, creating unsustainable upward pressure. As this momentum intensifies, excessive leverage builds within the market until it culminates in a sharp correction. This downturn typically brings Bitcoin back down to its Crash Line before initiating another growth phase.

Crypto Tice provided a weekly chart showcasing this recurring pattern. Historically, each time Bitcoin neared the Crash Line, it experienced corrections of approximately 33.10% and 30.97%, followed by swift rebounds higher. Given that Bitcoin recently dropped by 33.38% and returned to its Crash Line level, he suggested it might replicate past trends and initiate another substantial rally.

Additionally, Crypto Tice emphasized that the Crash Line consistently signifies moments of leverage liquidation and exhaustion of selling pressure while also marking zones for trend continuation in Bitcoin’s price action. Instead of indicating structural weakness within BTC’s framework, he argued that this trendline serves as a pivotal transition area; if overall conditions remain stable, it could signify where Bitcoin’s next upward move begins.

Analyst Forecasts Potential Future Movements for Bitcoin

In another post on X platform, expert Crypto King stated that currently there exists “no trading zone” for Bitcoin—implying an absence of clear direction despite its recent recovery above $90K mark.The analyst further noted diminishing liquidity and participation levels in BTC markets as prices fluctuate sideways; thus increasing risks associated with false breakouts or movements.

This situation led Crypto King to propose two possible scenarios regarding future price actions for cryptocurrency: If BTC can surpass $92K convincingly and maintain above it thereafter, he anticipates transitioning from resistance into support at said level.

If however prices fail reclaiming $92K threshold, predictions indicate potential declines ahead wherein testing Chicago Mercantile Exchange (CME) gap around $88K becomes likely.The expert highlighted two key demand zones illustrated on his chart:

– One near CME gap

– Another lower range between $60K-$50K.

,