Bitcoin is facing ongoing challenges following a significant liquidation event that occurred earlier this month. The enthusiasm in the market has diminished, and BTC is currently stabilizing around $111,000 as traders exercise caution.

Technical Overview

By Shayan

Daily Chart Analysis

The daily chart indicates that BTC is positioned just above crucial support at approximately $110,000, which aligns with the important 200-day moving average. This moving average now serves as resistance above the current price level near $116,000.

The region around $110,000 remains vital; a decisive drop below this level could lead to a decline towards $101,000 and the lower edge of a significant descending channel. Meanwhile, an RSI reading of about 42 suggests neutral momentum in the market—indicating indecision among both buyers and sellers. Unless Bitcoin can reclaim the $116,000 mark with substantial trading volume, its broader upward trend risks losing its mid-term stability.

4-Hour Chart Insights

The 4-hour chart reveals tight consolidation occurring between $110,000 and $116,000 following a strong downward movement. The demand zone at around $110,000 continues to hold firm; however, repeated tests have started to erode its reliability.

The resistance level remains at approximately $116,000—a barrier that has thwarted all recovery efforts over recent days. Additionally, an RSI hovering near 40 indicates balance on this timeframe; yet the absence of momentum implies that if sellers regain dominance in the market soon enough it could result in further declines.

Market Sentiment Analysis

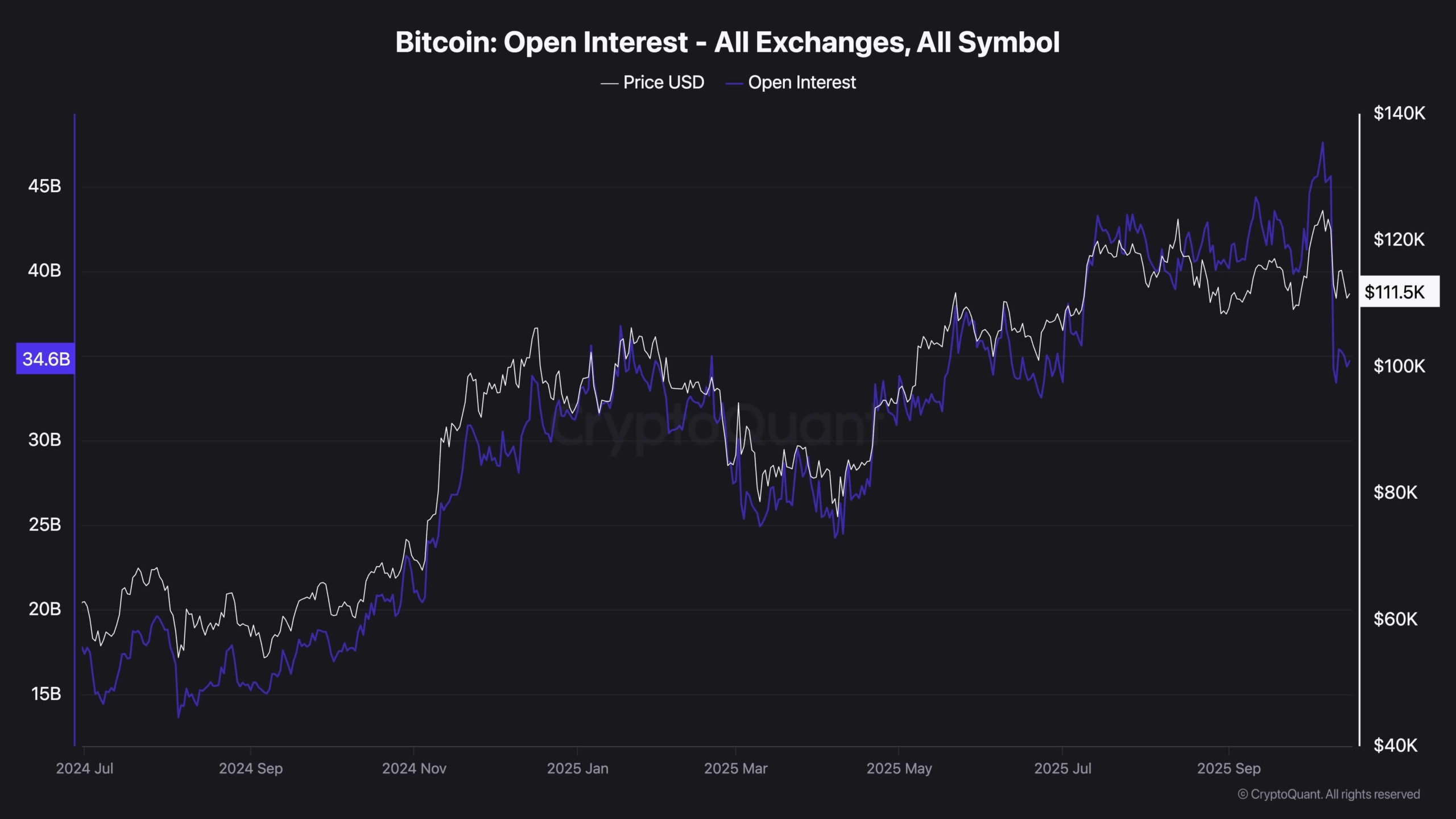

Status of Futures Open Interest

A notable decrease in open interest across various exchanges has been observed following recent sell-offs—signifying a clear downturn in speculative activity within the market. Traders are now more hesitant to take aggressive positions after experiencing liquidations during previous downward movements.

This reduction in leverage indicates that while there may be some resetting occurring within the market dynamics—it also reflects uncertainty regarding any robust bullish trends emerging shortly. Investor sentiment appears fragile as fear dominates over greed; many participants are opting to wait for stronger signals before considering re-entering long positions again.