Bitcoin (BTC) is currently undergoing a crucial phase of consolidation after experiencing significant volatility at the beginning of February 2026. Following its record peak near $126,100 in late 2025, the leading cryptocurrency encountered a steep correction that pushed its value down toward the $60,000 support level earlier this month. As of February 21, 2026, Bitcoin appears to be recovering and is trading close to $68,162. Many investors are now questioning whether this momentum will be strong enough to push Bitcoin’s price beyond the key psychological barrier of $70,000.

Can Bitcoin Surpass the $70,000 Mark?

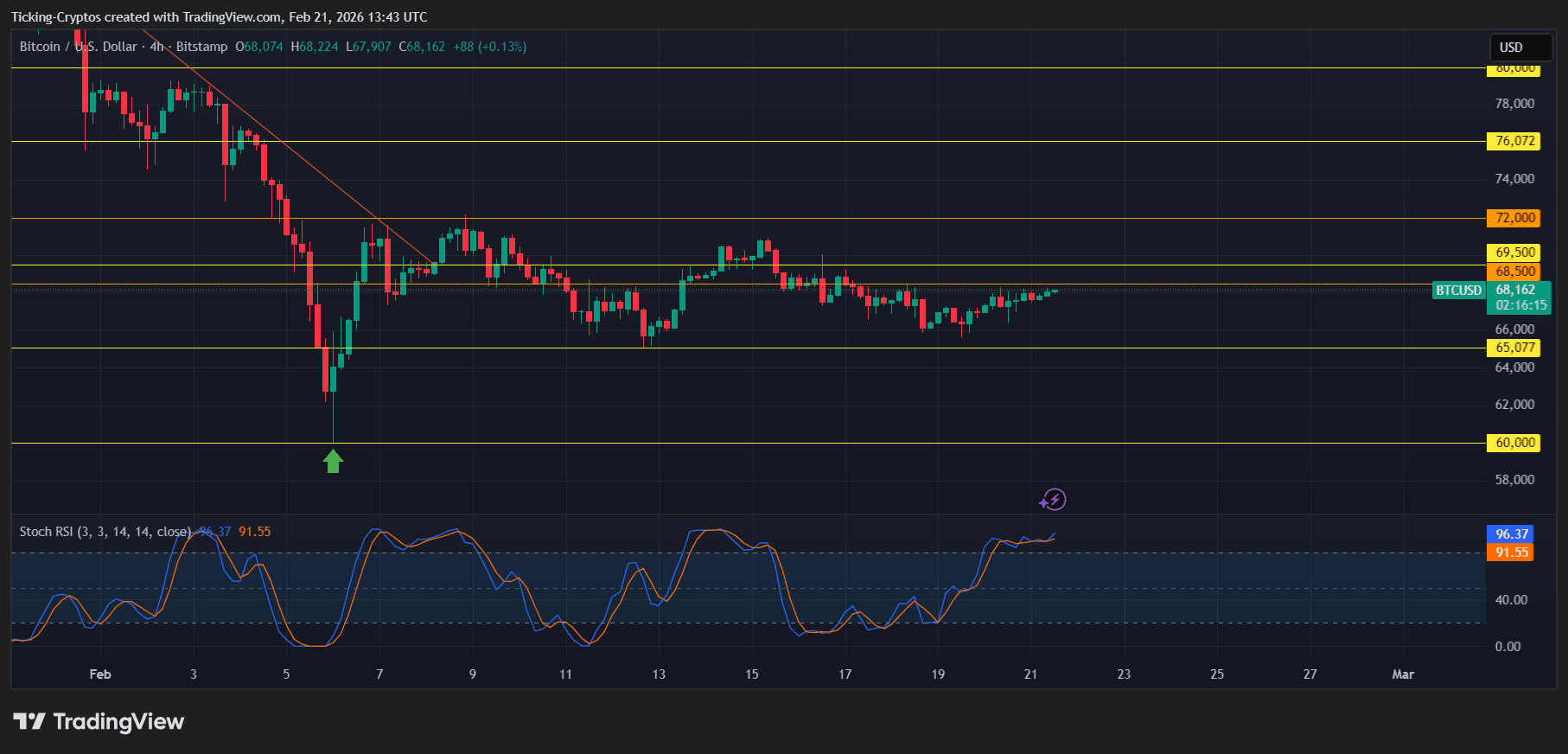

The current technical indicators reveal that Bitcoin is confronting a major resistance zone overhead. Recent price movements indicate that the range between $70,000 and $71,000 has served as a formidable obstacle for bullish traders. Nevertheless, with the Stochastic RSI signaling a bullish crossover in oversold territory and prices holding steady above support at around $65,000, reaching toward $70K remains an achievable short-term goal. A decisive break above approximately $68,500 would be necessary to set this upward move in motion.

Bitcoin Price Insights: Analysis on the Four-Hour Chart

The four-hour timeframe highlights several critical levels that market participants should watch closely:

Key Resistance and Support Zones

Immediate Resistance: The first challenge stands at roughly $68,500 followed by another resistance near $69,500.

$70K Threshold: This psychological milestone also corresponds with previous rejection points observed during mid-February trading sessions.

Crumbling Support: On the downside side lies crucial support around $65,077; falling below this could trigger renewed testing of psychological floor levels near $60K.

Momentum Signals

The Stochastic RSI (parameters: 3, 3, 14, 14) is trending upwards close to values around 96.37, indicating robust buying pressure. However, such elevated readings often suggest overbought conditions on shorter timeframes which might lead to brief pauses or sideways movement before any further gains occur.

Bigger Picture: Market Sentiment &

This month’s crypto environment has been characterized by mixed emotions ranging from “Extreme Fear” to cautious optimism. Data from Santiment reveals diminished retail frenzy and meme-driven hype like “Lambo” jokes have largely faded — something contrarian analysts interpret as groundwork for establishing sustainable market bottoms.

| Indicator | Current Status | Market Implication |

|---|---|---|

| Fear &; Greed Index | 14 (Extreme Fear) | Historical Buy Signal |

| Institutional Flows | Positive (Europe ETFs) | Long-Term Support |

| Federal Reserve | Hawkish Tone | Pressure on Risk Assets |

<h2> ;What Lies Ahead for BTC Price?</ h2> ;

<p> ;For traders navigating today&s acuteacuteacuteacuteacuteacute acute volatility,&s acute comparing exchanges carefully can help minimize slippage during rapid moves.</ p> ;

<p> ;Bullish Outlook:<br /> ;

Closing daily candles above approximately €9949,ヨ,�-�-#fffd;-#fffd;-#fffd;, #39;, '', ''', #69 , , , ,#,##,$,#,#,#,$,#,$,,##$#$#$##$$$, $$$$$$$$$$$$$$$$$$#$###$$### $$#### ### $$ ### ## #### ## #### ## #### ## ### ##### ####### ##### ##### ######## ######### ######## ########### ######################## ############################# ############################## ######################################## ###################################### ##################################### ###########################################################################################################################################################################

Upward momentum may accelerate sharply towards roughly €$72,". The milestone mark would then be reclaimed strongly.</ p> ;

<p> ;Bearish Outlook:<br /> ;

Failure to surpass about €$68,". could create double top formations visible on shorter charts which may prompt retracement back into lower zones between approximately €$64,-65k.</ p> ;

<p→u0027Regardless of direction trends,u0027 itu0027s wise to store your holdings securely using hardware wallets amid ongoing macroeconomic uncertainties.</ p> ;

<h2→u0027Summary: Approaching The Crucial $70k Levelu0027

<p→u0027Bitcoin presently adopts wait-and-watch behavior as technical signals hint bullish recovery off lows nearing $64k while facing stiff resistance just under $70k . If sentiment shifts positively soon , late February might witness BTC firmly positioned within ranges spanning roughly $70,–$75 thousand .u2019’;'</P