As of Thursday morning, Bitcoin’s value stands at $89,764, boasting a market capitalization of $1.79 trillion and a trading volume over the past 24 hours that nearly reached $47.55 billion. The cryptocurrency has navigated through a price range between $89,774 and $92,125 in the last day, testing both traders’ patience and possibly their caffeine limits.

Bitcoin Price Analysis

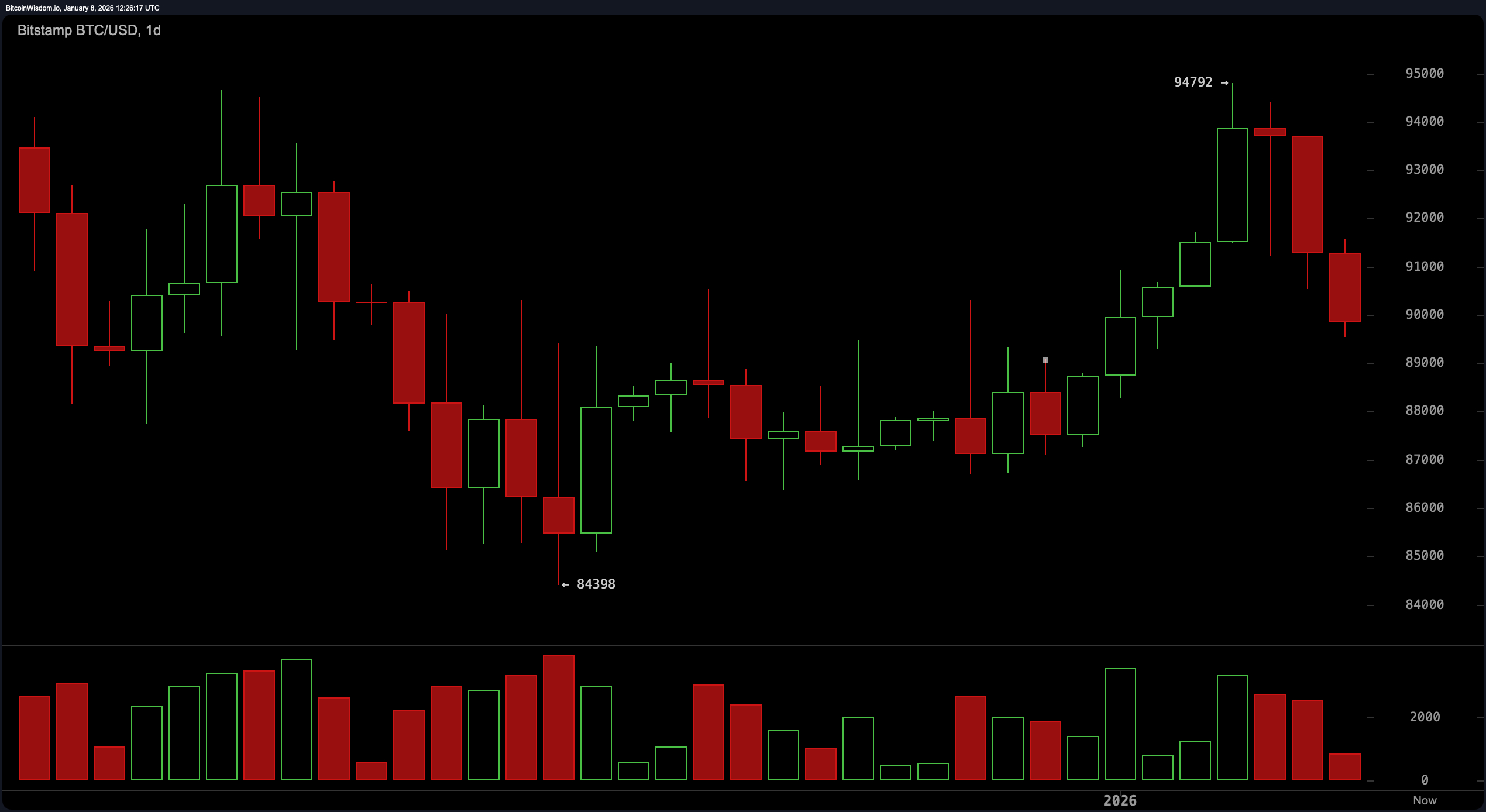

The daily chart reveals that Bitcoin is experiencing a post-rally hangover after surging to an impressive high of $94,792 but now faces significant resistance at this level. The psychological threshold of $90,000 is being approached yet remains unclaimed with conviction. With bearish candles stacking up like Jenga blocks and increasing volume during pullbacks indicating unease among traders.

If Bitcoin fails to reclaim the pivotal level of $90,000 soon enough, it may find itself heading down towards support levels around $87,000 or even as low as $84,400—previously identified as strong support zones. Currently trending downward into bearish territory leaves optimism waiting for clearer signs of reversal.

BTC/USD 1-day chart via Bitstamp on Jan. 8, 2026.

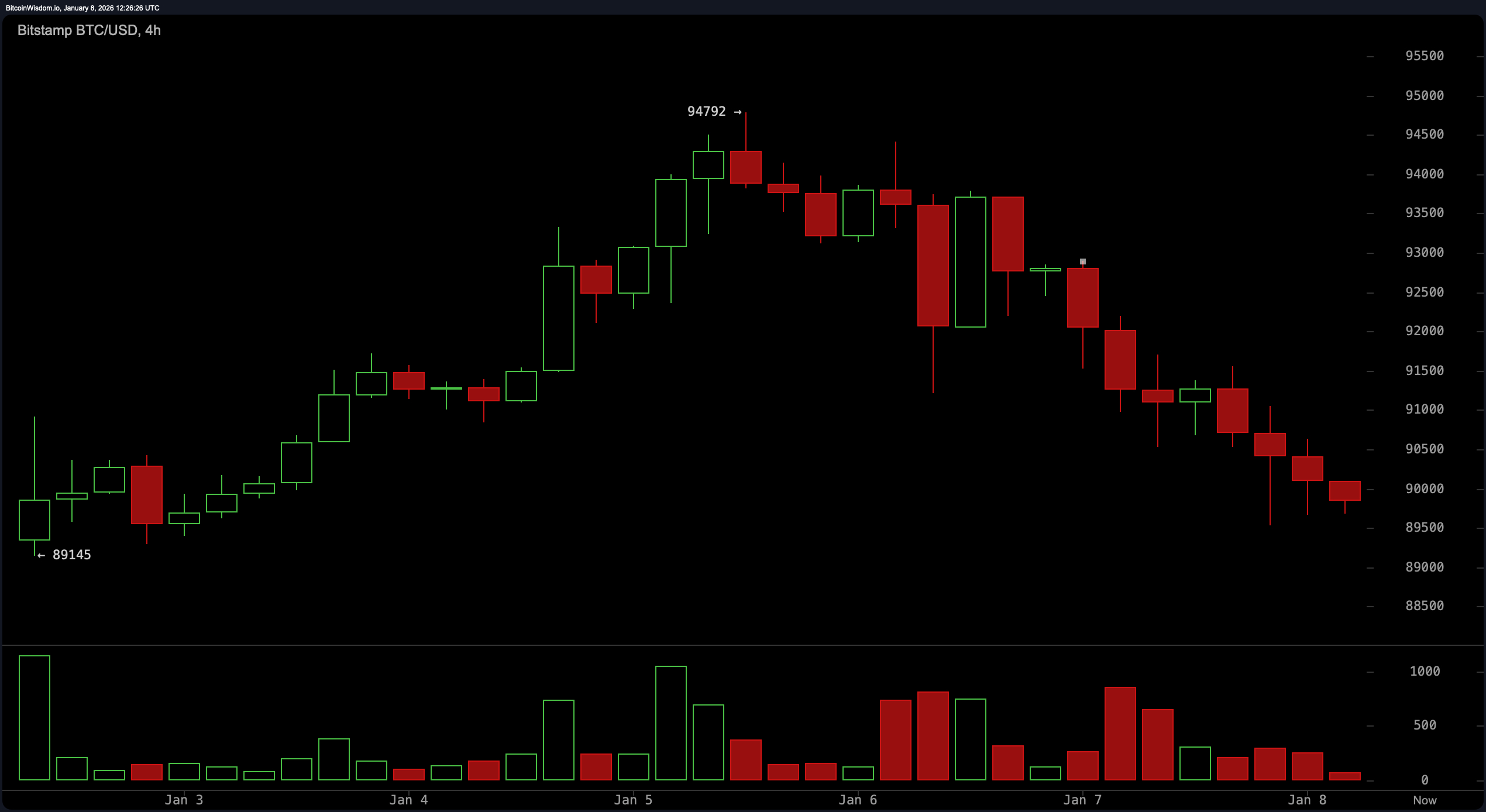

The analysis from the four-hour chart suggests distribution following the euphoric highs experienced earlier on January 6 when prices peaked near $94,792—a ceiling that turned out to be more like a trapdoor than anything else. Since then momentum has sharply declined with little evidence supporting bullish sentiment; candlestick patterns lack decisiveness while accompanying volumes indicate sellers dominate the narrative currently unfolding in this price range between approximately $89K and $90K—any close below could trigger declines toward $84K.

BTC/USD 4-hour chart via Bitstamp on Jan. 8,2026.

Diving deeper into hourly charts doesn’t present much improvement either—the microstructure continues reflecting downward trends with recent lows recorded around $89k indicating how precariously close Bitcoin is to its current support levels without any credible buying pressure emerging thus far; no notable bullish engulfing patterns or significant upticks have been observed—all attempts at reversal appear weak and indecisive rather than forceful or convincing enough for sustainable upward movement against prevailing currents unless there’s strength breaking above $91k soon enough which would signal caution instead!

BTC/USD 1-hour chart via Bitstamp on Jan。八,2026。

Across various oscillators currently analyzing market conditions show mixed signals—a relative strength index (RSI) resting at fifty while stochastic oscillator shows sixty-one alongside commodity channel index (CCI) sitting near forty-nine—all hovering right around neutral territory without clear directionality indicated here! Meanwhile average directional index (ADX) measuring twenty-four adds little confidence suggesting weak trend overall although momentum indicators hint downside pressures exist too while moving average convergence divergence (MACD) stands out amongst them offering slight glimmers optimism perhaps? But given lack follow-through from either volume structure could mean such positivity remains fleeting!

Moving averages tell another story altogether—and it’s not one likely worth celebrating! All exponential moving averages spanning ten through two hundred periods hover above current pricing signaling overhead pressure looming large! Only simple moving averages across twenty-thirty periods provide minor relief suggesting potential short-term cushions might arise however given towering presence two-hundred period SMA positioned way up high at one hundred six thousand four hundred eighty-nine dollars makes any immediate upside aspirations seem quite premature indeed until we see definitive bullish structures materialize signifying serious intent before traders should stay vigilant—perhaps keeping champagne corked for now!

Bullish Perspective:

If Bitcoin manages not only to reclaim but also hold onto that critical ninety-thousand dollar mark backed by substantial volumes coupled with robust reversal candlesticks—ideally something resilient like hammers—it could signify possible short-term bottoms forming here combined alongside shifts within momentum indicators plus cooperative MACDs allowing bulls potentially wrestle back control aiming climbs toward ninety-one thousand five hundred dollars even retesting previous highs nearing ninety-four thousand eight hundred again—but presently hope feels speculative confirmation essential first!

Bearish Perspective:

A sea filled red colors lower timeframes glaringly illustrates buyer conviction lacking significantly whilst stacked resistances formed by moving averages resemble fortresses firmly placing bears still very much in charge overall should bitcoin close beneath eighty-nine thousand five hundred accompanied by notable volumes chances rise straight towards seventy-eight-seventy-seven supports remaining intact until structures sentiments flip decisively otherwise least resistant paths remain skewed downward continuously ahead.

Frequently Asked Questions ❓

What is bitcoin’s price today? As per January eighth two thousand twenty-six data points reflect trading activity showing bitcoin priced approximately eighty-nine thousand seven hundred sixty-four dollars today.

What is bitcoin’s current market cap?The latest estimates suggest total market capitalization standing tall around one point seventy-nine trillion dollars presently attributed solely bitcoins alone

What is bitcoin’s trading volume over last twenty-four hours?This figure showcases roughly forty-seven point fifty-five billion dollar transactions occurring within preceding day cycle pertaining bitcoins traded actively throughout those intervals

Is there indication suggesting downtrend exists surrounding bitcoins performance lately? Certain technical indicators derived from hourly four-hour analyses illustrate prevalent short-term bearish momentum affecting valuations consistently noted recently too?