Bitcoin Price Analysis: Resistance Flip and False Breakouts

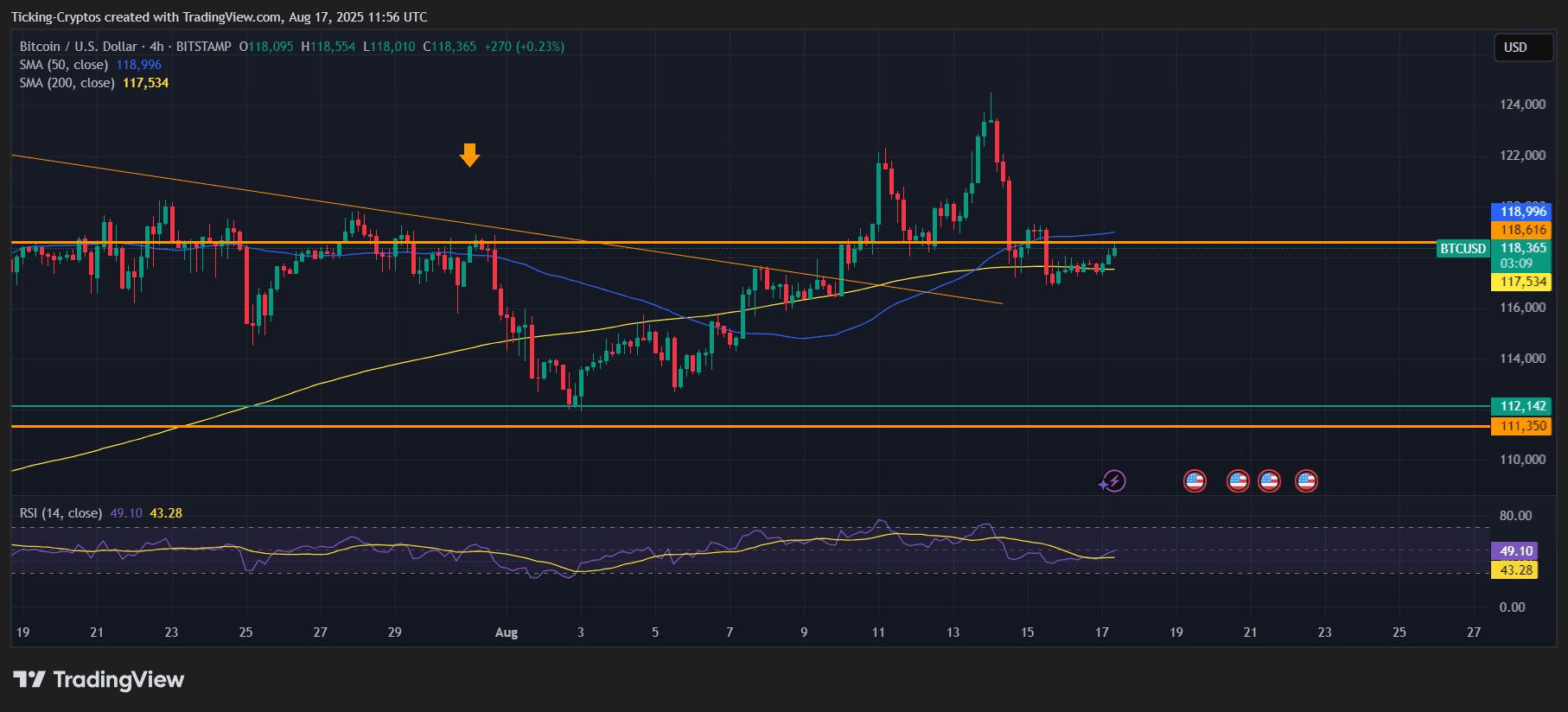

Looking back at Bitcoin’s recent 4H chart, we see how $BTC repeatedly tested the $118,500 – $119,000 zone as a critical resistance area. Each rejection in late July and early August (highlighted by the orange trendline) reinforced this ceiling. A mid-August rally briefly pushed BTC above $120K, but that move quickly reversed, showing a false breakout before price slid back toward support.

BTC/USD 4-hours chart – TradingView

Throughout these swings, the 200 SMA (117,534) provided strong dynamic support. Meanwhile, the 50 SMA (118,996) acted as a near-term ceiling, aligning closely with the same resistance band that BTC has been struggling to overcome.

Today’s Price Action: Sideways But Holding Strong

As of today, $Bitcoin is trading around $118,365, showing resilience above the 200 SMA and consolidating below the 50 SMA. RSI (49.10) sits near neutral, signaling indecision and low momentum in either direction.

Key levels to watch:

Support: $117,500 (200 SMA) and $116,000–$115,000 range.

Major Support: $112,142 and $111,350 if BTC breaks down sharply.

Resistance: $118,600–$119,000 zone, followed by $120,000+.

This consolidation suggests BTC is gathering momentum for its next breakout attempt.

Bitcoin Price Prediction: Breakout or Breakdown?

If Bitcoin closes decisively above $119K–$120K, we could see a swift move toward $122K+, as trapped shorts fuel momentum. On the flip side, if BTC fails to reclaim $118,996 (50 SMA) soon, a retest of $117.5K is likely, with risk of deeper correction toward $114K–$112K.

Given the tightening range, volatility is expected to return within days. Traders should prepare for either a breakout continuation or a support breakdown.

How To Trade Bitcoin Today

Bullish Entry: Consider long positions above $119,000, targeting $121K–$122K, with a stop near $117.5K.

Bearish Entry: Short entries may be considered if BTC fails at $118,600–$119,000, aiming for $115K–$116K, with stops above $120K.

Neutral Players: Stay patient and wait for a confirmed breakout of the range.

Risk management remains crucial given the narrowing structure.