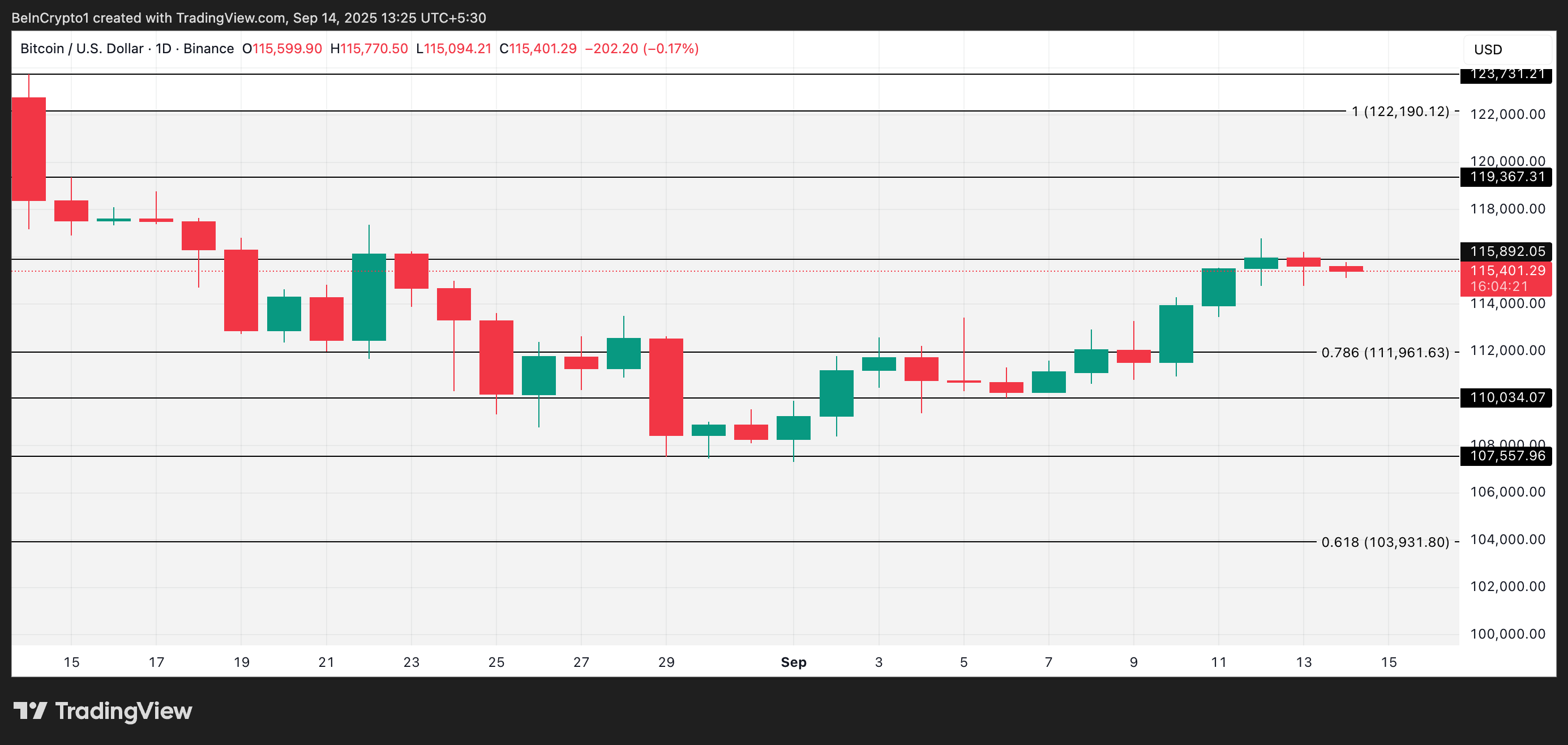

The prominent cryptocurrency Bitcoin is currently trading just below a significant resistance level of $115,892, following two unsuccessful attempts to break through this barrier in recent sessions. This stagnation in price movement indicates that a phase of consolidation may be underway.

Nonetheless, on-chain metrics continue to exhibit signs of increasing bullish momentum, suggesting that a more substantial rally could be imminent.

Bitcoin Faces Resistance Yet Wallet Growth and Profitability Inspire Hope

Analysis from the BTC/USD daily chart reveals Bitcoin’s difficulty in achieving a conclusive close above $115,892 during the last two trading days; this threshold now acts as an obstacle for upward movement.

Interestingly, despite this temporary pause, on-chain statistics indicate that market strength is still developing.

As reported by Glassnode, the number of Bitcoin addresses with non-zero balances has surged to its highest point so far this year. Currently, there are 54.37 million active wallet addresses holding BTC.

If you’re interested in token technical analysis and market updates: Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter for more insights like these!

A wallet with a non-zero balance refers to any Bitcoin address containing at least some amount of BTC—indicating active engagement within the network.

An increase in such wallets signifies growing interest from both retail and institutional investors along with deeper adoption within the network. This trend could potentially support an uptick in BTC prices soon.

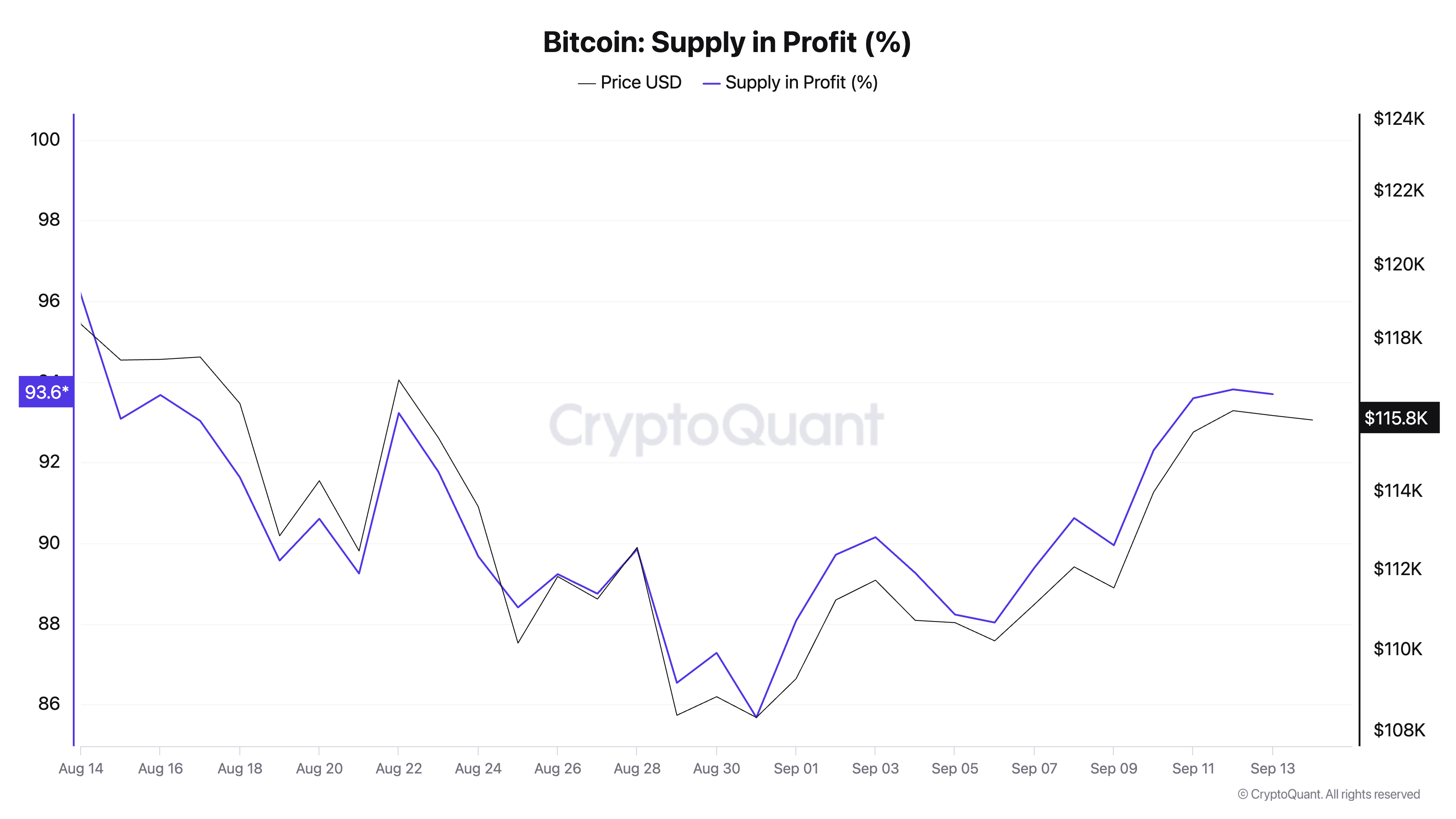

Additionally reinforcing the optimistic outlook is data from CryptoQuant showing that 93.6% of Bitcoin’s circulating supply is currently profitable—a pattern historically associated with robust bullish trends.

A recent report by pseudonymous analyst Crypto Avails from CryptoQuant noted that the long-term average for profitability typically hovers around 75%, indicating that current levels are significantly elevated compared to historical norms.

The analyst emphasized that at 93.6%, this trend reflects strong optimism and sustained momentum within the market.

“The market clearly exhibits bullish characteristics. While it might concern those thinking ‘everyone’s making profits; it’s time to exit,’ I view it positively—it keeps excitement alive,” stated Crypto Avails.

A Break Above $115,892 Could Lead To $122,000

With on-chain activity intensifying and profitability reaching levels often preceding rallies, Bitcoin appears poised for another ascent.

A decisive breakthrough past the resistance at $115,892 could initiate a surge towards $119,367; if buying pressure increases here,

BTC might extend its gains further toward approximately $122,190.

However,

should bearish sentiment prevail,

Bitcoin may continue its sideways trajectory or even decline towards around $111 ,961 .

This article titled “Bitcoin Stalls at $115 ,000 , But On-Chain Activity Says ‘Not For Long'” originally appeared on BeInCrypto .