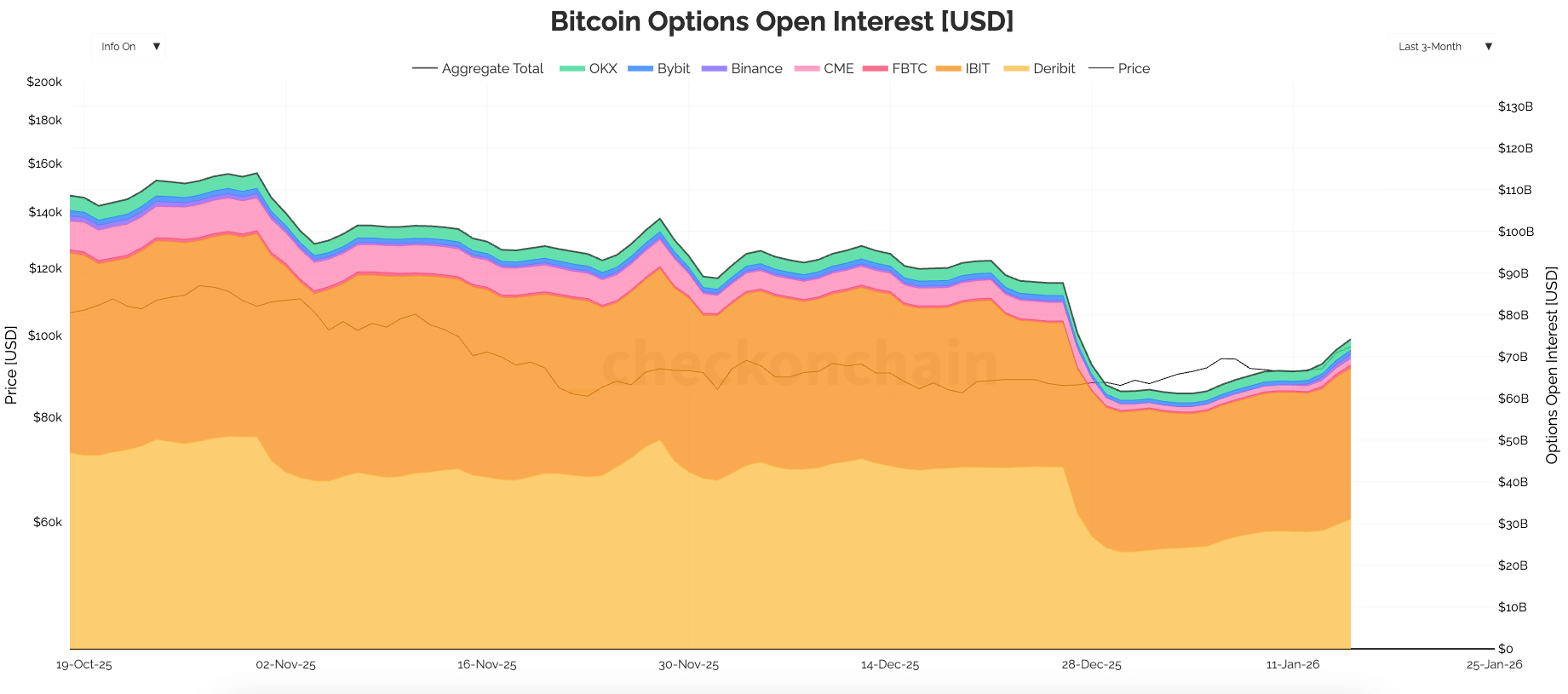

By mid-January, the open interest in Bitcoin options climbed to approximately $74.1 billion, surpassing the open interest in Bitcoin futures, which stood near $65.22 billion.

Open interest represents the total number of outstanding contracts that remain active and have neither been closed nor expired. It reflects the inventory of positions rather than actual trading volume. When options open interest exceeds that of futures, it often indicates a market leaning more towards structured exposure—such as hedging strategies, yield enhancements, and volatility plays—instead of straightforward directional bets.

While futures offer a direct and simple method for gaining leveraged exposure to Bitcoin’s price movements, options provide traders and institutions with sophisticated tools to tailor risk profiles precisely. Options allow participants to limit potential losses, profit from upward moves selectively, or target specific volatility scenarios through customized payoff structures.

This distinction is crucial because option positions tend to persist longer than futures contracts on average. Their longevity can significantly influence how volatility behaves around critical strike prices, expiration dates, and liquidity periods. The fact that options’ open interest has overtaken futures marks an important milestone with significant implications for daily Bitcoin trading dynamics.

Reasons Why Options Open Interest Can Surpass Futures

Futures are designed primarily for direct market exposure and rapid position adjustments. Traders post margin collateral to buy or sell contracts linked directly to Bitcoin’s price while managing funding costs, basis differences between spot and future prices, as well as liquidation risks amplified by leverage.

The scale of futures positions can expand swiftly but remains highly sensitive to carrying costs such as funding rates; when these become unfavorable or basis trades lose profitability, traders quickly reduce their holdings. During broad deleveraging phases triggered by market stress or shifts in sentiment,futures open interest tends to decline rapidly as fast-moving traders exit riskier bets while slower participants get forced out due to margin calls.

In contrast,opt ions typically serve more complex roles beyond pure leverage—they are often components within longer-term strategic structures like hedges or systematic income programs targeting yield generation or volatility management over weeks or months rather than days.

Calls (buy rights)and puts (sell rights) enable defined payoff profiles reflecting specific views on price direction,

while combinations such as spreads,collars,and covered calls transform raw spot exposure into controlled-risk portfolios.

This leads option inventories becoming “sticky,” persisting until predetermined expirations arrive instead of being frequently adjusted like many futures positions.

The calendar confirms this behavior: data from Checkonchain reveals a pronounced drop in options open interest toward late December followed by steady rebuilding through early January—consistent with major expiry events clearing old risk before new cycles begin accumulating fresh exposures again.

The same timeframe shows steadier growth patterns for futures open interest without sharp mechanical resets tied strictlyto expirations.This difference explains why even amid volatile price actionand mixed conviction levelsoptions can still outpacefuturesin terms ofin terest size .

As optionopeninterest expands,the roleofmarketmakers intensifies.Dealers facilitatingoption tradesoften hedge theirnetexposure usingspotmarketsandfuturescontracts.Thishedgingactivitycanimpactpricebehavioraroundkeystrikepricesandexpirydates.Inmarketswithheavypositioning,thishedge activitymay either moderateprice swingsor amplify themdependingonthe distributionofriskacrossstrikesandtimetomaturity .

The Divergent Ecosystem: Crypto-Native Versus Listed ETF Options Like IBIT

Bitcoinoptionsnowoperatewithinasegmentedlandscape.CheckonchaindatahighlightsthattraditionalcryptoexchangescoexistalongsidegrowinglistedETFoptionmarkets,suchasIBIT.These two segments differ substantiallyintradingrhythms,riskmanagementpractices,andstrategiesdriving demand .

Crypto-native venuestradecontinuously—includingweekends—andutilizecryptocollateral.Servingproprietarytraders,funds,andadvancedretailinvestors.ListedETFoptionsoperateonlyduringU.S.markethoursunderstandardizedclearingandsettlementframeworksfamiliar toequityoptionstraders .

This resultsina bifurcationwhereavastportionofvolatilityriskisexpressedviaregulated,onshorechannelswhileglobalBitcointradingcontinues nonstop 24/7.Market hoursalonecanreshapebehavior:US-hourconcentrationofsizableoptionflowmeanshedgingbecomesmore synchronizedduringthesewindows,butoffshorevenuesleadpricediscoveryovernightandweekends.Withtime,thiscreatesamarketthatfeelsmorelikeequities duringU.S.hoursbutretainscryptolikecharacteristicsoutside thoseperiods.Tradersmanagingmultivenuepositionsbridge gapsusingarbitrageandhedges,oftenleveragingfuturesforcross-marketexposure coordination .

Clearingrequirementsalsoplayakeyrole.ListedETFsarebackedbystandardmarginrulesandcentralizedclearing,makingthemaccessibletoinstitutionalplayersunabletoriskholdonoffshoreplatforms.Theseparticipantsbringplaybooksfromequitiesincludingcoveredcalls ,collars ,andyieldtargetingstrategies.WhenimplementedintheBitcoinspaceviatheETFoptions,thisresultsinarecurrentneedforspecifictenors,strikes,andkeepsopeninteresthighdue torepeatedprogramcycles.Crypto-nativevenuesremaindominantincontinuous tradingandspecializedvolatility/basisplays,buttheoverallmixshiftstowardsportfoliooverlaysstructuredflowsratherthanpure speculationexplainingwhyoptionsOIremainsrobustwhenfuturesexperiencefunding,basiscompression,deleveragingpressures .

The Impact Of This Shift On Volatility,Liquidity And Market Interpretation

Anincreaseinoptionsoiabovefuturesoftenmeansshort-termmarketmovementsaregovernedmorebypositiongeometryanddealerhedgingthanbyfundingsqueezesorliquidation cascades typical offuture-heavy regimes.Options-dominant markets manifest stressthroughexpiryclusters,strike concentrations,and dealer hedge flowswhichcan either muteor intensifypriceaction depending ondistributionsof exposures.Macro newseventsstillmatter,butmarket trajectoriesdepend increasinglyonwhere option risks resideandrelevant dealer responses.Large expiries bring heightened focusonspecific strikes alongside headlines.Post-expiry phasesusually involveinventoryrebuildingasparticipantsrollforwardpositions.TheDecember dipfollowedinJanuaryrebuildillustratesthis cyclical dynamic clearly.The key takeaway is derivatives positioning now strongly influences short-term pricing.Watching venue-specific options OI helps differentiate offshore crypto-driven vol strategies from US-regulated ETF overlays.Futures OI remains vital tomeasuringleverage appetitebasis trades but identical aggregate numbers may reflect vastly different underlying conditions basedonthe dominant instruments involved.Be it listed ETFs crypto native productsorfuture carry tradeswithdifferent unwindprofiles,the overall picture changes accordingly.The headline figures underscorebitcoin’s evolving market structure.Option OI at ~$74B vs.futures at ~$65B signals growing BTC risk storage inside instruments offering defined payoffs andrepeatable overlay programs whilefut urescontinue astheprimary vehiclefordirectional leverageandrisk management via delta hedging.As ETF-linked liquidity expands alongside persistent dominanceofcrypto venues,increased interactionbetweenUS hour regulated markets vs continuous global crypto liquidity will shape bitcoin’s volatilitiesignificantly.This crossover snapshot highlightsthe hybrid natureoftoday’s bitcoin derivatives landscape where positioning expiry cyclesandrisk mitigationmechanicsplayanoutsized role indriving pricemovements over time.