Analytics platform Swissblock is warning that a key metric is flashing a bearish signal for Bitcoin (BTC).

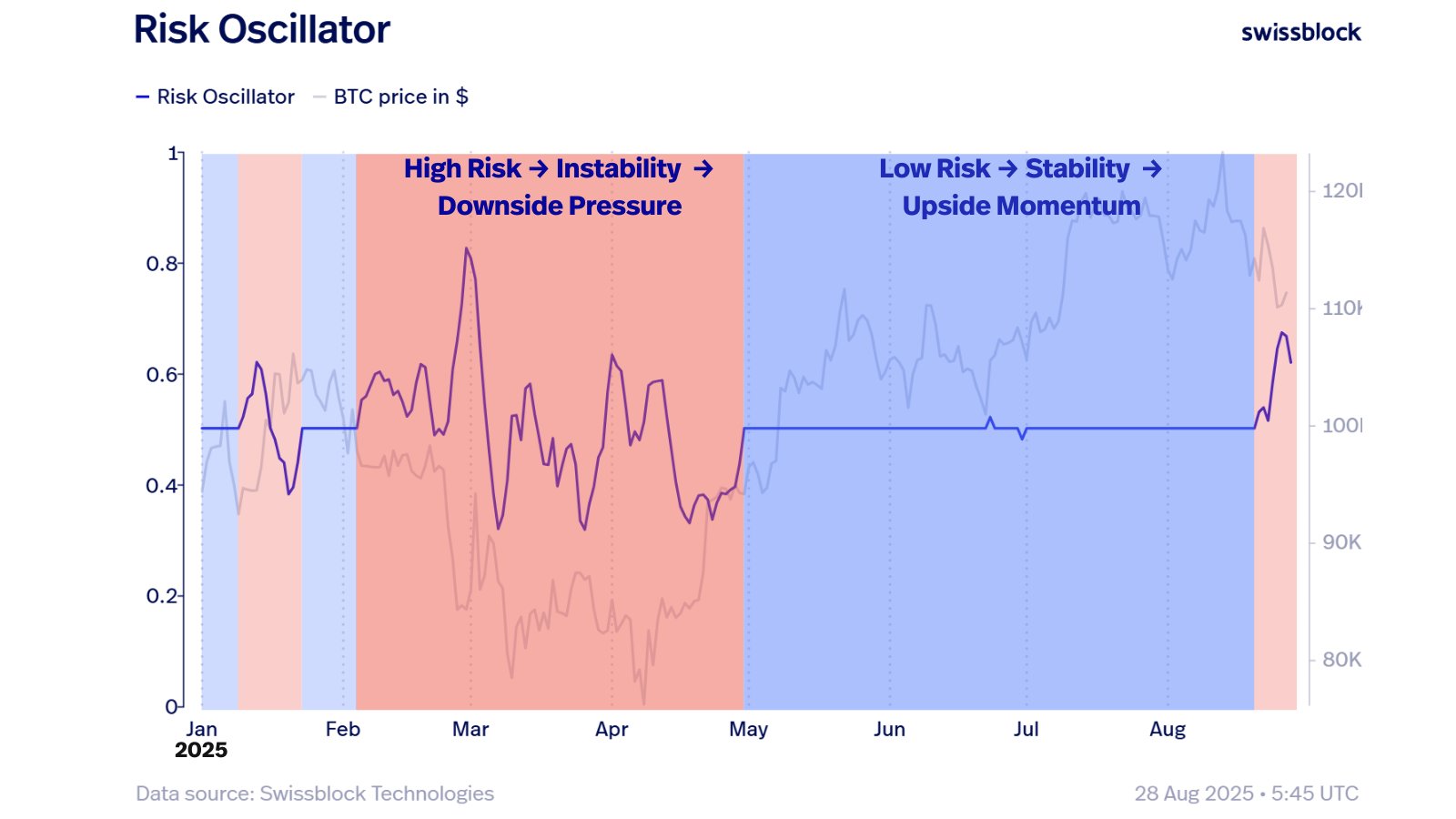

Swissblock says that its proprietary Risk Oscillator metric, which signals the direction of market sentiment using on-chain data, price behavior and other criteria, suggests Bitcoin may have already reached a cycle peak.

However, the analytics firm says that if Bitcoin can convincingly reclaim the $113,500 level as support, the risk of further downside will fade.

“Risk is showing signs of topping, price is recovering, but we’re not out of danger yet. The first step to ease pressure is price action confirming:

Reclaiming $112,000 equals initial relief signal.

Breaking $113,500 with strength equals true easing of risk.

Without these confirmations, the system remains fragile – upside capped, rallies short-lived and downside volatility still in play. If confirmed, this would be the foundation for broader recovery momentum.”

Source: Swissblock/X

According to the chart, the Swissblock Risk Oscillator suggests a higher risk market when prices may decline.

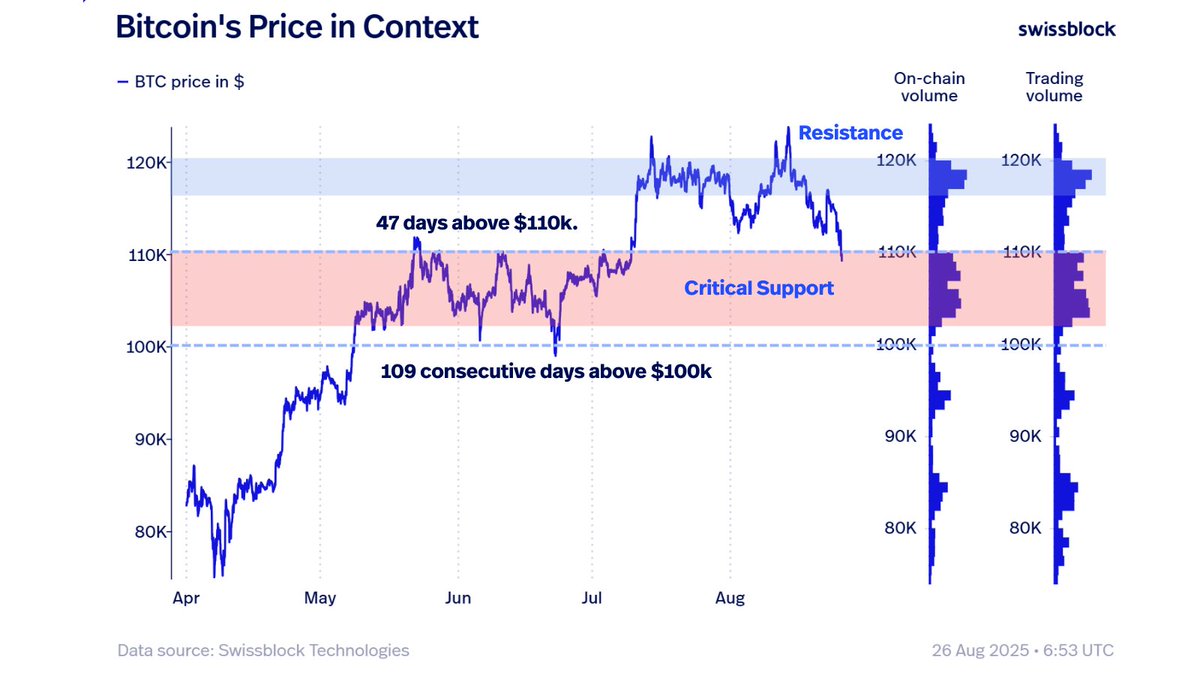

The analytics firm also says that Bitcoin needs to hold $110,000 as support to remain in a bullish trend.

“BTC is at a make-or-break level:

$110,000 equals lifeline support.

$121,000 equals ceiling to break.

In short: BTC has proven resilience above $100,000, but survival above $110,000 will decide if the trend continues bullish or tips into structural weakness.”

Source: Swissblock/X

Bitcoin is trading for $112,435 at time of writing, up marginally on the day.

Generated Image: DALLE-3