In the last 24 hours, Bitcoin positions valued at over $375 million have been liquidated, as reported by Coinglass. A staggering $100 million of this total was liquidated within just the past hour, coinciding with Bitcoin’s rise above $96,000.

Moreover, there is an estimated $1 billion in short positions that are at risk of liquidation as Bitcoin nears the $97,100 mark. According to Coinglass data, the risk of liquidation for short positions across various cryptocurrency exchanges—including Binance, OKX, and Bybit—escalates if Bitcoin continues its upward trend.

Cumulative Short Liquidation Leverage Peaks at $451.49 Million Nearing $96,202

Coinglass reports that a total of approximately $375.85 million in liquidations occurred due to Bitcoin’s price movements over the last day. The cumulative short liquidation leverage has reached a peak of around $451.49 million near the price point of $96,202. Of this amount, about 48.79 million is on Binance while OKX and Bybit hold approximately 54.47 million and 67 million respectively; further indicating that significant liquidations may take place once BTC exceeds the threshold of $97,100.

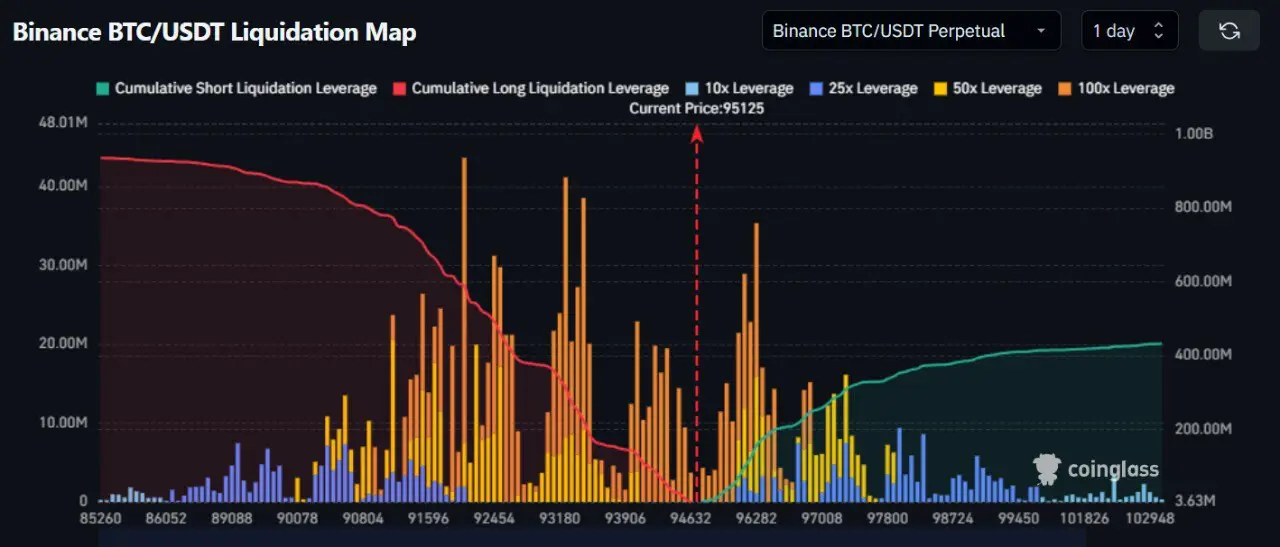

Source: Coinglass.BTC/USD Liquidation Map-Binance

A different chart from Coinglass illustrates the BTC/USDT perpetual liquidation map on Binance; it shows that cumulative short liquidation leverage stands at approximately 157.04 million when priced at around $96,282—with most traders utilizing high leverage ratios such as 100X (19.50 million) followed by those using a lower ratio like 50X (14.70 million), while only a minimal amount (1.14 million) utilized a more conservative ratio like 25X.

Institutional investors have shown renewed enthusiasm for BTC recently which contributes positively to market sentiment surrounding this cryptocurrency asset class according to SosoValue’s ETF tracking data indicating inflows into BTC ETFs totaling roughly **$753** .73million . This marks two consecutive days with positive inflows beginning January12 after experiencing withdrawals totaling **$1** .3 billion prior during four preceding days

The majority share went towards Fidelity’s FBTC which received **$351** .36million , closely followed by BlackRock’s iBIT logging inflows worth **$126** .27million ; Bitwise BITB recorded positive flows reaching **159** .42million while Ark &21Shares managed gains amounting up-to84 *.*88milliion

Additionally , Michael Saylor’s software firm has also increased its holdings in bitcoin significantly since earlier reports indicated they purchased13 ,627 bitcoins costing them around* *$1*.*25 billion leading average buying prices being setat91,*519 per coin

Currently their total bitcoin reserves standat687,*410 coins valuedapproximately66.*33billion reflecting growthof27.*78%in overall holdings makingthem undisputed leaders among corporate btc holders accordingto bitcoin treasuries data available today

Bitcoin Displays Recovery Signs Amidst Analysts’ Optimism for Higher Prices

Amidst uncertainties regarding future crypto valuations throughoutthis year,Bitcoin appears poisedfor recovery.Data sourcedfrom CoinMarketCap indicatesBTC tradingaround95,*734during publication time revealing an increaseof4 .*6%overthe past week alone.Additionally,it showcases9 .*56%growthsincebeginningofthisyear alone

Crypto analysts predict favorable performance trends forthe assetclass moving forward.A reportcompiledbyMercadoBitcoin,a Latin American exchange basedinSãoPaulo anticipatesthat substantial improvementswill be observed acrossgeneralcryptomarketby2026highlightedbyexpectations surroundingdoublingofthepricepointbeforeyearendforbtc specifically

If these predictions materialize,Bitcoin could see values rangingbetween180,*000and200,*000.The report emphasizedongoingsignificantregulatory developmentswithincryptoindustry coupledwithgrowinginterestamongregulatedprivateandpublicly listed companiesseekingexposuretowardscryptocurrencies.Accordingtoexchange estimates,Bitcoin market capitalizationcouldreach14 %oftotalgoldmarketcapoverall

Additionally,Cryptoquant analytics revealBinance’sbitcoin-to-stablecoinratiohas risenindicatingpotentialbreakout opportunities forthcomingforbtc.CryptoPolitan reportedonJanuary sixththattheratiowasstandingatone point zero signifyingstablecoinsaregaininggroundrepresentinga largerportionofBinance’stotalreservescurrentlyheld overall.