Bitcoin is currently maintaining its position around the $70,000 mark following one of the most significant sell-offs seen in this cycle, leaving investors divided on future movements.

Recent data from on-chain metrics, ETF flows, and market structure indicators present conflicting signals. This raises an important question: Is Bitcoin gearing up for another upward movement or preparing for further declines?

Persistent Selling Pressure

A notable warning sign can be observed in the disparity between Bitcoin’s market capitalization growth and its realized capitalization. This indicator remains in negative territory, which historically correlates with increased selling pressure.

When realized cap increases at a faster rate than market cap, it indicates that coins are being redistributed at lower prices rather than being driven higher by new demand.

Currently, Bitcoin is not in a pumpable state.

In 2024, an influx of $10 billion could potentially create a book value of $26 billion for $BTC. In 2025 alone, there was a flow of $308 billion into the market while the overall market cap dropped by $98 billion. The selling pressure is too substantial to allow any multiplier effect.

MSTR and DATs will remain ineffective until conditions become favorable again. pic.twitter.com/T8NZHio4H9

— Ki Young Ju (@ki_young_ju) February 9, 2026

This environment has historically made sustained price increases challenging as rallies often encounter distribution instead of continued momentum.

The current landscape suggests that structural selling pressures are outstripping demand.

Whales Actively Accumulating Bitcoin

Conversely, data regarding on-chain accumulation presents a contrasting narrative. There was a significant surge in inflows to long-term accumulation addresses during the recent downturn—marking this cycle’s largest single-day inflow.

This kind of spike typically occurs near local bottoms rather than peaks historically.

While such accumulation does not guarantee an immediate price increase, it indicates that large holders are absorbing supply instead of distributing it—which creates support levels and mitigates downside risks even amid fragile broader sentiment.

During this recent decline period, whales have been accumulating vast amounts of Bitcoin.

“On February 6th alone saw an inflow of 66.94k $BTC. This marks the highest inflow amount recorded during this cycle.” – By @CW8900 pic.twitter.com/F4YkRjTNcp

— CryptoQuant.com (@cryptoquant_com) February 9,2026

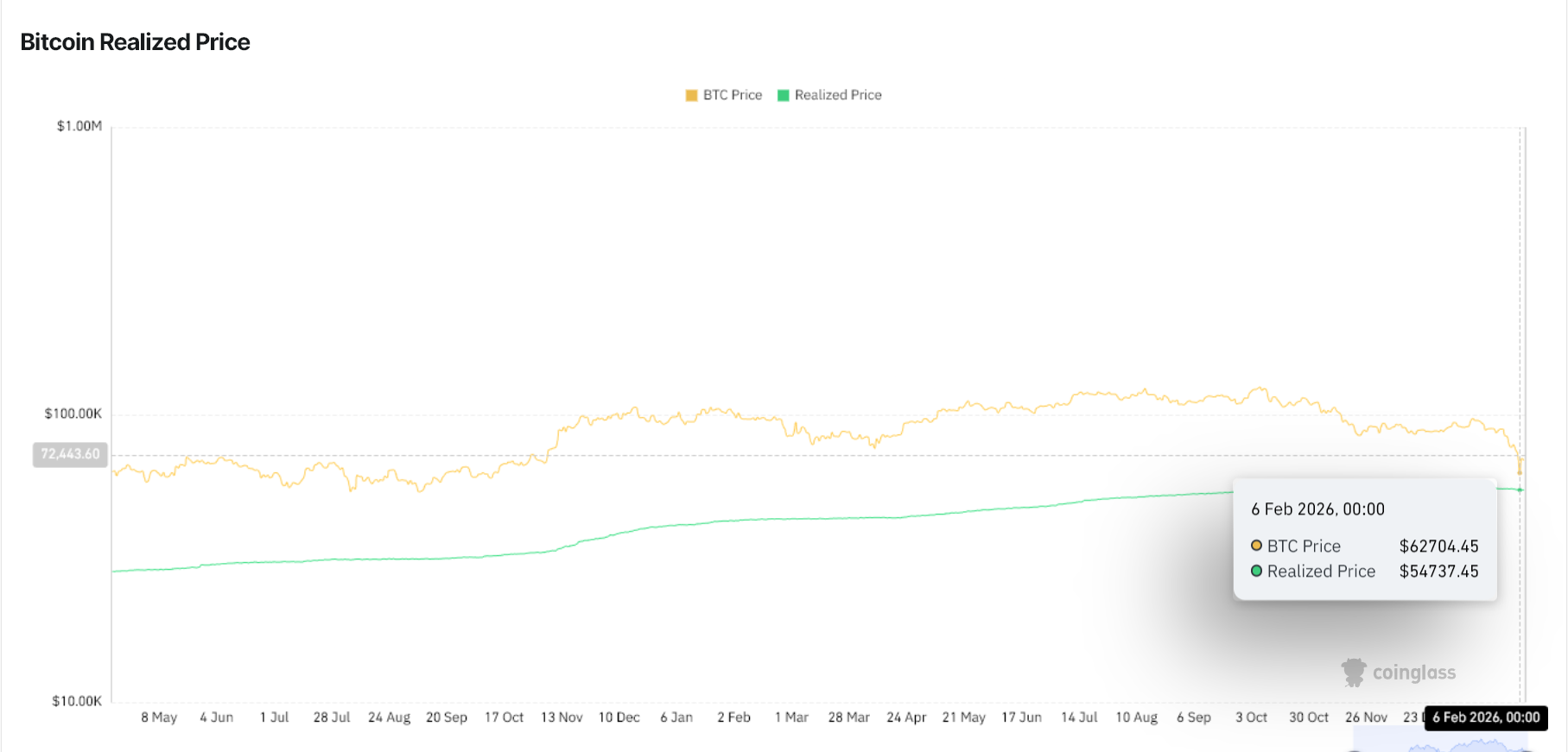

The Price Remains Above Realized Value

The trading price for Bitcoin continues to stay well above its realized value which hovers around mid-$50K range; thus keeping most network participants profitable while reducing chances for widespread capitulation events.

Past cycles indicate that prolonged bear markets generally occur only when prices fall below realized values over extended periods; hence currently BTC remains within neutral-to-positive territory.

Bitcoin Realized Price Currently Sits at $54K Source: CoinGlass

ETF Flows Stabilize After Significant Outflows

The US spot bitcoin ETFs experienced considerable outflows during previous crashes validating Arthur Hayes’ assertion about institutional hedging amplifying these moves however once prices stabilized around $60K–$65K we saw strong returns back into ETFs.

This reversal implies that forced selling may have peaked although ETF demand hasn’t yet rebounded sufficiently enough to trigger breakout scenarios.

Weekly Bitcoin ETF Inflow And Outflow In Year Of Twenty Twenty-Six Source : SoSoValue

A Range-Bound Market Rather Than Explosive Movements

Taking all factors into account shows us how markets seem caught between phases where both accumulation & distribution coexist . Whale purchases combined with stabilization within ETFs help support downside pressures but ongoing sell-offs limit upside potential too .

Thus ,it’s likely we’ll see bitcoin remain stuck within ranges surrounding seventy thousand dollars rather than experiencing any decisive pumps or dumps soon thereafter .

The post titled “Bitcoin Stable At Seventy Thousand Dollars : Will $BTC” Pump Or Dump From Here?” first appeared on BeInCrypto .