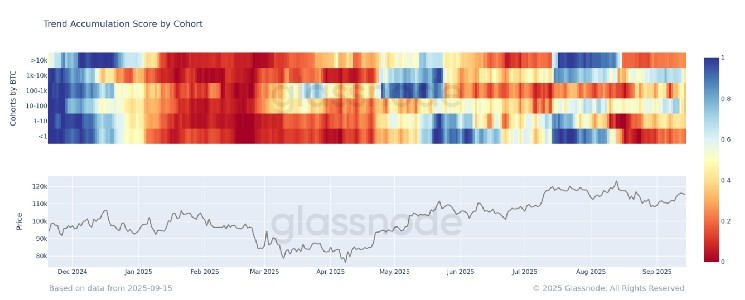

According to data from Glassnode, all categories of wallets have shifted back to a distribution phase, indicating a net sell-off of Bitcoin. This insight is derived from the Accumulation Trend Score analysis categorized by wallet type.

This metric breaks down the Accumulation Trend Score to illustrate how different wallet groups behave relative to one another. It assesses the accumulation strength for each balance category based on both the size of entities and their coin acquisition volume over the last 15 days. (For further details regarding this methodology, please refer to this Academy entry.)

A score approaching 1 indicates that a particular cohort is accumulating assets, while a score nearing 0 suggests that they are distributing them.

It’s important to note that exchanges, miners, and similar entities are not included in these calculations.

At present, every cohort—from those holding less than one Bitcoin up to those with more than 10,000—are net sellers. This trend follows last week’s surge when certain large holders—especially those in the 10-100 BTC and 1,000-10,000 BTC brackets—were actively purchasing but have since reverted back to selling mode.

Recently, Bitcoin has been fluctuating around $117,000 after an uptick during Asia’s trading session lifted it from $115,000 over the weekend. Data from Velo indicates that Asia has consistently propelled Bitcoin prices approximately 10 percent higher over the past three months. Conversely, European trading sessions have experienced pullbacks; Monday’s market activity reflects this trend as well. Additionally, Bitcoin has seen a decline exceeding 10% within EU markets during this same period.

The overall market remains in a consolidation phase—a trend likely to continue throughout September. Based on current information available at this time frame of September’s start date at $107K appears most likely as its bottom point.