Bitcoin is currently hovering around $112,100, reflecting a modest increase of approximately 1% over the past week. The rise from $107,200 to $112,100 indicates that September has started on a more positive note following August’s decline of over 6%. While traders are optimistic about this rebound, the overall sentiment remains somewhat pessimistic.

Despite this recent uptick, Bitcoin has experienced a nearly 9% decrease compared to last month. New indicators suggest that bearish trends may still persist. The pressing question remains: can Bitcoin maintain its position above $112,000 or will it revert back downward?

Long-Term Holders Are Reducing Their Holdings as Whales Re-enter Exchanges

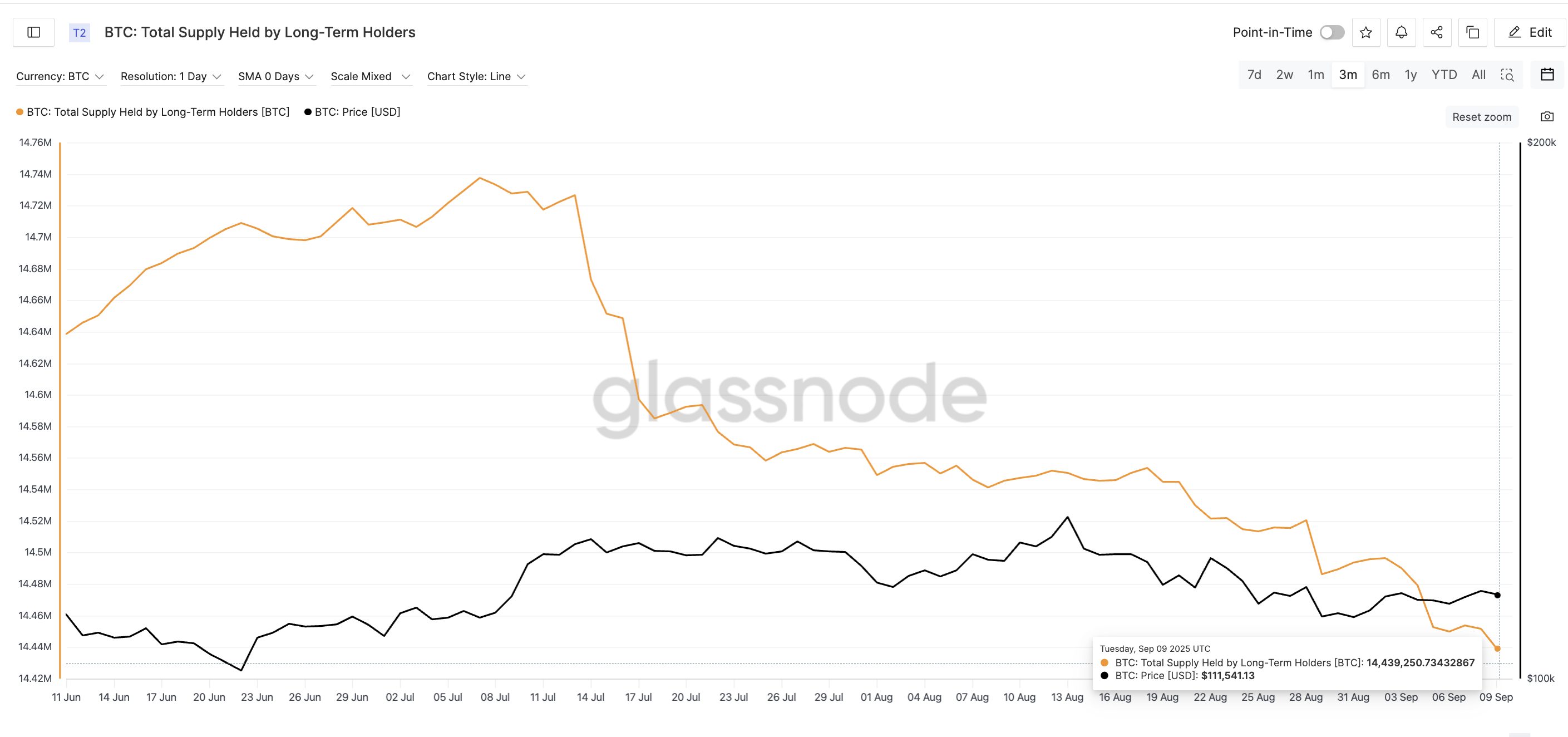

A concerning trend is emerging among long-term holders of Bitcoin. Typically known for their steadfastness and reluctance to sell during downturns, these investors have begun altering their strategies since mid-July.

On July 13th, long-term holders possessed approximately 14.72 million BTC; however, by early September this figure had decreased to around 14.43 million BTC—the lowest level seen in three months.

The departure of roughly 290,000 BTC from these strong hands signals that even the most patient investors are either minimizing risk or capitalizing on price recoveries by selling off portions of their holdings.

Bitcoin Long-Term Holders Dropping Supply: Glassnode

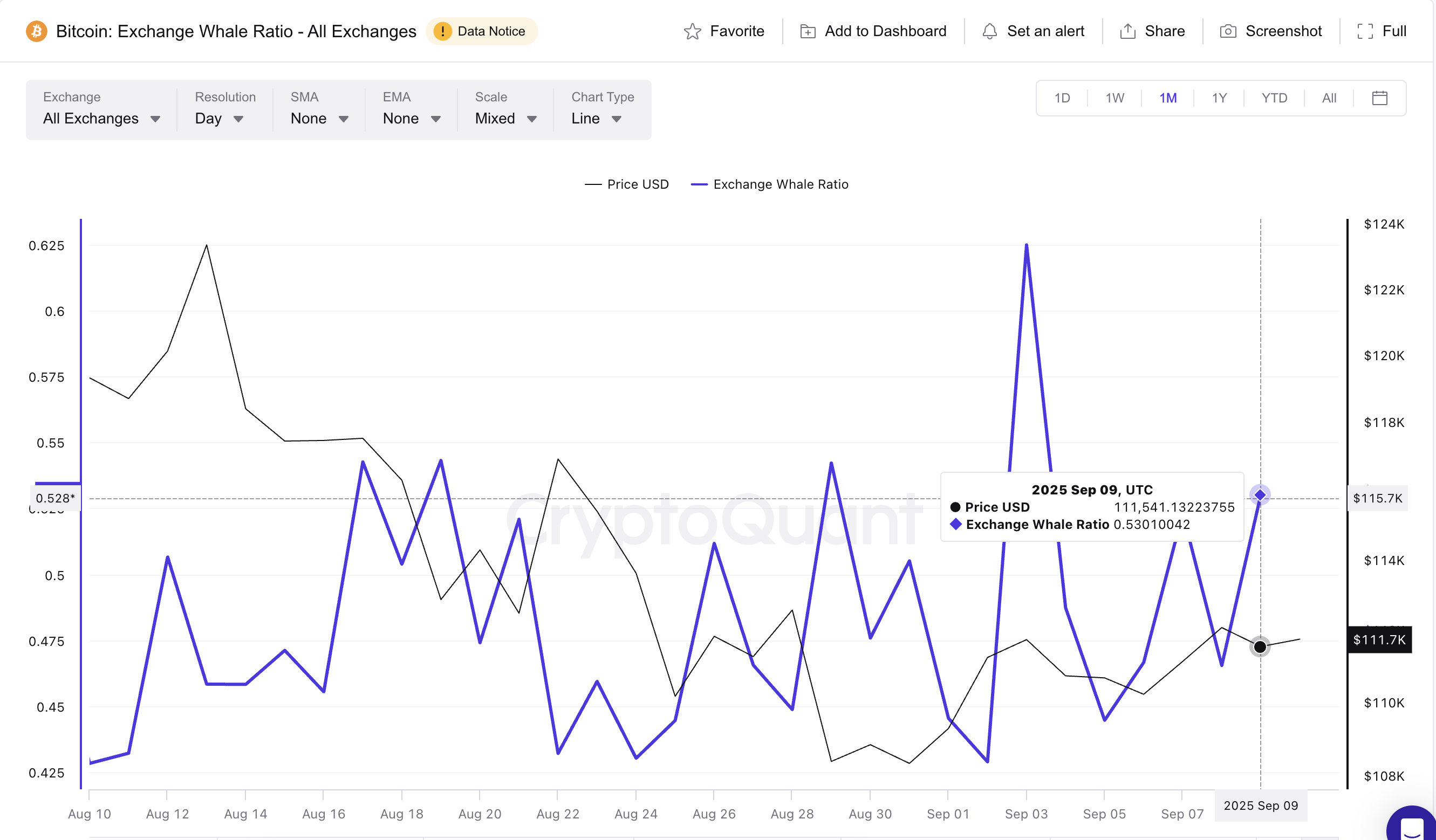

In contrast to this trend among long-term holders is the re-emergence of whales in the market. The exchange whale ratio—which measures inflows attributed to the ten largest wallets—has risen from 0.44 on September 5th to reach approximately 0.53 at present.

This ratio previously peaked at similar levels on August 21st before Bitcoin plummeted from $116,900 down to $108,300 within just a few days.

Bitcoin Whales Keep Pushing BTC To Exchanges: CryptoQuant

If you’re interested in more insights regarding cryptocurrencies like these? Subscribe now for Editor Harsh Notariya’s Daily Crypto Newsletter!

The monthly Exchange Whale ratio chart reveals an intriguing observation as well; it shows that whales have consistently transferred BTC onto exchanges over the past month—even with minor price increases prompting such actions—indicating persistent selling pressure through multiple local peaks observed in indicators.

Together with decreasing supply from long-term holders and increasing transfers by whales onto exchanges creates an unfavorable scenario for bullish sentiment—it suggests preparations are being made should prices continue declining further.

Bears May Have An Upper Hand According To Divergence Observed In Price Charts

The data derived from blockchain activity aligns closely with what we see reflected in Bitcoin’s price charts as well; between August 28th and September 8th there were lower highs recorded while simultaneously seeing higher highs reported via Relative Strength Index (RSI)—which measures buying momentum—resulting in what’s termed hidden bearish divergence.

Essentially , while momentum appears promising , actual price movements do not reflect such optimism . This often sets up conditions leading towards subsequent declines .

For traders observing these patterns , they typically indicate potential continuation downwards which could extend current monthly losses already nearing -9 % .

A critical support level lies at \$110 ,500 ; if breached due largely because of prevailing bearish divergences alongside mounting selling pressures then further drops toward \$107 ,200 become plausible—and potentially even \$103 ,500 if conditions worsen significantly .

Conversely speaking though should prices manage closing above \$113 ,500 then those RSI-driven negative sentiments would be invalidated allowing bulls regain control once again!

This article titled “ Bitcoin Price At Risk Despite September Bounce — Three Warning Signs Emerge For Btc ” originally appeared first here BeInCrypto !