Bitcoin is currently encountering fresh geopolitical challenges following a stern warning from U.S. President Donald Trump directed at Iran. This situation unfolds as the premier cryptocurrency attempts to surpass the critical psychological threshold of $90,000 ahead of today’s Federal Reserve announcement.

Geopolitical Tensions Put Bitcoin Under Pressure After Trump’s Warning to Iran

In a post on Truth Social, President Trump announced that a substantial naval fleet is en route to Iran, implying an imminent military action. He emphasized that this armada surpasses the size of the one previously dispatched to Venezuela and asserted their preparedness “to swiftly and forcefully execute its mission if necessary.”

Following his statement, Trump called on Iran to promptly engage in negotiations for a fair agreement devoid of nuclear weapons—one beneficial for all involved parties. He stressed urgency by referencing past delays that culminated in Operation Midnight Hammer and warned ominously: “The next strike will be far worse! Don’t let history repeat itself.”

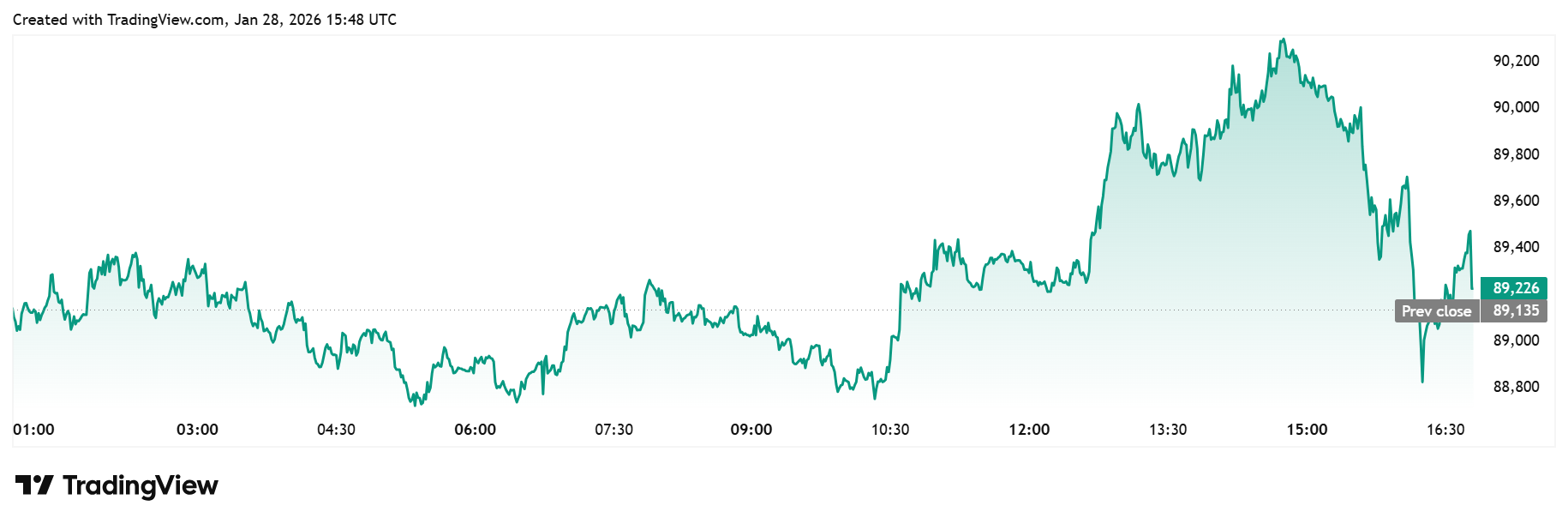

The price of Bitcoin dipped below $90,000 after these remarks from Trump concerning Iran. The flagship cryptocurrency faces downward pressure especially when recalling how it reacted last year during U.S. military actions against Iran related to nuclear deal failures; back then, Bitcoin fell beneath $99,000 amid heightened risk aversion.

Source: TradingView; Daily Bitcoin Chart

In response to Trump’s declarations, the Iranian Mission at the United Nations expressed willingness for dialogue grounded in mutual respect and shared interests but cautioned that if provoked further, Iran would defend itself with unprecedented measures.

The previous U.S. engagements in Afghanistan and Iraq cost over $7 trillion and more than 7,000 American lives due to miscalculations.

Iran remains open for respectful dialogue based on common interests — BUT IF PUSHED IT WILL DEFEND ITSELF AND RESPOND LIKE NEVER BEFORE! pic.twitter.com/k3fVEv1rus

— I.R.IRAN Mission to UN, NY (@Iran_UN) January 28, 2026

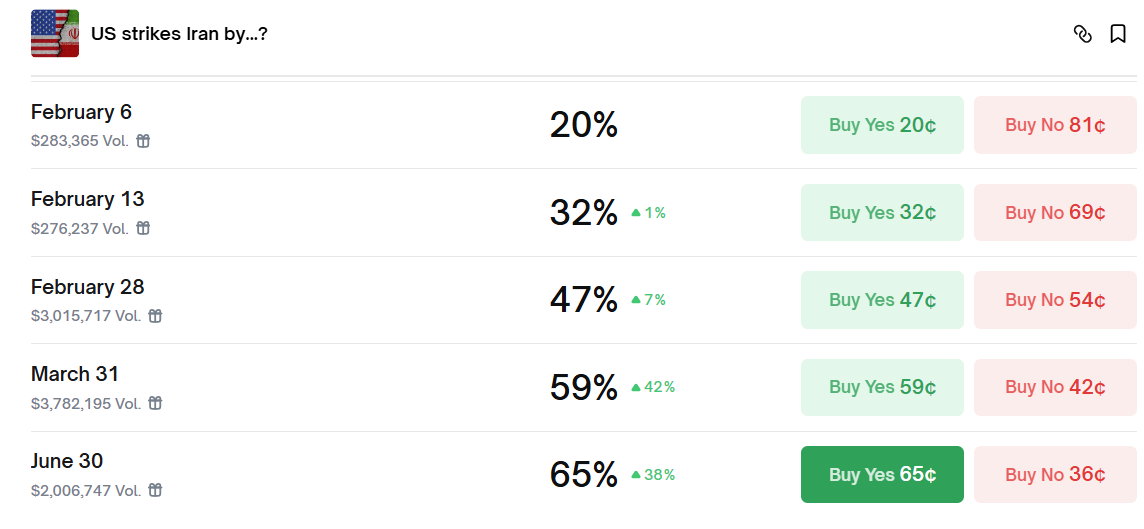

A Potential Military Strike Against Iran Expected By June

Data from Polymarket reveals that crypto investors are placing bets anticipating a U.S. strike on Iran by June’s end with approximately a 65% probability—an event likely escalating geopolitical instability which could cause significant declines in Bitcoin’s value.

Source: Polymarket

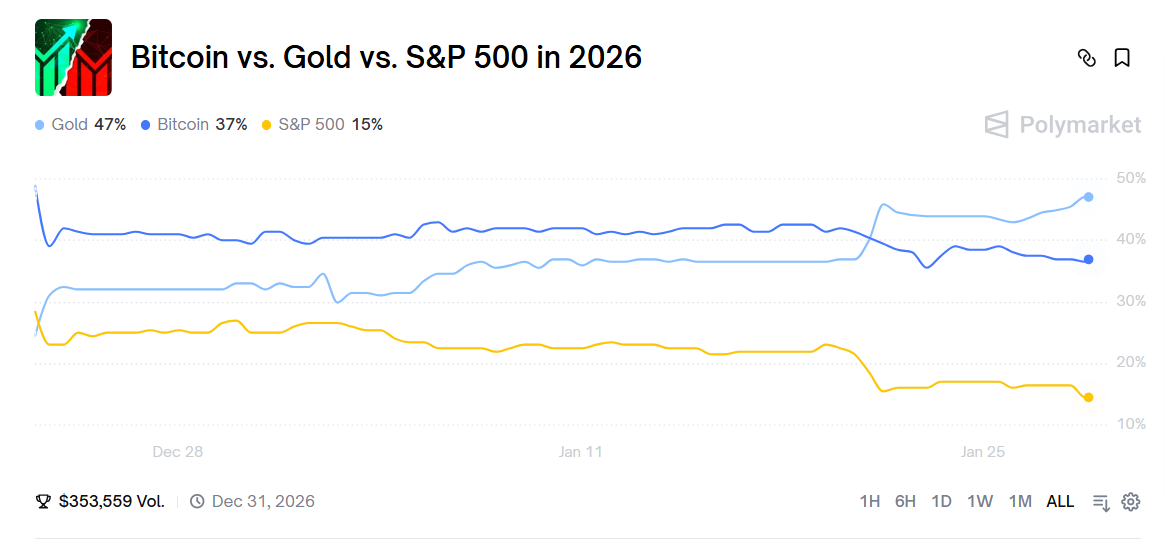

Amid these rising tensions between nations, gold prices have surged dramatically, reaching record highs above $5,300 per ounce as investors flock toward safe-haven assets. $BTC (Bitcoin) along with other cryptocurrencies remain relatively stagnant after erasing gains made earlier this year. This trend positions gold well ahead of cryptocurrencies performance-wise throughout this period due largely to market uncertainty driving demand for stability.

Source: Polymarket

The bearish outlook persists within crypto markets partly because interest rates are expected by many analysts not to decrease until mid-year. The latest data suggests there is roughly a 70% chance Federal Reserve officials will maintain current rates through their June FOMC meeting..... Recent reductions in Fed interest rates have historically triggered upward momentum across cryptocurrencies including Bitcoin which achieved new all-time highs last year shortly before rate cuts were implemented during September and October sessions... .. .. .