Bitcoin has been caught in a frustrating tug-of-war, oscillating between $85,000 and $90,000 without any decisive breakout. This stagnation isn’t due to weak buying interest or economic factors but is largely influenced by the options market dynamics.

Data from derivatives reveal that dealer gamma exposure is currently limiting Bitcoin’s price swings through automated hedging activities. This setup has effectively kept Bitcoin confined within a narrow band; however, these controlling forces are set to expire on December 26.

The Gamma Flip Threshold

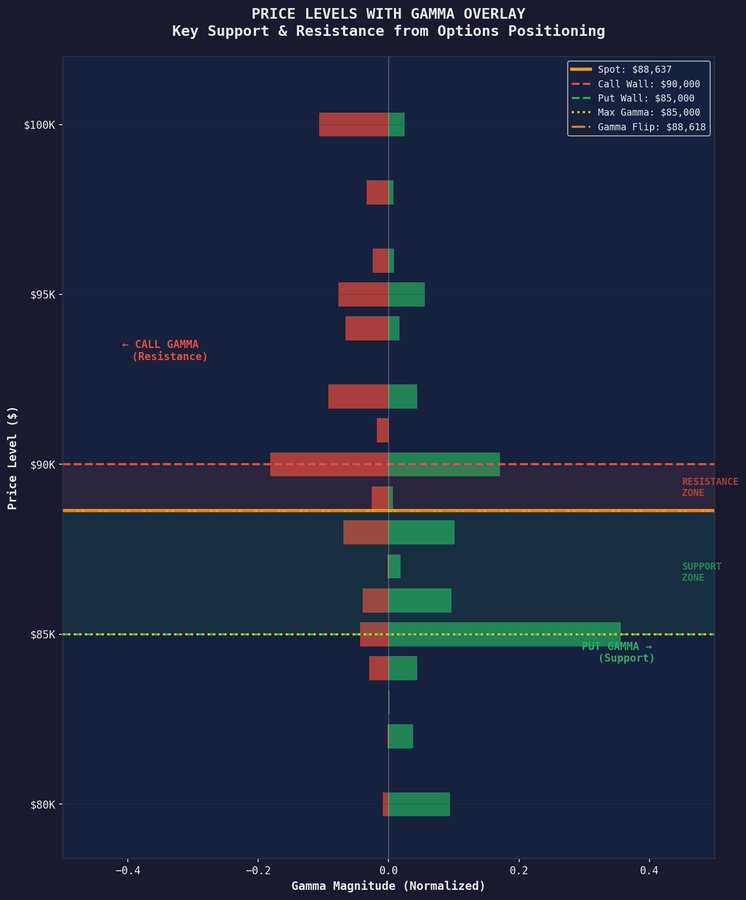

A key concept driving this phenomenon is the “gamma flip” level, which traders identify around the $88,000 mark.

When prices rise above this point, market makers with short gamma positions must sell during upward moves and buy during dips to maintain delta neutrality. This behavior reduces volatility and nudges prices back toward the center of the range.

If prices fall below this threshold, hedging actions reverse direction—selling pressure intensifies as dealers hedge alongside price declines—resulting in amplified volatility instead of dampening it.

$90K Resistance Meets $85K Support

The resistance at $90,000 repeatedly halts upward momentum due to concentrated call option shorts held by dealers at that strike price. As Bitcoin nears this level, dealers sell spot BTC to hedge their risk exposure. What appears as natural selling pressure is actually forced supply generated by derivatives hedging strategies.

This recurring hedging activity explains why attempts to break above $90K have consistently failed.

Conversely, strong support near $85K stems from heavy put option positioning at that strike. Dealers must purchase spot Bitcoin when prices approach this floor level — creating forced demand that absorbs selling pressure and prevents breakdowns below it.

Together these opposing forces create an artificial equilibrium where surface stability masks underlying mechanical constraints imposed by derivatives markets.

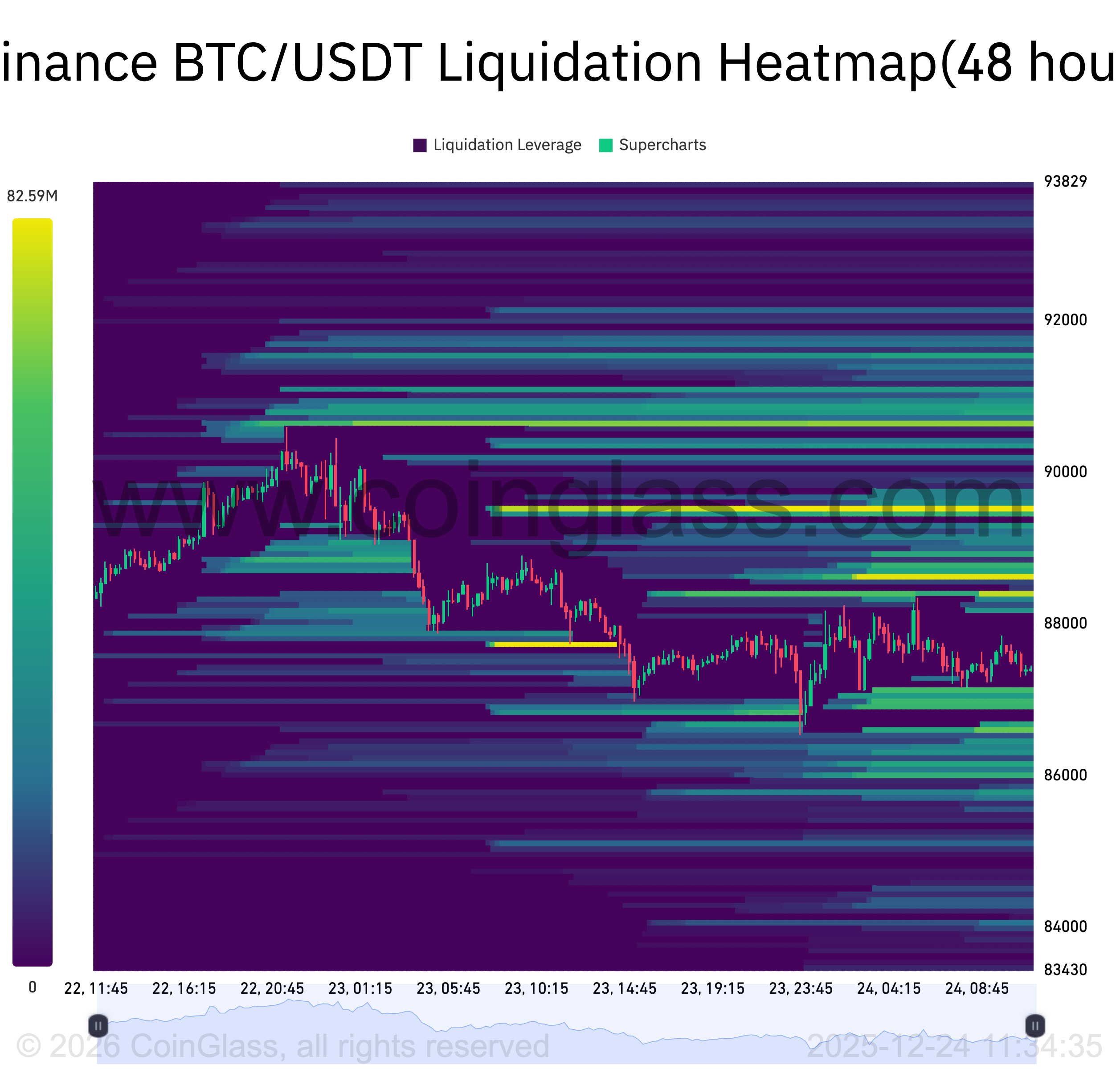

Futures Liquidations Reinforce Price Boundaries

This options-driven range does not exist in isolation; futures liquidation data further strengthens these boundaries. According to Coinglass heatmaps showing leveraged futures liquidations clustered near current levels — additional magnetic pull keeps Bitcoin trapped between roughly $85K and $90K ranges.

Above the ceiling of $90K lie significant short liquidation points: breaking through would trigger rapid short covering cascades leading to aggressive buying spikes. Below approximately $86K are long liquidation zones where stops accelerate downside moves if breached — reinforcing structural pressures from both options dealer hedging and futures liquidations alike keep BTC confined tightly within its current corridor.

An Imminent Options Expiry Trap

The upcoming December 26 expiry promises historic scale with nearly $23.8 billion in notional value set for expiration—a massive leap compared with previous years: about $6.1 billion in 2021, $11 billion in 2023, and roughly $19.8 billion so far in 2024.

This surge reflects growing institutional involvement within Bitcoin’s derivative markets.

Analyst NoLimitGains estimates approximately 75% of existing gamma exposure will vanish post-expiry—effectively removing much of the mechanical grip keeping BTC locked between $85k-$90k .

Dealer Gamma Overshadows ETF Demand

The magnitude of dealer hedging dwarfs spot market demand: current data indicates dealer gamma exposure stands near $ 507 million versus just $ 38 million daily ETF inflows—a staggering ratio exceeding thirteen-to-one.

Such imbalance clarifies why positive fundamentals often fail to move price meaningfully until derivative overhang dissipates—the math behind dealer activity outweighs narratives around institutional adoption for now.

The Road Ahead Post-Expiry

After December 26 passes,the suppressive influence exerted by options mechanics will lift.This doesn’t guarantee directionality but frees bitcoin from its constrained range allowing more pronounced movements either way.& nbsp ;

Should bulls defend support near $& nbsp ;85k ,breakout attempts toward & d ol ar ;100k become structurally feasible.In contrast,failure below this zone amid low-gamma conditions could trigger accelerated declines .& nbsp ;

Traders should brace for heightened volatility entering early 2026 as fresh positioning emerges.The recent sideways action likely represents a temporary state driven primarily by derivative structures rather than genuine shifts in underlying sentiment .& nbsp ;

–––––-

Original article appeared first on BeInCrypto.