In recent weeks, analysts have increasingly categorized Bitcoin as being in a persistent bear market. However, five significant indicators suggest that the market is undergoing a mid-cycle reset following the dramatic surge to record highs observed in late 2025.

Current on-chain and ETF data indicate that the selling pressure is diminishing. Rather than long-term investors exiting their positions, it appears that latecomers are being forced out while more resilient holders are absorbing the available supply.

This shift is crucial because mid-cycle resets often signify a transition from panic selling to accumulation.

ETF Outflows Indicate Washout Rather Than Long-Term Distribution

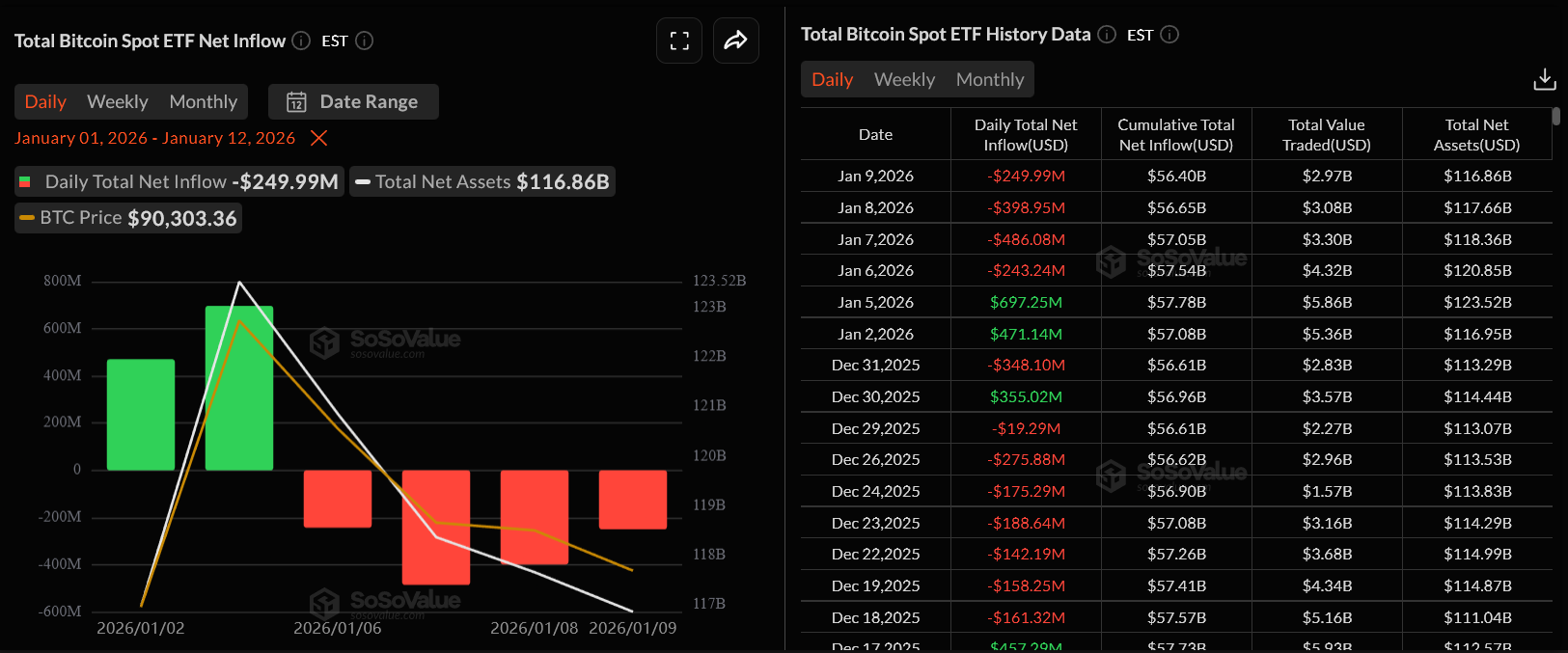

The US Bitcoin ETFs faced their most severe selloff since inception during early January. Following substantial inflows on January 2 and January 5—totaling over $1.1 billion—the situation reversed dramatically.

In just three sessions afterward, more than $1.1 billion exited these funds.

US Spot Bitcoin ETFs Daily Inflow in January 2026. Source: SoSoValue

US Spot Bitcoin ETFs Daily Inflow in January 2026. Source: SoSoValue

This trend exemplifies classic capitulation or washout behavior. Investors who purchased ETFs during the October and November rally entered when Bitcoin was nearing its all-time highs; however, as prices failed to maintain above $95,000, many of those investments turned into losses quickly leading to redemptions as risk managers and short-term traders reduced their exposure.

Critically, this wasn’t a gradual outflow characteristic of bear markets but rather an abrupt flush of weak hands from the market first.

Recent data indicates stabilization in ETF flows suggesting we may be nearing the end of this forced selling phase.

Typically within market cycles, such ETF washouts precede periods of sideways consolidation followed by recovery phases.

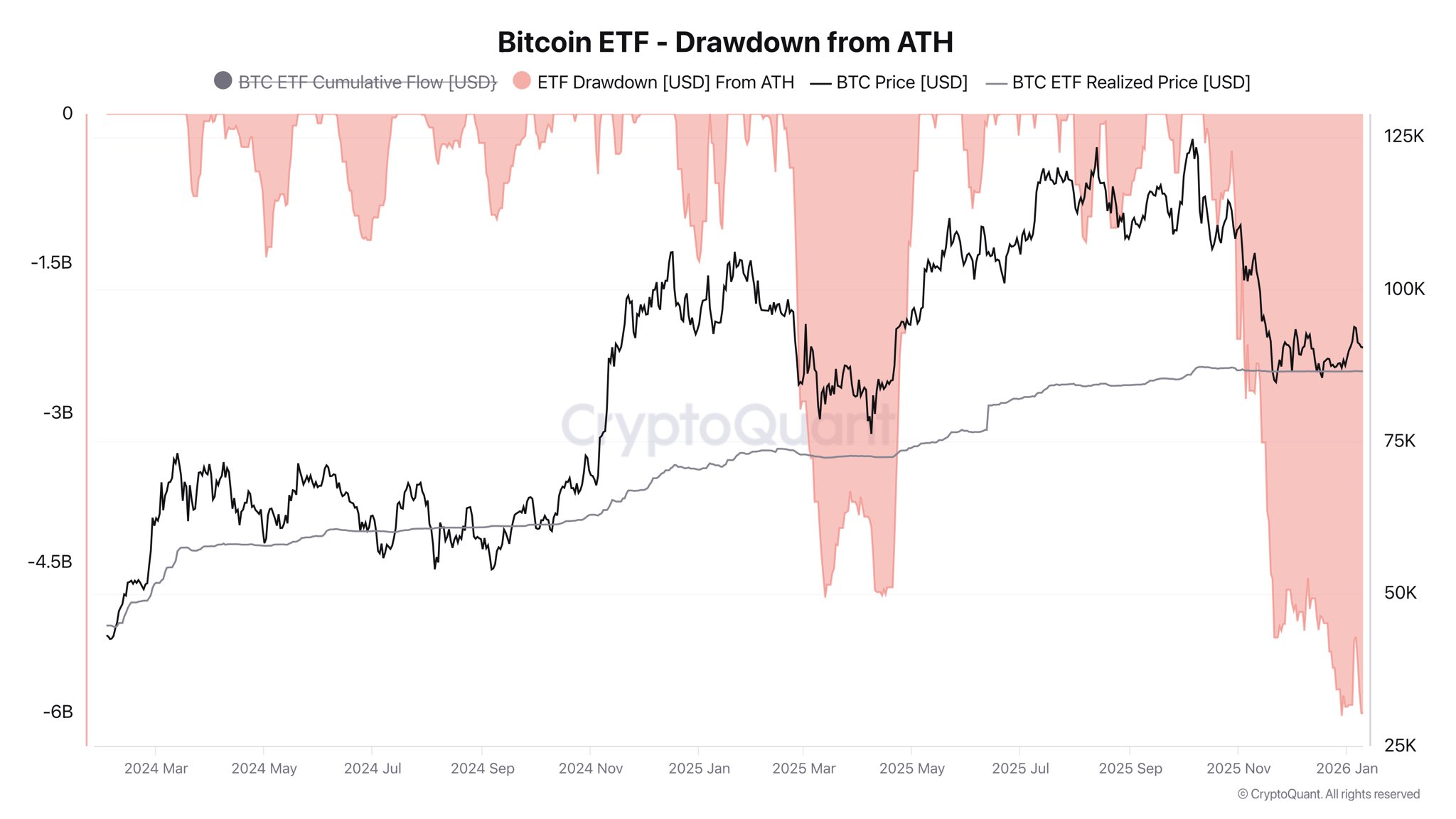

🔴 We are witnessing an unprecedented liquidity drawdown recorded for ETFs.

With an average realized price around $86,000 for most ETF inflows since October’s ATH now at a loss.

💥 Over $6B has exited spot Bitcoin ETFs recently… pic.twitter.com/N3sOGsi7iT

— Darkfost (@Darkfost_Coc) January 12, 2026

The Current ETF Cost Basis Near $86K Serves As Price Anchor

The drawdown chart from CryptoQuant reveals that the average realized price for Bitcoins held by ETFs hovers around $86K—indicating that most investors who entered post-October peak are close to breaking even now.

This level holds significance; when prices trade near this cost point for major marginal buyers typically leads to reduced selling pressure overall.

If investors have already incurred losses they tend not to sell further but instead wait for potential rebounds before making any moves on their holdings instead of cutting losses prematurely.

Bitcoin ETF Drawdown Chart Source: CryptoQuant

Bitcoin ETF Drawdown Chart Source: CryptoQuant

A historical perspective shows these cost-basis zones act like gravitational pulls; if BTC drops significantly below them dip buyers usually step up while profit-taking occurs once prices rise too far above them currently BTC remains slightly above this critical anchor point.

This explains why stability has been observed between approximately $88K-$92K despite billions flowing out from various exchanges.

The established cost basis among these funds represents structural support typical during mid-cycle resets rather than indicative signs associated with prolonged bearish trends.

An analysis using blockchain data indicates BlackRock transferred over 3700 BTC along with more than7200 ETH into Coinbase Prime which initially suggests institutional offloading activity.

Your understanding must include how ETFS function though—as shareholders redeem shares back they require corresponding amounts delivered directly via authorized participants utilizing platforms like coinbase prime serving custody needs throughout settlement processes involved here.

A surge in redemptions last week necessitated movements made by blackrock fulfilling obligations set forth accordingly reflecting demand primarily focused towards liquidity rather than directional bets taken against current markets themselves thus illustrating timing perfectly aligned alongside heavy outflows seen earlier within same month!

BlackRock just deposited over3743$BTC($339M)and7204$ETH($22M)toCoinbasePrime https://t.co/qmuDIrPHc6

-Lookonchain(@lookonchain )January12th ,2026

<img decoding=“async”src=“https://cnews24.ru/uploads/abe/abecc46e1e718e5440592f482ab87b0bf3626.jpg”size=“1538×718”alt=”“BitcoinTotalExchangeNetflow.Source:CryptoQuant

.