On Thursday, Bitcoin’s value dropped beneath the $66,000 mark following the release of mixed economic indicators from the United States. While initial jobless claims came in better than anticipated, a significant expansion in the trade deficit sparked renewed caution among cryptocurrency investors.

The broader crypto market closely monitored these economic figures, which were expected to influence Bitcoin’s performance throughout the week.

Bitcoin Dips Under $66K Amid Conflicting US Economic Data

The Labor Department revealed that initial jobless claims totaled 206,000 last week—lower than both the revised figure of 229,000 from the previous week and analysts’ forecast of 225,000.

Additionally, the four-week moving average for claims declined slightly to 219,000. This suggests that despite ongoing challenges facing the economy, employment conditions remain relatively robust.

Conversely, continuing unemployment claims—which measure those still receiving benefits—increased by 17,000 to reach 1.869 million. This was marginally above expectations set at 1.860 million.

Initial Claims: 206K (Expected: 225K)

Continuing Claims: 1.869M (Expected: 1.860M)— zerohedge (@zerohedge) February 19, 2026

This data paints a picture of a labor market that is stable but showing signs of softening — with hiring slowing down but no major layoffs occurring.

“These preliminary figures reinforce a narrative of a labor market that remains steady yet less dynamic,” noted Truflation.

Despite this relative stability in employment metrics providing some reassurance to markets, investor confidence was shaken by an unexpected surge in America’s trade deficit.

The Treasury Department reported January’s trade gap widened sharply to $70.3 billion—far exceeding forecasts around $55.5 billion and well above December’s revised figure of $53 billion.

US Trade Deficit widens dramatically to $70.3B (Forecast: $55.5B), up from prior month's $53B

Market reaction suggests concern over underlying demand imbalances.”

— zerohedge (@zerohedge) February 19, 2026

This expanding deficit signals growing external imbalances fueled by sustained domestic consumption levels and adds complexity for investors navigating an already uncertain macroeconomic landscape.

Meanwhile, Truflation data indicates inflation has remained subdued below one percent since early February despite these mixed signals.

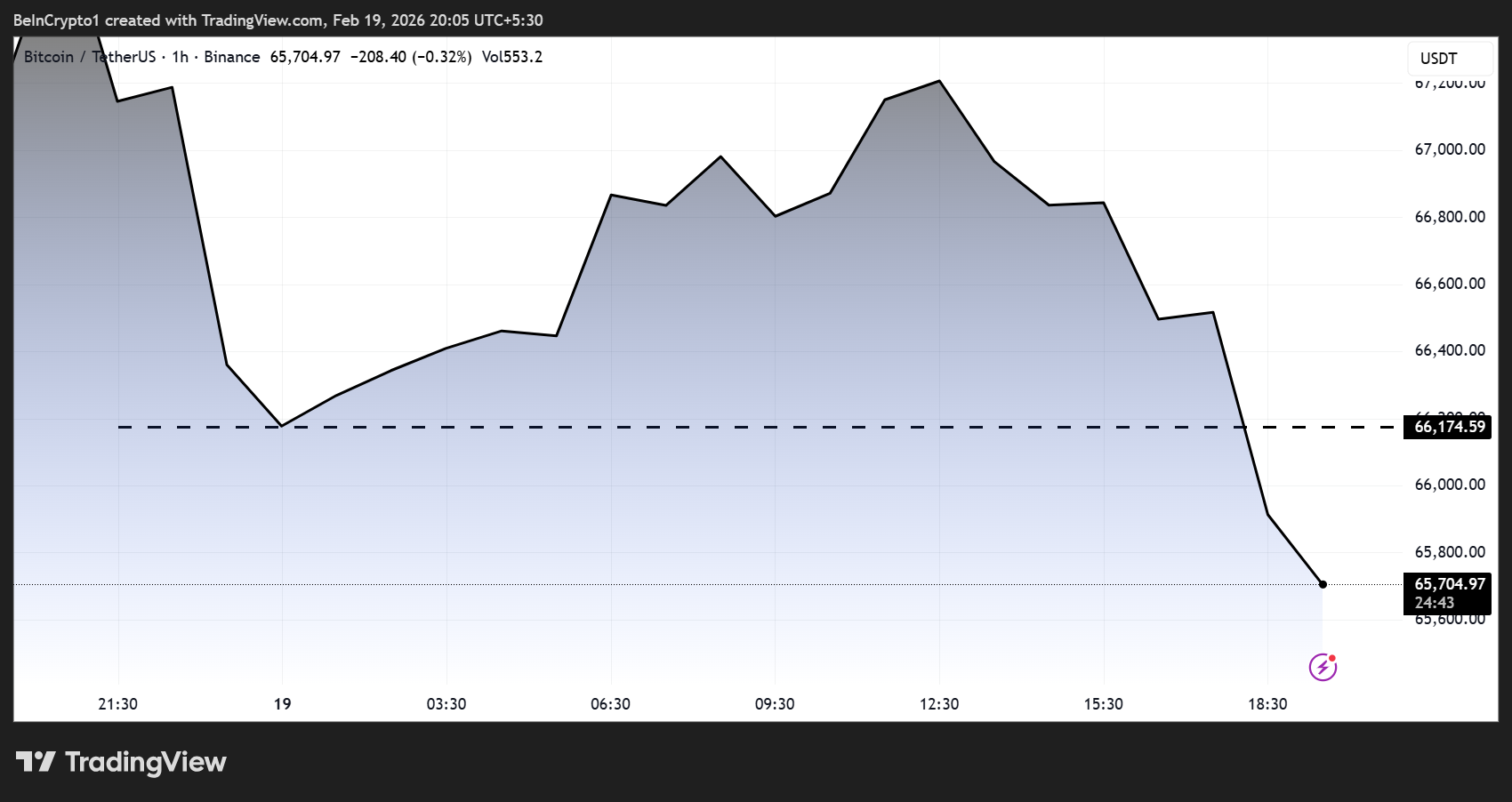

Bitcoin price Performance.&a mp=TradingView

The negative response across cryptocurrency markets coincided with Bitcoin slipping under$66k as traders grappled with contrasting forces:& ;#160;a resilient labor sector coupled with deteriorating trade balances amid low inflationary pressures.

These developments underscore how technical trading sentiment can intensify reactions when faced with unexpected economic news.

Investors have adopted more cautious stances recently due to heightened uncertainty surrounding global financial conditions.

The disparity between solid employment statistics and soaring trade deficits exemplifies current macroeconomic tensions affecting risk appetite.

Although strong jobs numbers may ease concerns about an imminent recession,& ;#160;the ballooning trade shortfall could weigh heavily on risk assets if it reflects deeper demand-side issues.

The complex interaction between vigorous employment data ,sub-1% inflation rates ,and widening external imbalances is shaping an intricate environment for both traditional finance and digital asset markets alike .

<P> ;Looking ahead ,market participants will be closely monitoring upcoming key releases such as December ’s Personal Consumption Expenditures reports along with final revisions for Q4 GDP . These indicators will be crucial in determining whether investor sentiment stabilizes or volatility escalates further .

The article “Ютка, Прост, Не& #1089 ; пu0430u0434u0430u0458 u0447 u0440 u044b u041a u0438 u0442 u043a u043e u041fu0440u0438 шu04af& #1084 ; & #1079;u04af& #1076;u04af& #1103&;rdquo;, appeared first on BeInCrypto.