The demand for Bitcoin (BTC) has significantly diminished since October 2025, indicating that the cryptocurrency may have entered a new bear market phase, as noted by analysts from the crypto analytics platform CryptoQuant.

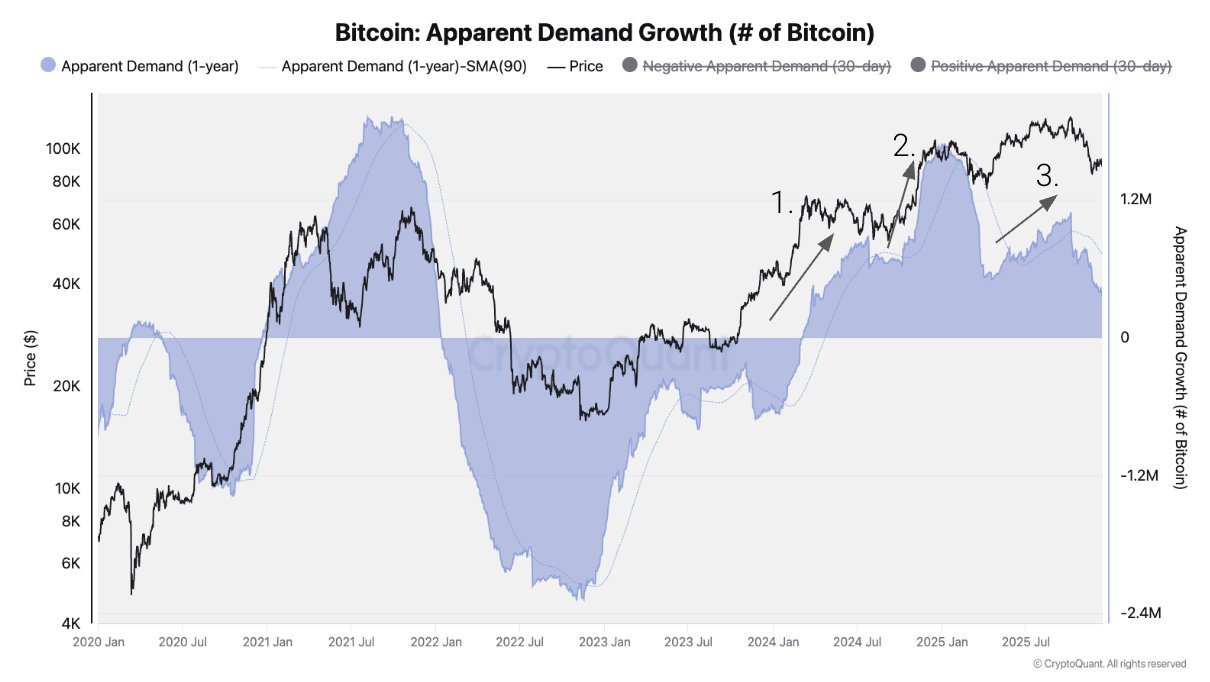

According to CryptoQuant, investor interest in BTC has manifested in three distinct phases throughout this market cycle. The initial surge occurred in January 2024 following the introduction of Bitcoin exchange-traded funds (ETFs) in the United States.

The second wave of demand was triggered by the outcomes of the 2024 US presidential election, while a subsequent bubble involving BTC treasury companies marked the third wave. As per CryptoQuant:

“Since early October 2025, demand growth has dipped below its expected trend. This suggests that most incremental demand for this cycle has already been realized, thereby diminishing a crucial support factor for prices.”

Demand for Bitcoin noticeably declined during Q4 2025. Source: CryptoQuant

Institutional interest also saw a decline; approximately 24,000 BTC were withdrawn from ETFs during Q4 2025—a stark contrast to accumulation patterns observed in Q4 2024 according to CryptoQuant.

Additonally, funding rates—the fees perpetual futures traders pay to maintain their positions—have dropped to their lowest levels since December 2023. This is yet another indicator that BTC is likely experiencing a bear market.

The analysts further pointed out that Bitcoin’s price structure fell below its critical and dynamic support level represented by its 365-day moving average—a significant bearish signal for any asset.

Bitcoin continues trading well beneath its yearly moving average of around $98,172. Source: TradingView

Related: Bullish rallies hindered by declining Fed rate cut expectations and softening US macroeconomic conditions

A glimmer of hope remains amidst widespread fear regarding future prices

Certain analysts still project an increase in BTC prices throughout 2026 due to rising demand coupled with decreasing interest rates—an environment generally favorable for cryptocurrencies and other risk assets.

Nonetheless,the overall sentiment within the crypto market remains entrenched firmly within “fear” territory as indicated by CoinMarketCap’s Crypto Fear and Greed Index.

A mere 22.1% of investors anticipate that the Federal Open Market Committee (FOMC) will lower interest rates at their upcoming meeting scheduled for January according to data from CME Group’s FedWatch tool.

Interest rate target probabilities leading up to January’s FOMC meeting . Source : CME Group

In an effort to influence Federal Reserve Chairman Jerome Powell into lowering interest rates during the year , US President Donald Trump threatened Powell with termination .

Powell’s term concludes in May of next year , prompting Trump’s search for potential successors who are anticipated to adopt more accommodative monetary policies .

This article does not provide investment advice or recommendations . Every investment carries inherent risks , so readers should conduct thorough research before making decisions . While we aim at delivering accurate information promptly , Cointelegraph cannot guarantee complete reliability or accuracy concerning any details presented herein . Furthermore , this article may include forward-looking statements subjecting it towards uncertainties & risks involved ; thus Cointelegraph shall not be liable against losses incurred based on reliance upon such information provided herewith .

Magazine : Six reasons why Jack Dorsey could definitely be Satoshi … along with five reasons he might not be !