The January meeting of the Federal Open Market Committee (FOMC) highlighted a significant rift within the Federal Reserve, marked by two dissenting voices advocating for a more dovish approach.

While most policymakers supported maintaining the current monetary policy, some officials pushed for “two-sided language” regarding future interest rate adjustments. This indicates that if inflation continues to exceed targets, rate hikes may be back on the table.

Fed Minutes Uncover Divided Opinions as Bitcoin Faces Challenges

Recent economic indicators have bolstered Fed Chair Jerome Powell’s cautiously optimistic perspective.

The economy has shown unexpected growth, inflation seems to be easing, and employment figures are stabilizing.

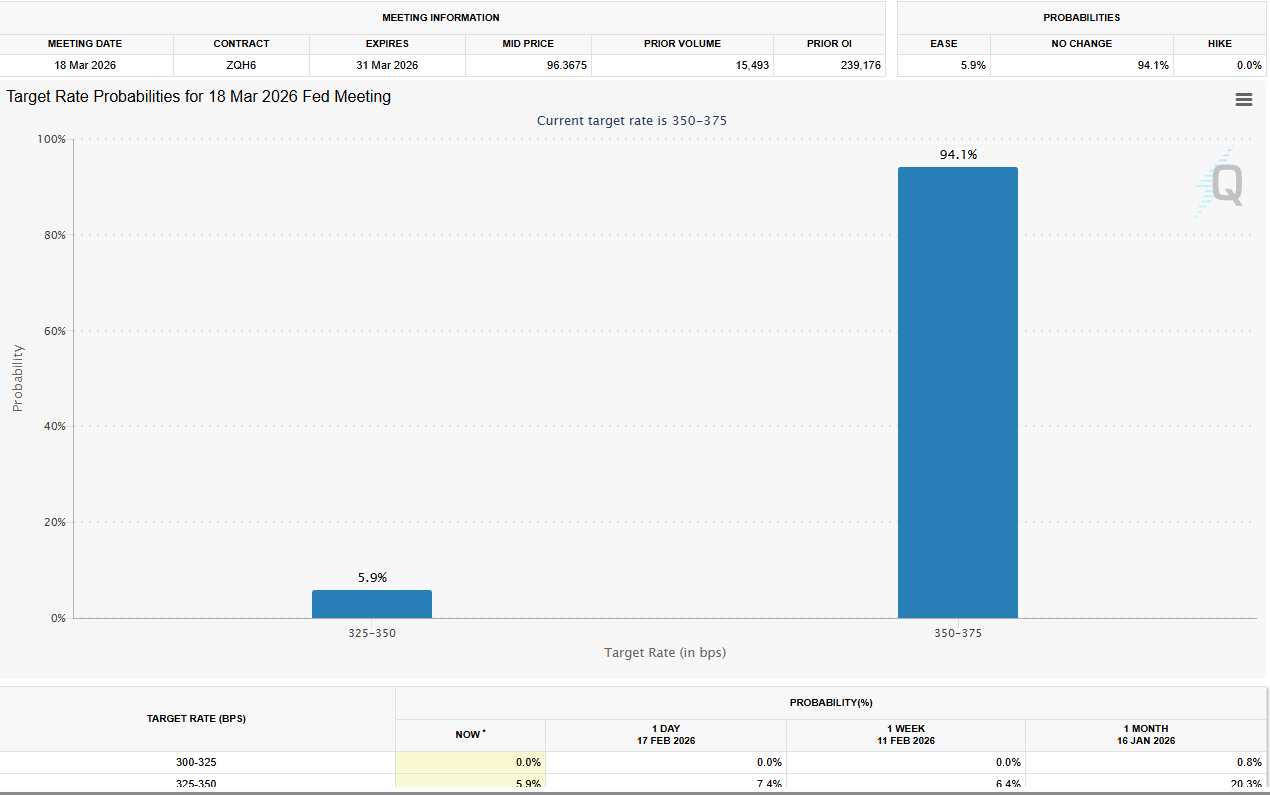

These factors have led to an increase in expectations for potential rate cuts in 2026; however, following last week’s stronger-than-anticipated payroll data, any March cuts appear unlikely.

Interest Rate Cut Probabilities. Source: CME FedWatch Tool

Interest Rate Cut Probabilities. Source: CME FedWatch Tool

The minutes also shed light on intricate discussions within the Fed regarding inflation and productivity:

- A number of officials warned that disinflation might progress at a slower pace than expected.

- Some suggested that further rate reductions could be justified if inflation decreases as projected; however, others cautioned against excessive cuts which could exacerbate inflationary pressures.

- Productivity improvements were noted as a possible factor in mitigating future inflation rates.

The vulnerabilities present in financial markets were another key topic of discussion. Several participants pointed out risks associated with private credit and overall financial stability.

An analysis indicates that these concerns—coupled with hawkish signals from the Fed—have spurred safe-haven investments in bonds and strengthened demand for dollars while Bitcoin remains under pressure from market headwinds.

Bitcoin (BTC) Price Performance. Source: TradingView

A senior market strategist commented: “The minutes reflect a divided Fed still mindful of both growth momentum and risks related to inflation. The underperformance of Bitcoin can largely be attributed to risk-averse sentiment alongside ongoing strength in the dollar.”

Investors will closely monitor any additional remarks from Federal Reserve officials as they analyze these minutes. The interplay between hawkish caution and dovish optimism will play a crucial role in shaping monetary policy decisions leading into 2026.

This article was originally published on BeInCrypto under the title “Bitcoin Falls, Dollar & Bonds Rally On Hawkish Fed Minutes.”