Since the beginning of 2025, Bitcoin has consistently maintained monthly closing prices above $80,000, establishing this figure as a crucial support level.

Nonetheless, recent trends in the Coinbase Premium Index suggest potential challenges to this support. Despite these warning signs, experts remain cautiously optimistic even if Bitcoin dips below this threshold.

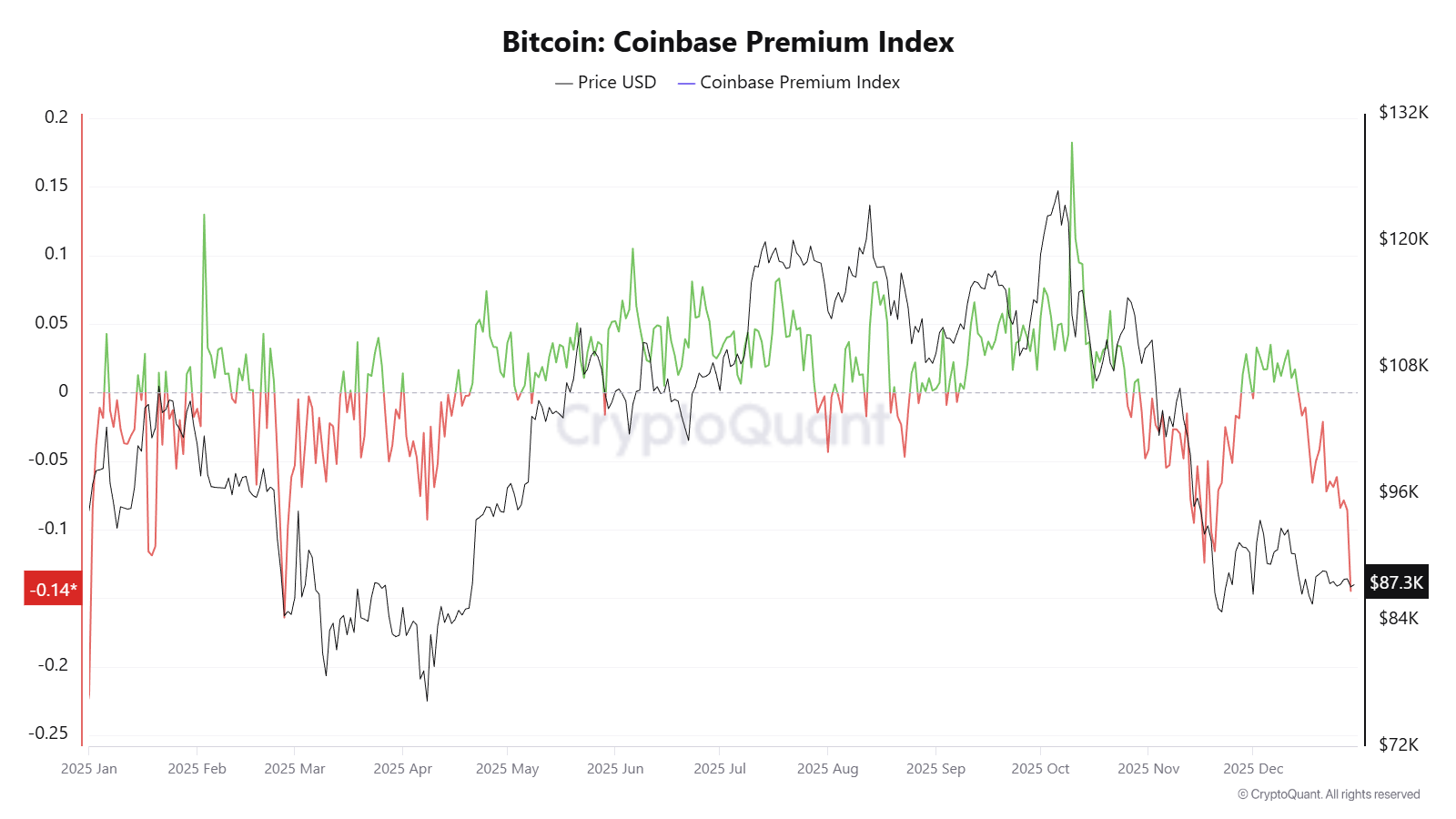

The Coinbase Premium Index for Bitcoin Reaches Its Lowest Point Since February

The Coinbase Premium Index tracks the price disparity of Bitcoin between Coinbase (serving US markets) and Binance (catering to international users). This metric often reflects purchasing activity from institutional investors based in the United States.

A negative reading on this index indicates heightened selling pressure from US participants, which significantly influences downward movements in BTC’s price.

According to data from CryptoQuant dated December 30th, the index dropped to -0.14 — its lowest since February of this year.

This negative trend persisted for sixteen consecutive days throughout December. During that time frame, Bitcoin was unable to close any weekly candle above $90,000.

Consequently, analysts argue that a definitive bottom may not yet have been established as selling pressure from US investors remains unabated.

“The clearest sign of a local bottom will be when we see the Coinbase premium bounce back,” stated investor Johnny.

A comparable steep decline earlier in February led BTC prices below $80K before quickly rebounding afterward—suggesting that current conditions might mirror past patterns.

Moreover, December experienced ETF outflows for a second month running; however these outflows were notably smaller compared with November’s figures.

The behavior observed during February and early March 2025 shows similar dynamics—indicating ongoing but diminishing sales by American investors—which could pave way for recovery opportunities despite temporary breaches below $80K support levels.

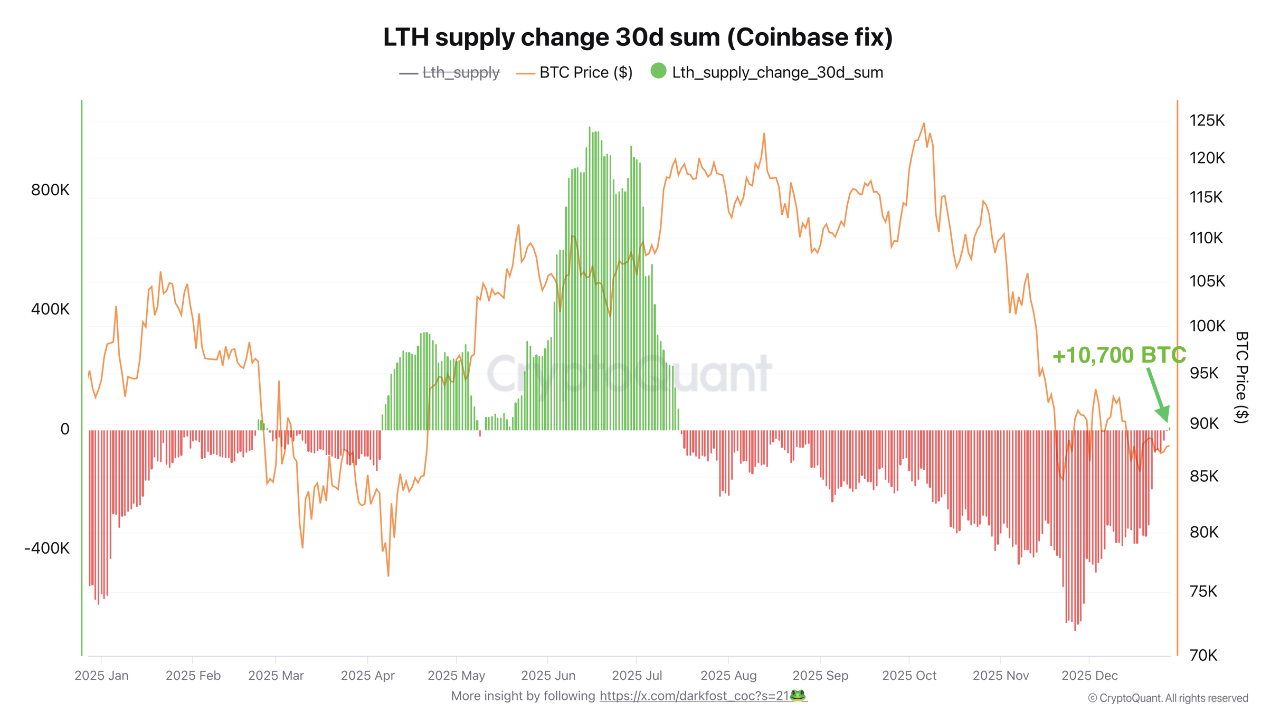

Meanwhile long-term holders (LTHs) have eased their selling activities while increasing their holdings once again over recent weeks:

Data reveals that LTH supply shifted toward accumulation at late December with approximately 10,700 BTC moving into long-term holding status—the first positive indication since July when they ceased offloading coins extensively.

“Although modest so far, such shifts historically precede consolidation phases or bullish rallies depending on broader market context,” analyst Darkfrost noted thoughtfully.

In conclusion, while both the Coinbase Premium Index remains near historic lows and ETFs continue seeing withdrawals, encouraging signals coming from long-term holders provide some optimism.

If sustained selling persists, BTC might dip beneath $80,000 temporarily; nevertheless, a rebound could happen unexpectedly at any point.

“Bitcoin Coinbase Premium Hits Lowest Level Since February – Will BTC Drop Below $80,000?“és original post appeared first on BeInCrypto.&br/>

</html