An expert in Bitcoin has recently asserted that the cryptocurrency remains within a bullish phase, as it briefly climbed above $112,000 on Monday following a week marked by significant fluctuations.

Over the past week, Bitcoin (BTC) has faced challenges in gaining momentum. Analysts noted signs of investor fatigue, especially after last week’s abrupt decline led to two substantial liquidation events across the broader crypto market.

On Monday morning, Bitcoin reached a peak of $112,293 within 24 hours—exceeding $112,000 for the first time since its sharp drop on Thursday. As per CoinGecko data, it is currently valued at $111,835.

The Bullish Trend Persists for Bitcoin

Despite recent turbulence unsettling traders, XWIN Research Japan highlighted in a CryptoQuant note on Sunday that “on-chain data continues to indicate that Bitcoin’s bull market persists.”

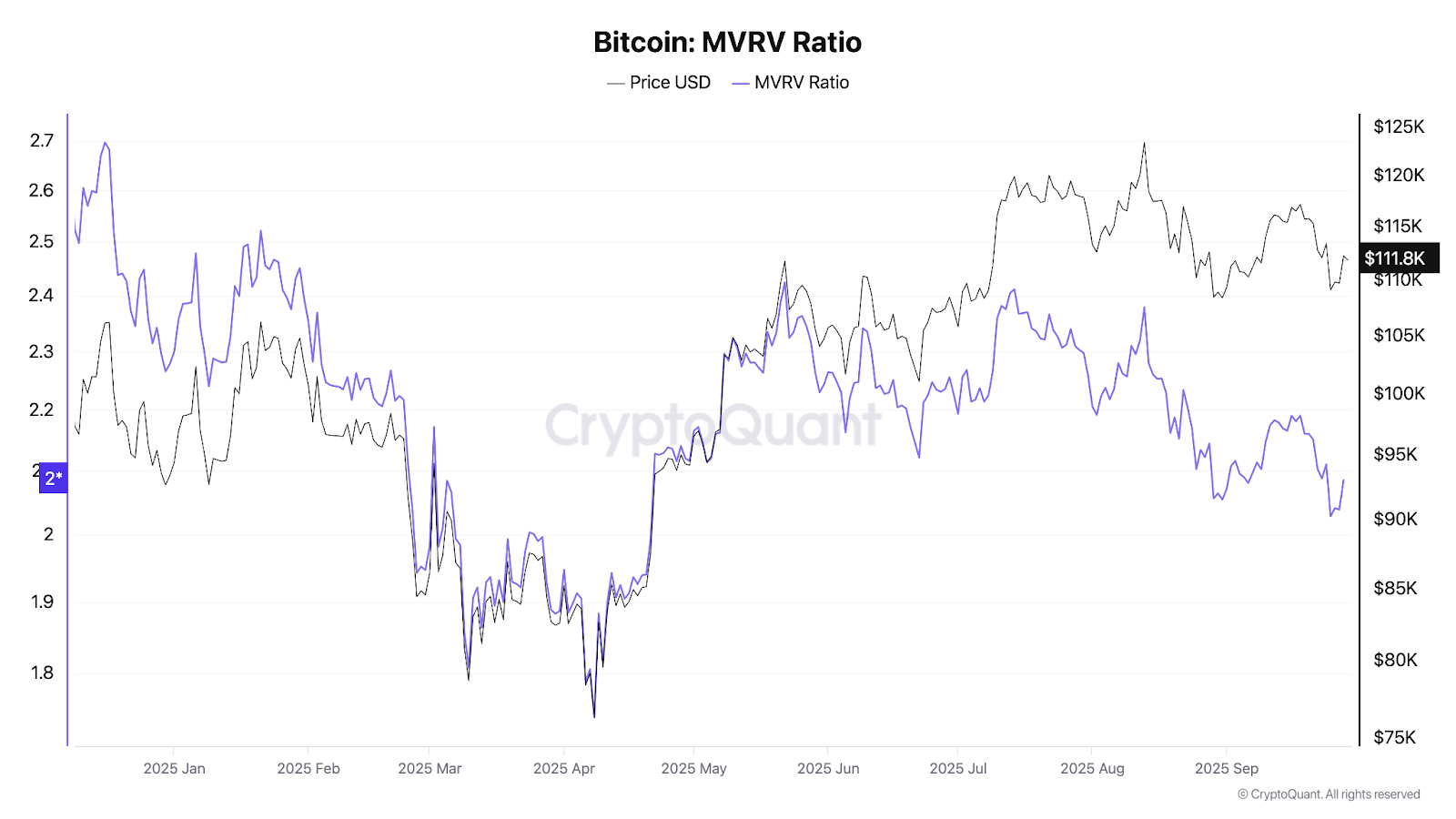

The firm pointed out that both long-term holder behavior and Bitcoin’s Market Value to Realized Value (MVRV) ratio—which contrasts its market value with holders’ average cost basis—demonstrate “underlying resilience.”

XWIN elaborated that “Bitcoin’s recent pullbacks seem less like an end to its rally and more akin to a period of stabilization.”

The MVRV ratio for Bitcoin has declined to 2; meanwhile, the average cost basis stands at approximately half of its current price—a situation XWIN historically associates with neither panic nor exuberance.

Comparison between Bitcoin’s MVRV ratio (purple) and its price (black) since late 2024. Source: CryptoQuant

XWIN also noted reduced profit-taking among long-term investors which “effectively diminishes available supply,” thereby mitigating short-term volatility while fostering conditions conducive for renewed demand potentially driving prices upward.

This Cycle Remains Unfinished

XWIN concluded from these metrics that “this cycle hasn’t reached completion yet,” suggesting recent consolidation might lay groundwork for another major upward move—indicating continued vitality within this bull market phase.

Crypto Longs Impacted by Recent Decline

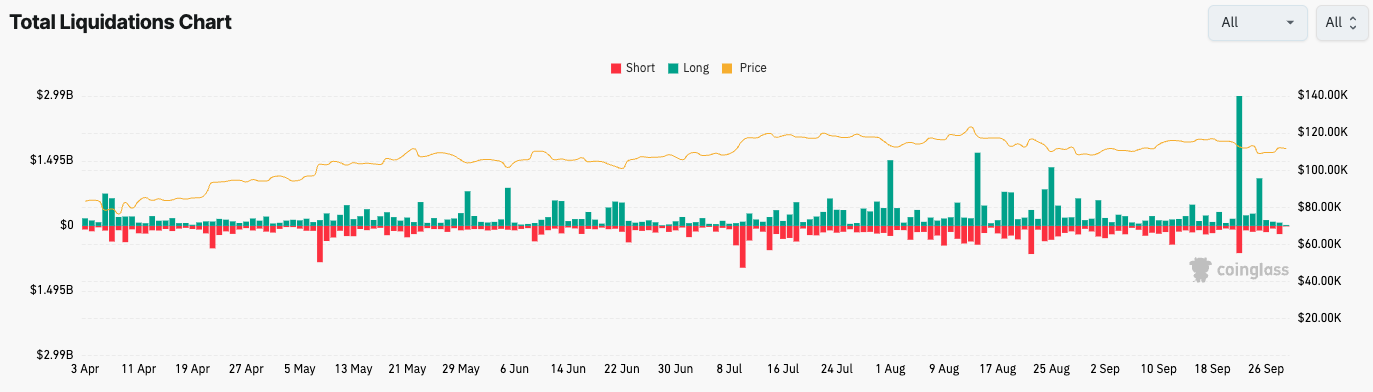

A surge in long liquidations occurred across markets on Monday Sept. 22nd and Thursday due largely due BTC declines according CoinGlass sources:

“Expect significant BTC corrections before achieving new all-time highs,” advises one analyst regarding future prospects.

Meanwhile amidst recovery efforts following losses incurred during past seven days when crypto bulls were wiped out totaling over four billion dollars through dual major liquidations events.

First notable liquidation transpired September twenty-second resulting nearly three billion dollars worth positions eliminated throughout entire sector stemming directly from fall below hundred twelve thousand dragging down remainder marketplace alongside according Coinglass statistics:

Subsequent follow-up witnessed additional billion-dollar liquidation encompassing totality longs occurring Thursday compounded further complications amid another downturn reaching hundred nine thousand mark:

Related: Anticipate substantial BTC adjustments preceding fresh record-breaking peaks warns seasoned observer analyzing current landscape